TL;DR

- Recent market corrections have led to a decrease in enthusiasm among traders, with discussions shifting from a “bull market” to a “bear market” mindset.

- However, this sentiment could ironically suggest an impending bullish trend.

Enthusiasm Goes Down

The recent decline in the cryptocurrency market, causing Bitcoin (BTC) to drop to a two-month low of $60,000 and Ethereum (ETH) to slip under $3,000, has left traders and investors with a sense of unease.

Based on data from market intelligence platform Santiment, the term “bull market” is being used less frequently in crypto circles these days, while references to a “bear market” are on the rise.

The Bitcoin Fear and Greed Index, which reflects the current mood of investors, has taken a downturn. Today (April 18), its reading stands at 57, the lowest it has been since late January.

In contrast, Santiment pointed out that the shift toward bearish sentiment among the crypto community could potentially signal an upcoming bull run. This is because it’s common for market prices to go against the prevailing views of large groups of traders.

In simpler terms, the decrease in fear of missing out (FOMO) and the increase in fear, uncertainty, and doubt (FUD) could signal that cryptocurrencies are on the verge of recovering, possibly just before or right after their halving events.

Additional Indicators Signaling a Potential Recovery

“The upcoming Bitcoin halving in late April (scheduled for the 19th) is likely to be a significant factor boosting its value.”

Approximately every four years, an event takes place that reduces by half the reward for mining new Bitcoin blocks. Consequently, with fewer coins being introduced into circulation, they become increasingly rare and potentially more valuable if demand stays high or rises. Historically, each prior halving has been followed by a significant Bitcoin price surge and a rejuvenation of the entire cryptocurrency market.

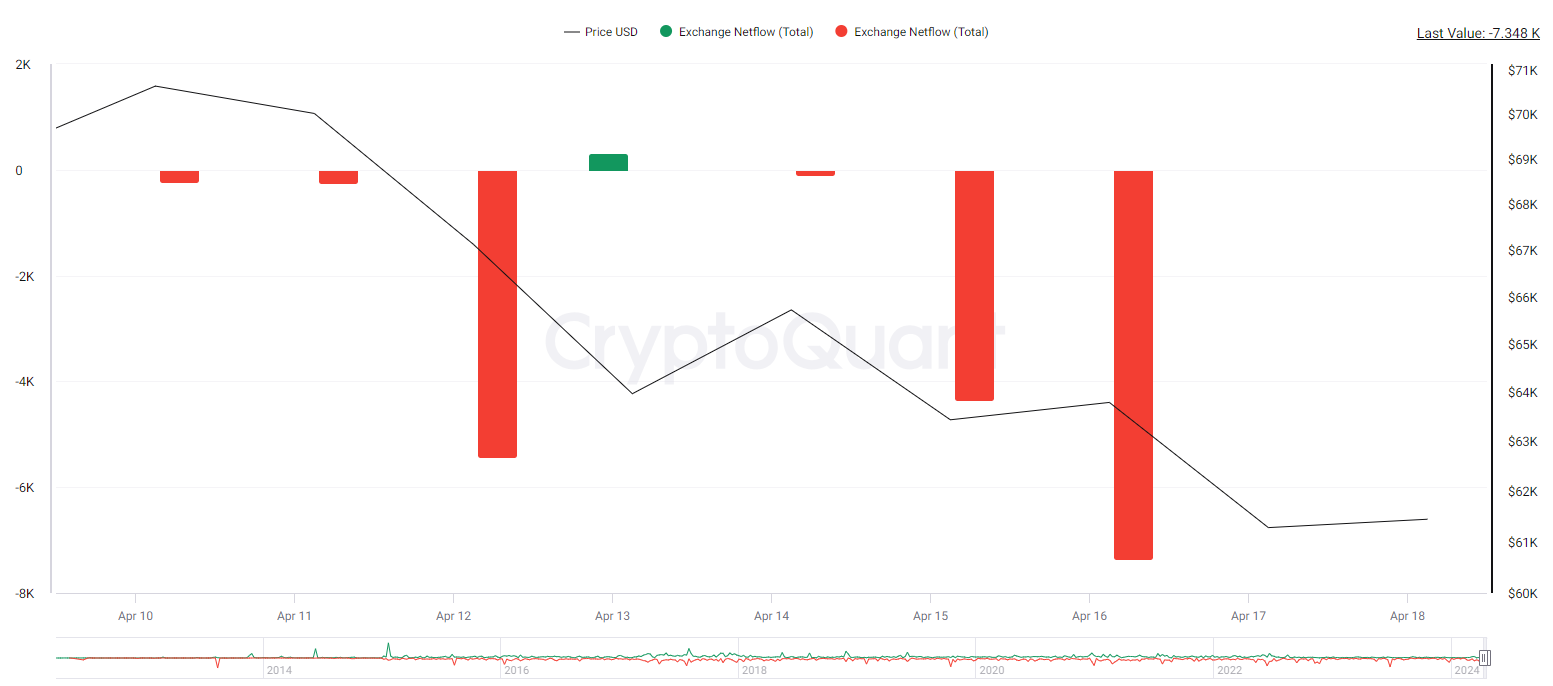

Another factor hinting that the primary digital asset may head north soon is the Bitcoin exchange netflow, which has been predominantly negative in the last week (according to CryptoQuant’s data). A shift from centralized platforms toward self-custody methods is considered bullish since it reduces the immediate selling pressure.

Read More

- WLD PREDICTION. WLD cryptocurrency

- BTC EUR PREDICTION. BTC cryptocurrency

- ZBC/USD

- Top gainers and losers

- MEME PREDICTION. MEME cryptocurrency

- PRMX PREDICTION. PRMX cryptocurrency

- AGLD PREDICTION. AGLD cryptocurrency

- Brent Oil Forecast

- PRISMA PREDICTION. PRISMA cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

2024-04-18 17:46