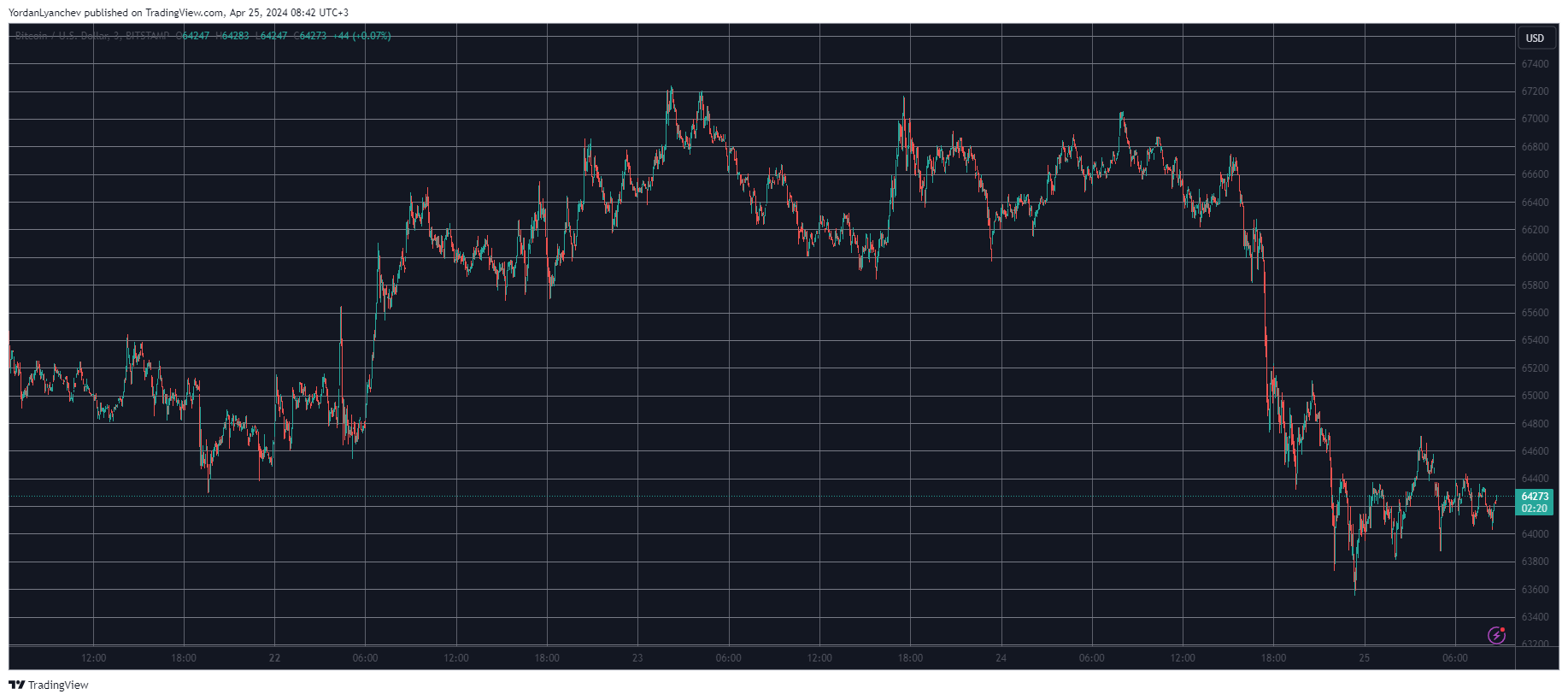

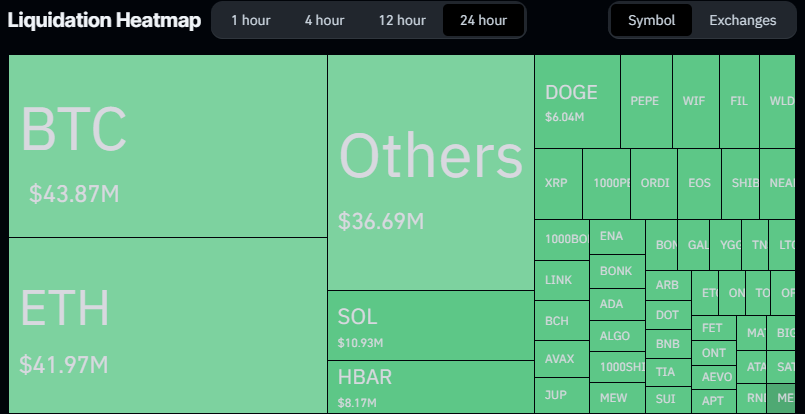

For several days, Bitcoin‘s price surpassed $66,000 and came close to reaching $67,000 on occasion. However, these attempts were unsuccessful. The price drop that followed caused significant losses for bullish investors and overextended traders holding long positions. The daily total of liquidations exceeded $200 million as a result.

However, the altcoins also have a big say in this, as most have plummeted even more than bitcoin.

Last week brought significant losses for the leading cryptocurrency, with it dipping below $60,000 on two different instances due to escalating tensions between Iran and Israel.

Previously stated that it wouldn’t respond with reprisals, at least momentarily, leading to a significant recovery in bitcoin’s value. By the end of its fourth halving, bitcoin’s price had climbed back up to approximately $65,000.

After that point, Bitcoin’s value continued to rise gradually, reaching over $67,000 by Tuesday and Wednesday morning. However, bears took control at this stage and caused Bitcoin’s upward trend to reverse.

Within a short timeframe, the value of the asset dropped from around $65,000 to below $63,600, representing a multi-day low. Although it has regained some ground and is now above $64,000, the asset remains deeply in the red.

These cryptocurrencies, such as Solana, Toncoin, Dogecoin, Avalanche, and Shiba Inu, have experienced even steeper drops with decreases of -7%, -7%, -7%, -10%, and -8% respectively.

Approximately 100,000 traders suffered significant losses in the previous day, the majority holding long positions. The aggregate value of these losses, as reported by CoinGlass, exceeded $210 million.

Read More

- WLD PREDICTION. WLD cryptocurrency

- BTC EUR PREDICTION. BTC cryptocurrency

- Best coins for today

- Top gainers and losers

- PRISMA PREDICTION. PRISMA cryptocurrency

- PRMX PREDICTION. PRMX cryptocurrency

- Brent Oil Forecast

- SEC Demands $5.3 Billion From Do Kwon And Terraform Labs

- ZBC/USD

- Venezuela to Accelerate Crypto Usage in Response to Reimposed US Oil Sanctions: Report

2024-04-25 08:54