As an experienced technical and sentiment analyst, I believe that Ethereum’s recent price action presents a compelling opportunity for further analysis. The daily chart suggests that Ethereum has consolidated near critical support levels defined by the 0.5 and 0.618 Fibonacci retracement levels and the 100-day moving average. This consolidation coincides with the lower boundary of a multi-month descending wedge pattern, typically signaling a bullish continuation. However, Ethereum now faces a significant resistance zone encompassing the upper boundary of the wedge pattern and the $3.4K mark. A successful breach of this resistance could lead to a substantial bullish surge towards the $4.1K threshold. Conversely, failure to overcome selling pressure may result in continued consolidation within the upper boundary of the wedge pattern and the 100-day moving average.

After a pause around key support areas identified by the 0.5 and 0.618 Fibonacci retracements and the 100-day moving average, Ethereum experienced a gentle upward trend.

As an analyst, I would interpret this as follows: The price action has encountered significant resistance at certain levels, and surmounting these hurdles could lead to a resurgence in bullish sentiment.

Technical Analysis

By Shayan

The Daily Chart

After closely analyzing Ethereum’s day-to-day price chart, it is clear that important support areas are approaching during its prolonged period of sideways movement.

At the 0.5 and 0.618 Fibonacci retracement levels, marked by $3139 and $2910 respectively, and with the presence of the significant 100-day moving average, we witnessed a mild upturn in price action. This price consolidation occurred near the lower edge of a prolonged descending wedge formation, usually indicating a bullish market resumption.

As an analyst, I’ve identified a significant resistance level for Ethereum, which includes the upper boundary of the wedge formation and the crucial price point at $3.4K. Overcoming this barrier could potentially trigger a strong bullish trend that propels the price towards the $4.1K target.

As an analyst, I would rephrase that as follows: If the selling pressure persists and we’re unable to break through it, then we might see an extended period of sideways trading within the upper limit of the wedge pattern and above our 100-day moving average.

The 4-Hour Chart

Examining the 4-hour chart uncovers Ethereum’s sideways behavior close to the bottom edge of the wedge formation, aligning with the $3K support level.

In this stage, Ethereum exhibited an inverted head and shoulders formation, implying a possible bullish turnaround. Yet, despite reaching $3.3K above the pattern’s neckline, the price movement was later reversed, signaling a potential false signal or breakdown instead.

Based on current market trends and the prevailing sentiment, Ethereum seems set to keep trading between the $3.4K resistance and the $3K support. If Ethereum manages to break through this crucial price range, it could signal the beginning of a new trend in the medium term.

