As a seasoned analyst with extensive experience in cryptocurrency markets, I have closely monitored Ethereum’s price action and market sentiment. Based on my technical and sentiment analysis, I believe Ethereum is currently navigating through a critical period of consolidation within the $3K to $3.2K range.

The price of Ethereum has hit a roadblock in its attempt to drop below the significant $3,000 support level, resulting in minor price swings within a vital and narrow range. Nevertheless, there’s a growing sense of optimism among investors for a resurgence of bullish momentum in the near future due to increasing demand.

Technical Analysis

By Shayan

The Daily Chart

After examining the day-to-day Ethereum chart, it’s clear that the cryptocurrency is finding resistance at the significant $3,000 support level. Its price movement remains restricted within a narrow band.

The important range is marked by the $3133 (0.5 Fibonacci level) and $2906 (0.618 Fibonacci level), which nearly intersects with the 100-day moving average. This convergence implies a strong likelihood of increased buying interest near this significant barrier.

As an analyst, I’ve noticed some intriguing price movements lately that suggest increasing demand. This trend could potentially lead to a robust bullish recovery. However, it’s important to keep in mind that a sudden break below this crucial support level might have serious consequences. In such a scenario, the next significant support could be found at around $2.5K. Furthermore, the 200-day moving average would also come into play at approximately $2.6K.

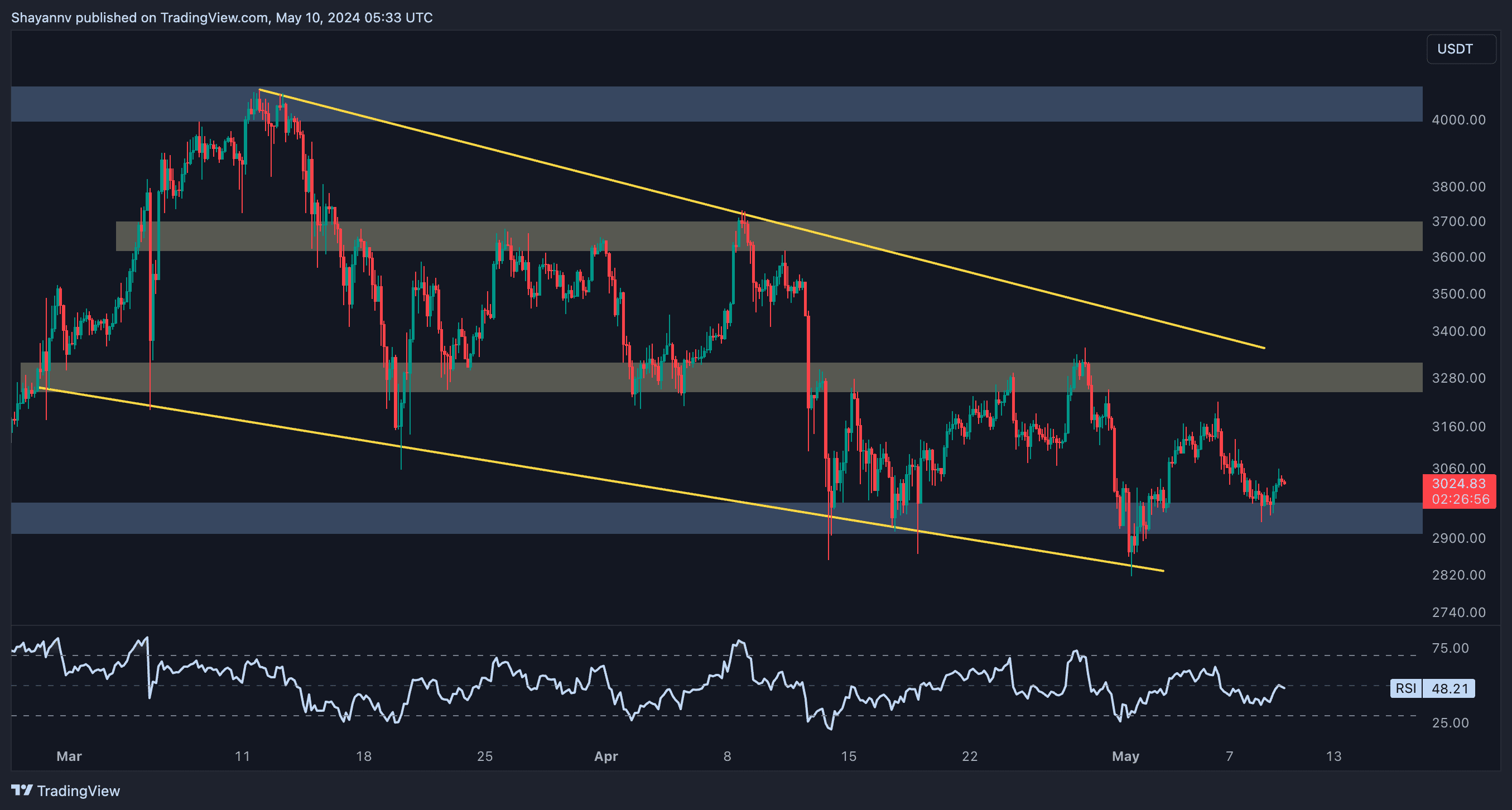

The 4-Hour Chart

Examining Ethereum’s 4-hour chart more closely reveals a period of sideways price action over several weeks. During this time, Ethereum has bounced between the strong support level at $3,000 and the crucial resistance at $3,200.

Currently, the price is moving laterally within this range, fluctuating towards the lower end around the $3K support level. This suggests that both sellers and buyers are in a stalemate.

