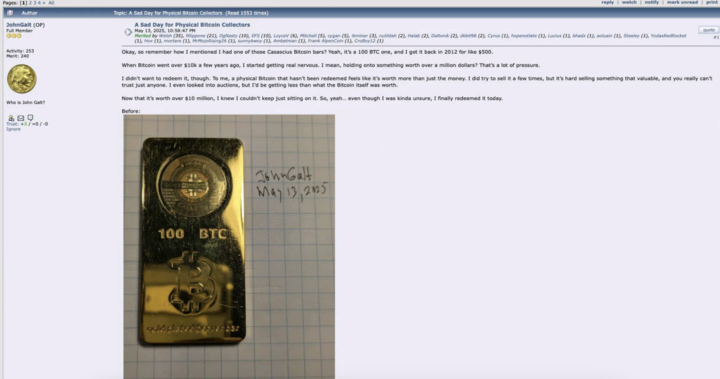

From $500 to $10M: BitcoinTalk User’s Fortune Unlocked!

Here’s the scoop on this rare piece of Bitcoin history.

Here’s the scoop on this rare piece of Bitcoin history.

//cdn.sanity.io/images/s3y3vcno/staging/ac6bf763b67c66aeb40bc1b8d64de9e4fea8527f-2000×1500.png”/>

Oh, the irony! Just as a cunning fox evades hounds, South African investment maestro Sygnia has conjured forth a product that slyly mirrors Blackrock’s Ishares Bitcoin Trust ETF (IBIT). Launched on the momentous date of June 1, 2025, this extraordinary fund is every investor’s ticket to the digital realm—without the hassle of wearing a virtual helmet for that perilous journey!

In a single, dizzying 24-hour period, Shiba Inu traders have added a staggering 14.03 trillion SHIB tokens to the futures derivatives market, a move that suggests the token is not just wagging its tail but is also making a serious bid to become the top dog in the crypto world. 🚀

Now, on the fateful day of March 12, the illustrious investment firm MGX from Abu Dhabi did proclaim a rather majestic $2 billion investment into Binance, confirmed, as if by divine decree, to be resting comfortably in USD1. One can almost hear Eric Trump’s voice from the heavens suggesting that USD1 shall henceforth double as the magical mechanism of settlement. At this very moment, around a staggering 90% of that USD1 is nestled snugly in Binance wallets, creating a veritable goldmine of potential interest income. My, my, how things take a turn! 💰

Take Scott Merovitch, a loyal Wells Fargo customer for nearly four decades. He was left with a bitter taste in his mouth when scammers drained $20,000 from his account, and the bank refused to make amends. The nerve!

Bitcoin is ahead of its long-term “power law” curve, historically leading to euphoric price highs in previous cycles.

According to data from SoSoValue, IBIT attracted a whopping $448 million in fresh inflows on July 10 alone, pushing total net inflows above $53 billion. Trading volumes topped $5.39 billion that day, with each share priced at $64.50. The ETF now holds over 700,000 BTC, representing about 3.55% of Bitcoin’s total supply.

“I’m encouraged by reports that Jerome Powell is considering resigning. I think this will be the right decision for America, and the economy will boom,” Pulte noted.

The network, with its ever-growing assembly of 225 million accounts, has seen a marked increase in user adoption and engagement. After several attempts to breach the lower supports, buyers have gradually reclaimed higher lows, much to the delight of the bulls.