In simpler terms, Polkadot‘s price could bounce back in the coming weeks due to its current position at a strong support level. This level includes the area between the 50% and 62% Fibonacci retracement points, as well as the backing provided by the 100-day moving average.

Technical Analysis

By Shayan

The Daily Chart

Looking closely at Polkadot‘s daily price chart reveals a significant drop, amounting to approximately 30% from its highest point this year at $11.9. Yet, potential sellers have encountered strong resistance from the reliable support provided by the 100-day moving average. This line aligns closely with important Fibonacci retracement levels, making it a formidable barrier for those looking to sell.

In the coming weeks, this important area is predicted to halt any additional declines, allowing the market to make a strong comeback. The high demand surrounding this key point will spark increased buying, propelling the market back up towards the significant $10 level.

Yet, we must keep in mind that if the price were to unexpectedly fall beneath this vital support level, it might set off a chain reaction of numerous sell orders, possibly resulting in a substantial decrease toward the $7.2 threshold.

The 4-Hour Chart

Looking at Polkadot’s price movements over the past 4 hours, it appears that the cryptocurrency has hit a significant support level around $8. As a result, there has been some stabilization in the market, with prices hovering near this level before potentially continuing onward or reversing course.

In simpler terms, this important area lines up nicely with the bottom edge of a decreasing triangle chart pattern, serving as a strong shield preventing any additional price drops.

An intriguing development has arisen: The Relative Strength Index (RSI) for Polkadot is showing minor divergence from its price, suggesting that a bullish reversal could be on the horizon in the near future. This discrepancy might rekindle investor interest and fuel further gains for Polkadot.

Based on the current wedge pattern and the $8 support level, it’s reasonable to assume that Polkadot’s price will keep bouncing around before potentially breaking out. However, there’s a positive vibe in the market, leading investors to believe that an uptrend towards the $10 mark is on the horizon in the coming weeks.

Sentiment Analysis

By Shayan

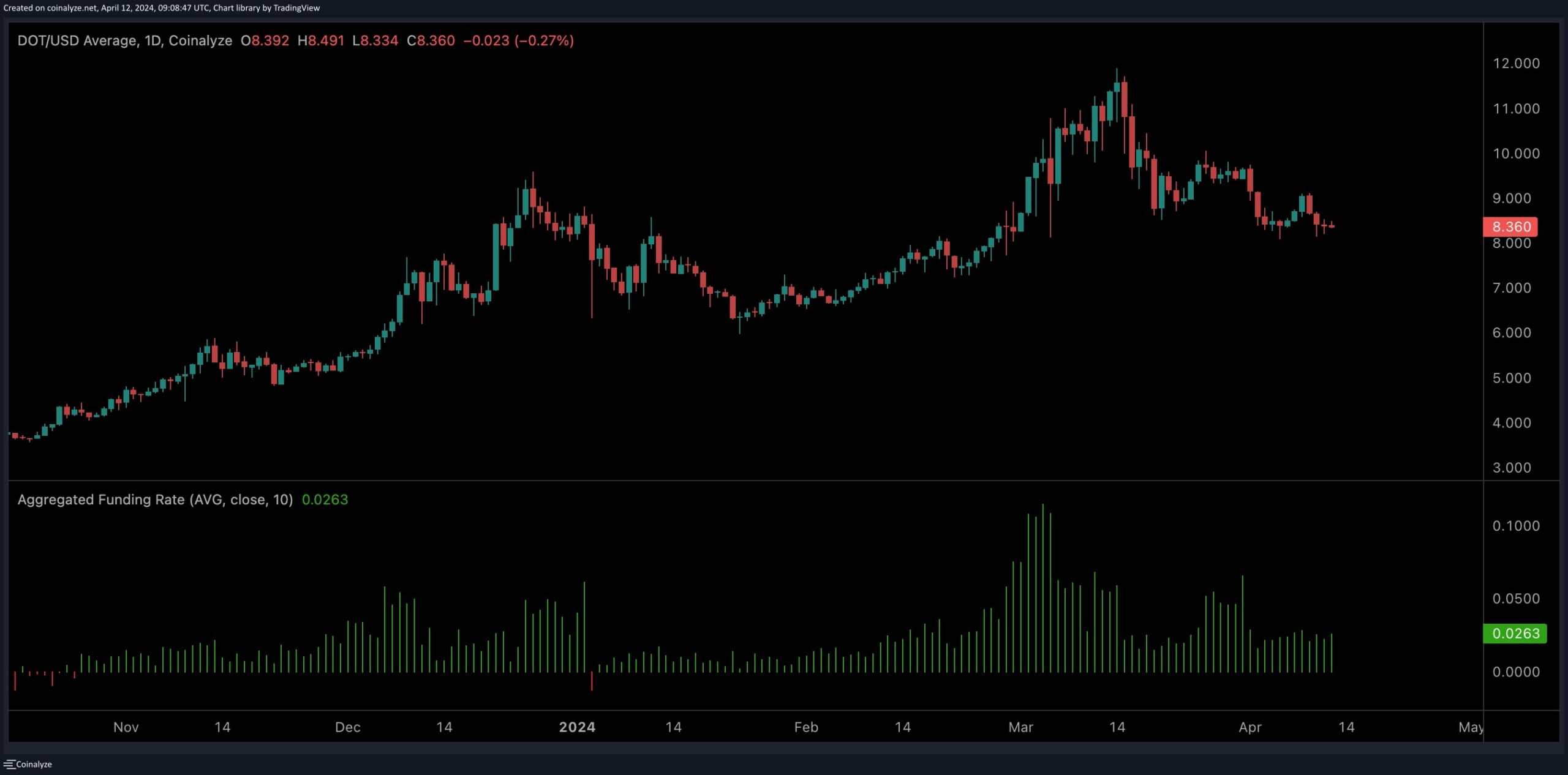

The price of DOT has experienced a long downturn, dropping by nearly 30% from its highest point of $11.9 in the past year. It is essential for investors to consider if this price decrease has diminished trading volume in the futures market.

Presented below is a chart illustrating Polkadot’s aggregate funding rates, which serve as indicators of the intensity with which buyers or sellers are executing their orders. Elevated funding rates often precede a cascade of long liquidations. Thus, while positive funding rates are essential, excessively high values raise concerns.

The graph shows a recent modest drop in price, coinciding with a steady decrease in funding rates after a significant increase. This indicates that the futures market is cooling down. It’s important to mention that even with this decline, the metric remains positive. Furthermore, the futures market seems prepared for the resumption of long positions.

Based on these findings, this pattern could be seen as a good indication, lowering the chances for more downsizes and paving the way for a lasting upward trend in the near future.

This post is powered by Polkadot.

Read More

- WLD PREDICTION. WLD cryptocurrency

- BTC EUR PREDICTION. BTC cryptocurrency

- ZBC/USD

- Top gainers and losers

- MEME PREDICTION. MEME cryptocurrency

- PRMX PREDICTION. PRMX cryptocurrency

- AGLD PREDICTION. AGLD cryptocurrency

- Brent Oil Forecast

- PRISMA PREDICTION. PRISMA cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

2024-04-12 16:52