If Ethereum manages to break through the $3,000 resistance, there’s a good chance that a prolonged bearish trend may follow in the medium term. On the other hand, given the current market conditions and investor sentiment, it is anticipated that Ethereum will regain bullish momentum, possibly pushing prices up to around $3,600.

Sentiment Analysis

By Shayan

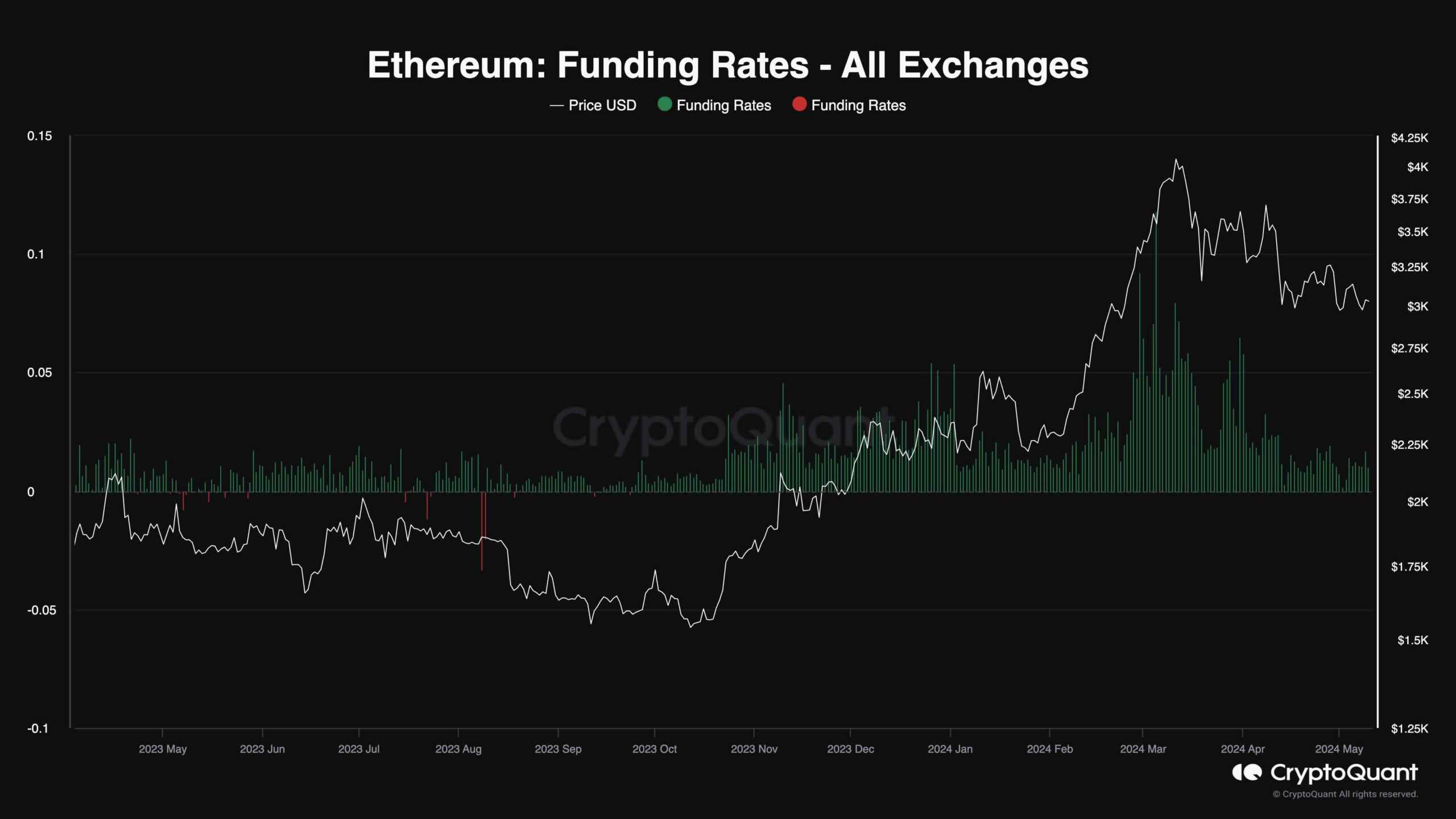

During Ethereum’s current phase of price stability and indecisive movements, investors keep a keen eye on the actions of traders in the futures market to decipher any hints of changing market sentiments.

As a data analyst, I’d explain that the given chart depicts Ethereum funding rates, a metric revealing the intensity of market participants’ positions through their use of market orders. Positive figures signify stronger buying intentions, suggesting a bullish outlook, while negative numbers reflect more forceful selling actions, indicating bearish expectations.

As a researcher examining the data, I’ve noticed a substantial decrease in funding rates compared to what we saw just a few months ago, according to the chart. However, despite this decline, the funding rates are still hovering above zero, signaling a bullish trend. This finding implies that demand persists, while the futures market is no longer showing signs of overheating. Therefore, the current state of affairs presents an opportunity for a price surge in the not too distant future.

Read More

- APT PREDICTION. APT cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

- Top gainers and losers

- Gold Rate Forecast

- SHIB PREDICTION. SHIB cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- PRMX PREDICTION. PRMX cryptocurrency

- SPACE PREDICTION. SPACE cryptocurrency

- Here’s Why Jack Dorsey’s Block Will Invest 10% of Bitcoin Profits Into BTC Monthly

- Robinhood Delivers Big Earnings Beat Driven by Booming Crypto Trading: Analysts

2024-05-10 14:04