As someone who closely follows the crypto industry, I’m thrilled to witness the promising signs of recovery we’ve seen in recent months. The surge in stablecoin usage is particularly noteworthy, with these digital assets accounting for over half of all transaction volume. This trend is truly global, as evidenced by Chainalysis’ data showing significant demand from countries like the United States, Turkey, and emerging markets.

I’ve noticed an encouraging turnaround in the crypto industry after a rough patch. While Bitcoin and its notable counterparts have garnered substantial limelight, stablecoins have been quietly leading the charge. In fact, they’ve accounted for over half of all transaction volume these past few months.

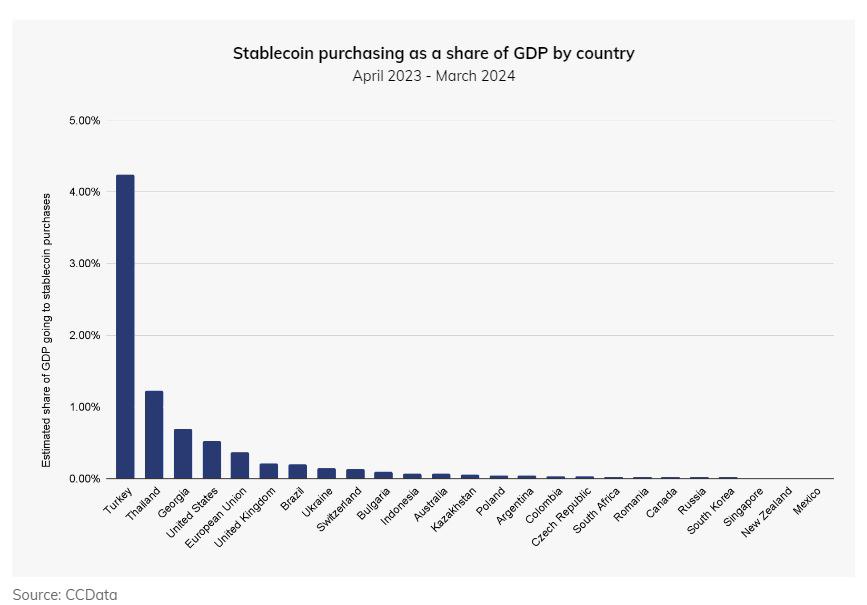

Chainalysis’ latest data suggests that stablecoins are becoming a true global asset.

United States Leads Stablecoin Purchases

In their 2024 Crypto Spring report, Chainalysis uncovered a large increase in worldwide interest for stablecoins. The US took the lead in acquisitions, with notable additions from various countries and areas adding up to over $30 billion in January 2024 alone.

In simpler terms, when it comes to buying stablecoins, countries like the US and Europe have significant participation. However, it’s worth noting that emerging economies, including Thailand, Brazil, and particularly Turkey, exhibit notable levels of stablecoin purchasing relative to their respective national economies.

In various parts of the world, the increasing global attention has brought to light a rising dependence on stablecoins like USDT. This trend is particularly noticeable in countries undergoing local currency instability and devaluation, such as Turkey and Georgia. As revealed by industry experts speaking with Chainalysis, residents in these nations frequently utilize stablecoins as a protective measure for their savings during currency turbulence.

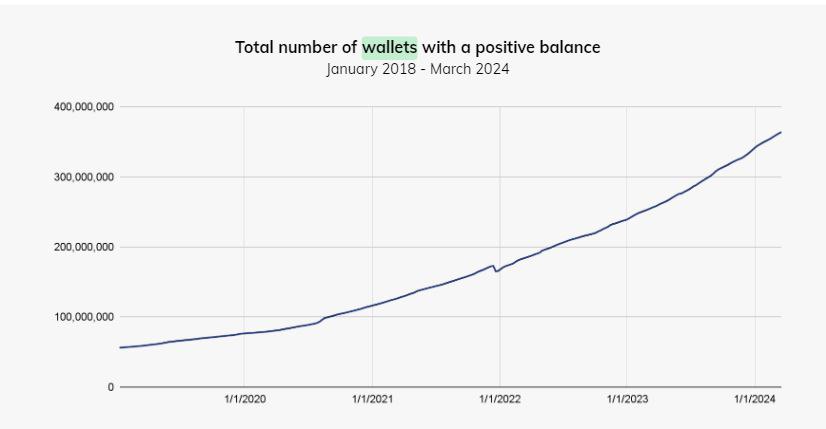

Looking at the bigger picture, Chainalysis reported that the volume of transfers during the recent cryptocurrency market surge has exceeded the peak levels seen in late 2020 and early 2021. This suggests that the current market cycle is more dynamic than the previous bull run, implying a stronger investor confidence.

The rising trend is underscored by the fact that more than 400 million cryptocurrency wallets currently hold a positive balance. Although one wallet may represent multiple users, as both organizations and individuals can manage multiple wallets, this upward trend indicates a expanding adoption of cryptocurrencies.

Crypto Investment Sees First QoQ Rise Since 2023

Despite a deceleration in crypto funding during the lengthy cryptocurrency market downturn, there was a noteworthy surge in crypto investments in Q1 of 2024. This signified the first rise in quarter-on-quarter investment since Q1 of 2023. Median deal sizes, which had seen a significant drop in Q4 of 2022, have since recovered and remained stable around the $10 million threshold.

Additionally, according to a Bloomberg report, crypto investment firm Paradigm is reportedly planning to secure funding of between $750 and $850 million in upcoming discussions. This would make it the largest venture capital fundraising in the crypto sector since the market experienced a significant decline in 2022.

In Q3 2023 and extending into Q1 2024, Chainalysis identified numerous significant transactions valued over $100 million, including early-stage investments.

As an assistant observing the financial landscape during this period, I came across several significant deals that caught my attention. Swan Bitcoin successfully raised $165 million for asset management and tax purposes. Blockchain.com impressively secured $100 million for its exchange platform. Wormhole received a substantial investment of $225 million to develop bridges and interoperability solutions. Totter obtained an impressive $101 million investment for open-source cloud storage services. together.ai stood out with a $225 million fundraising round, valuing the company at $2.5 billion for their DeFi solutions. Lastly, EigenLayer garnered $100 million to advance developments within the Ethereum protocol.

Read More

- WLD PREDICTION. WLD cryptocurrency

- BTC EUR PREDICTION. BTC cryptocurrency

- Best coins for today

- Top gainers and losers

- PRISMA PREDICTION. PRISMA cryptocurrency

- PRMX PREDICTION. PRMX cryptocurrency

- Brent Oil Forecast

- SEC Demands $5.3 Billion From Do Kwon And Terraform Labs

- ICP PREDICTION. ICP cryptocurrency

- Bitcoin (BTC) Fails to Attract Safe-Haven Flows: Kaiko

2024-04-25 16:09