Sentiment Analysis

By Shayan

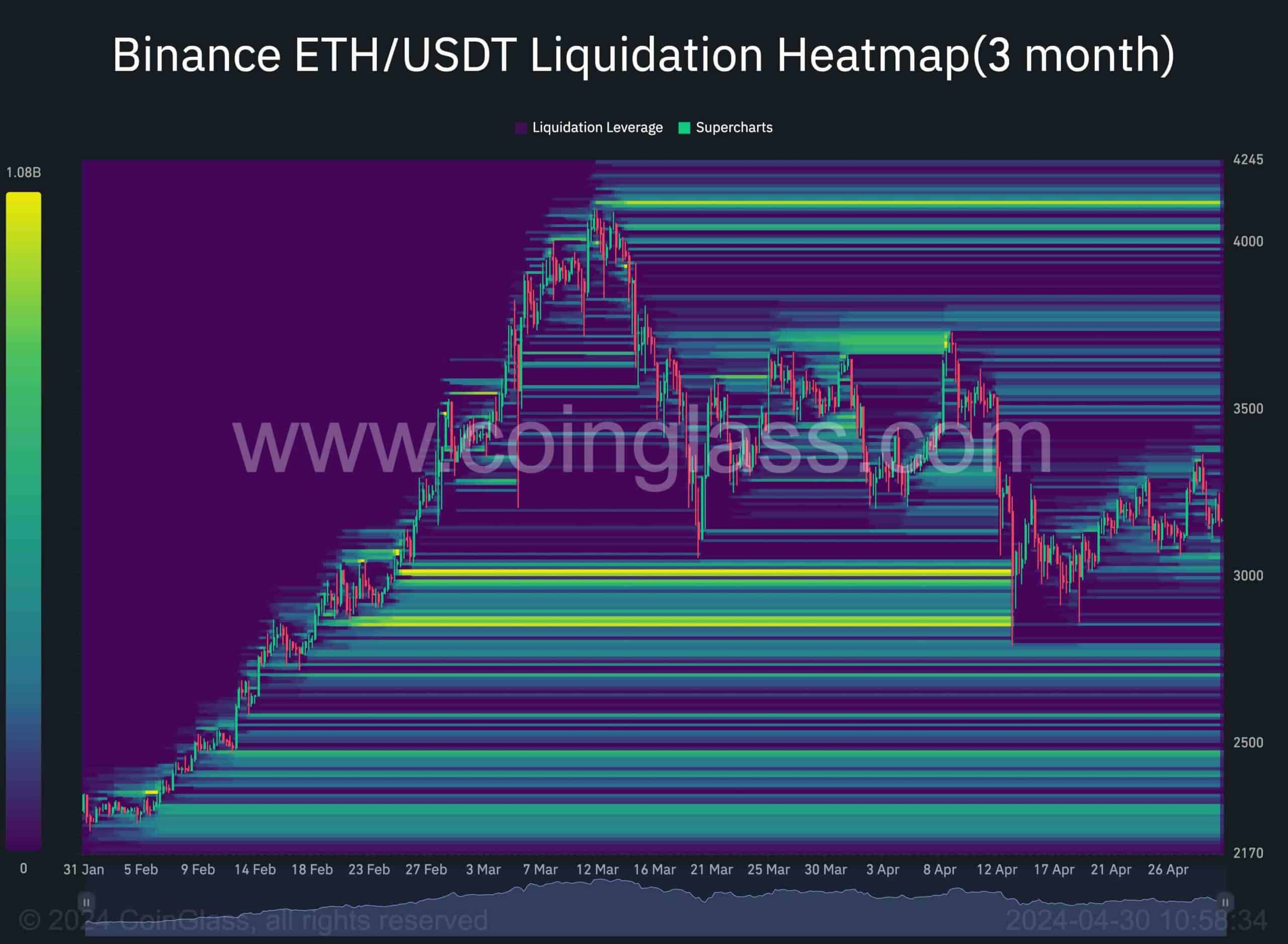

After Ethereum failed to break through its previous peak of $3,300, investors might now focus on the actions of traders in the futures market for clues. The chart presented below displays the Binance ETH/USDT pair’s liquidation heatmap, highlighting crucial price points with substantial liquidity that could potentially shape the direction of the trend.

The significant decline below the $3K mark led to a large-scale liquidation of long positions, causing a chain reaction of sell-stop orders being executed. However, over the past few weeks, the price has been experiencing corrective movements, resulting in a more tranquil atmosphere in the futures market.

In the short term, Ethereum’s price action lacks significant liquidity in both directions, resulting in a potential market shift based on sentiment in the futures market. This could lead to a renewed and powerful price trend.

Given current conditions and the surge in Ethereum’s popularity, it’s likely that the price will aim for prices above $4,000 in the future. Any sudden changes in the near term notwithstanding.

Read More

- APT PREDICTION. APT cryptocurrency

- Best coins for today

- MILK PREDICTION. MILK cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

- BTC EUR PREDICTION. BTC cryptocurrency

- Rare ‘Epic Sat’ from Bitcoin’s Fourth Halving Block Sold for Over $2 Million

- Brent Oil Forecast

- Pantera Capital’s Fund V Targets $1 Billion for Diverse Blockchain Investments

- FOTA PREDICTION. FOTA cryptocurrency

- MicroStrategy Q1 Operating Loss of $53.1M After Bitcoin Holdings Impairment Charge of $191.6M

2024-04-30 22:58