The price of Bitcoin has bounced back from its previous dip at $65,000 and is expected to reach a new peak value shortly.

Technical Analysis

By TradingRage

The Daily Chart

On the daily price chart, there’s a well-defined triangle formation where prices have been moving up and down in a symmetric pattern. However, the market is presently challenging the upper limit of this triangle.

if the price manages to go above its current upper limit, there’s a higher chance of it reaching $75K and setting a new record high. The RSI, which measures momentum, is currently reading above 50%, suggesting that the bullish trend is strong and a significant price increase is likely.

The 4-Hour Chart

On a 4-hour chart, the price has just breached the triangle formation and is now checking out the previous resistance level (trendline) once more.

If BTC bounces back successfully, it may climb towards $75K or even beyond. Conversely, if it falls back within the triangle, the recent surge could have been a false alarm. In that scenario, a slide towards the lower end of the pattern or the $60K support area would be more probable.

On-Chain Analysis

By TradingRage

Net Unrealized Profit Loss (NUPL)

With Bitcoin‘s price bouncing back over $70,000, there’s growing anticipation among traders that this cryptocurrency will reach a new peak value soon. This positive outlook is reflected in how investors are holding onto their Bitcoins.

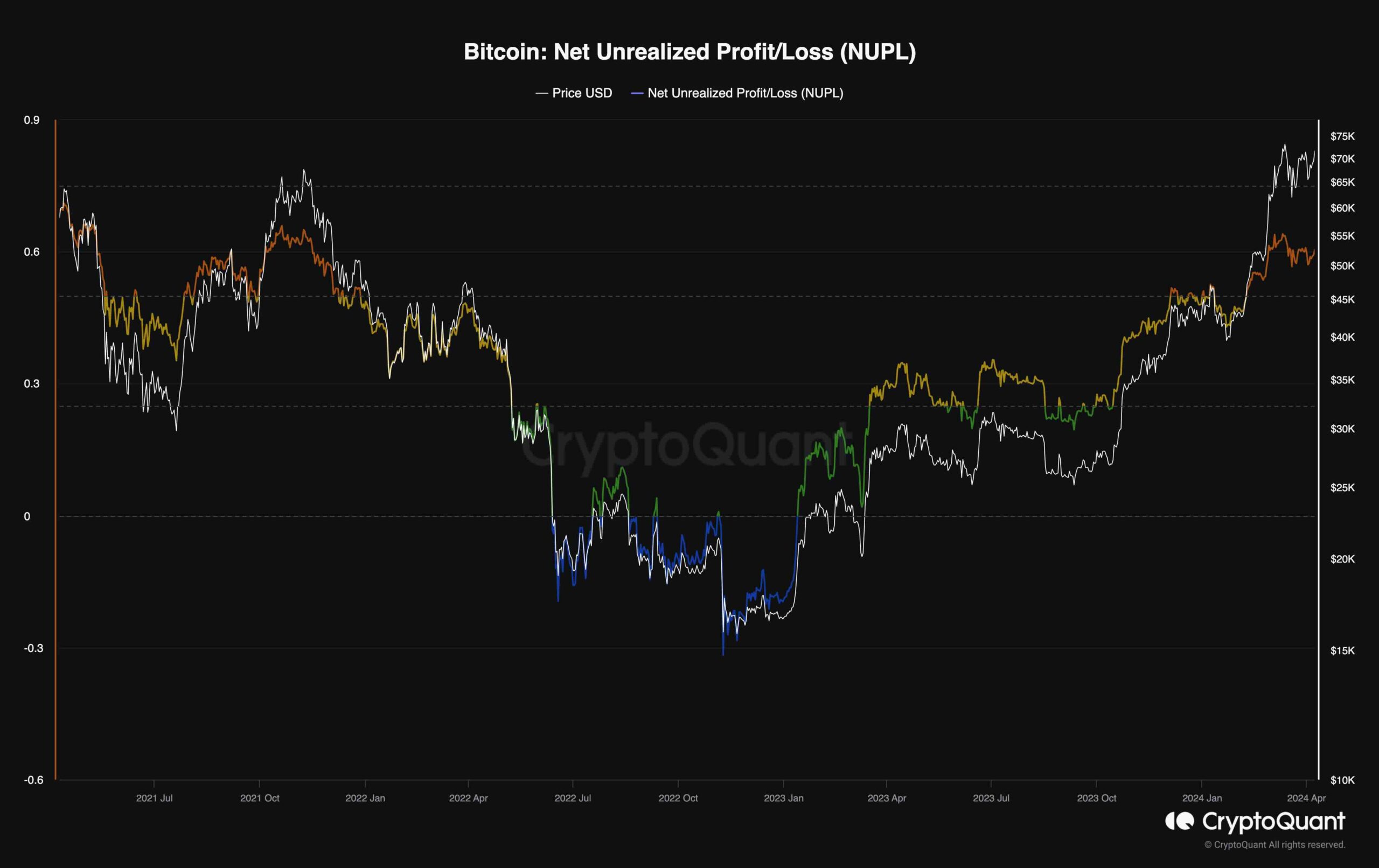

This chart displays the Net Unrealized Profit Loss (NUPL), calculated as the difference between market value and realized value divided by market value. If we assume that recent price changes are due to new purchases, NUPL represents the overall profit or loss for all coins held. Consequently, it can be viewed as an indicator of the proportion of investors currently experiencing gains.

Based on the chart’s indication, the NUPL metric indicates values exceeding 0.5, reminiscent of the 2022 peak. Consequently, although the market may continue to climb, the buildup of unrealized profits could be a cause for concern. Should heavy selling ensue, a substantial price decline is a real possibility.

Read More

- WLD PREDICTION. WLD cryptocurrency

- BTC EUR PREDICTION. BTC cryptocurrency

- ZBC/USD

- Top gainers and losers

- MEME PREDICTION. MEME cryptocurrency

- PRISMA PREDICTION. PRISMA cryptocurrency

- PRMX PREDICTION. PRMX cryptocurrency

- AGLD PREDICTION. AGLD cryptocurrency

- Brent Oil Forecast

- Bitcoin Likely to Drop After the Halving, JPMorgan Says

2024-04-09 17:28