Polkadot has recently received buying interest around a significant area. This area is marked by the price range between $8.2 (0.618 Fib retracement level) and $8.9 (0.5 Fib retracement level), along with the 100-day moving average.

After a lengthy pause for correction, this new development could signal a rebound in the market’s uptrend within the mid-term.

Technical Analysis

By Shayan

The Daily Chart

Looking at the daily price chart, it’s clear that Polkadot underwent a strong upward trend after breaking through its 100-day and 200-day moving averages in early November 2023. This rally peaked at a yearly high of $11.9, demonstrating a widespread optimistic outlook among investors, who were the driving force behind market activity.

Despite reaching resistance at $11.9, the price climb faced significant selling force. This caused an extended decline back towards support areas. These areas are strengthened by Fibonacci retracement levels at $8.9 (0.5) and $8.2 (0.618). Additionally, they align with the 100-day moving average, making them strong barriers for sellers to overcome.

At this important turning point, the alignment of these various levels of support indicates strong demand, which could hinder any further price drops. However, the key goal for DOT right now is to surmount the significant resistance at $10 in order to initiate an uptrend.

The 4-Hour Chart

Looking closely at the last 4 hours, it’s clear that DOT‘s price correction came after a strong upward trend pushed it up to $11.9. During this period, there was a prolonged consolidation. A notable event occurred when the price broke below the long-term uptrend line, possibly due to profit-taking and liquidation of holdings.

After hitting the significant support level at $8, the cryptocurrency underwent increased buying activity, leading to a small recovery. This bounce back, however, might be viewed as just a brief correction, potentially preparing for a deeper pullback towards the broken trendline around $10. If the price moves in this direction, there’s a possibility of a bearish correction that could challenge the important $8 support once more.

Despite being contained between the $8 support and $10 resistance, DOT‘s price movement remains uncertain, with no clear breakthrough in sight.

Sentiment Analysis

By Shayan

In simpler terms, the feelings of investors in futures markets about Polkadot’s price direction hold great importance. Previous data shows that the size and potential for closing out these positions have led to significant price swings. Therefore, analyzing the number of open long (buy) versus short (sell) positions can help traders understand future price trends.

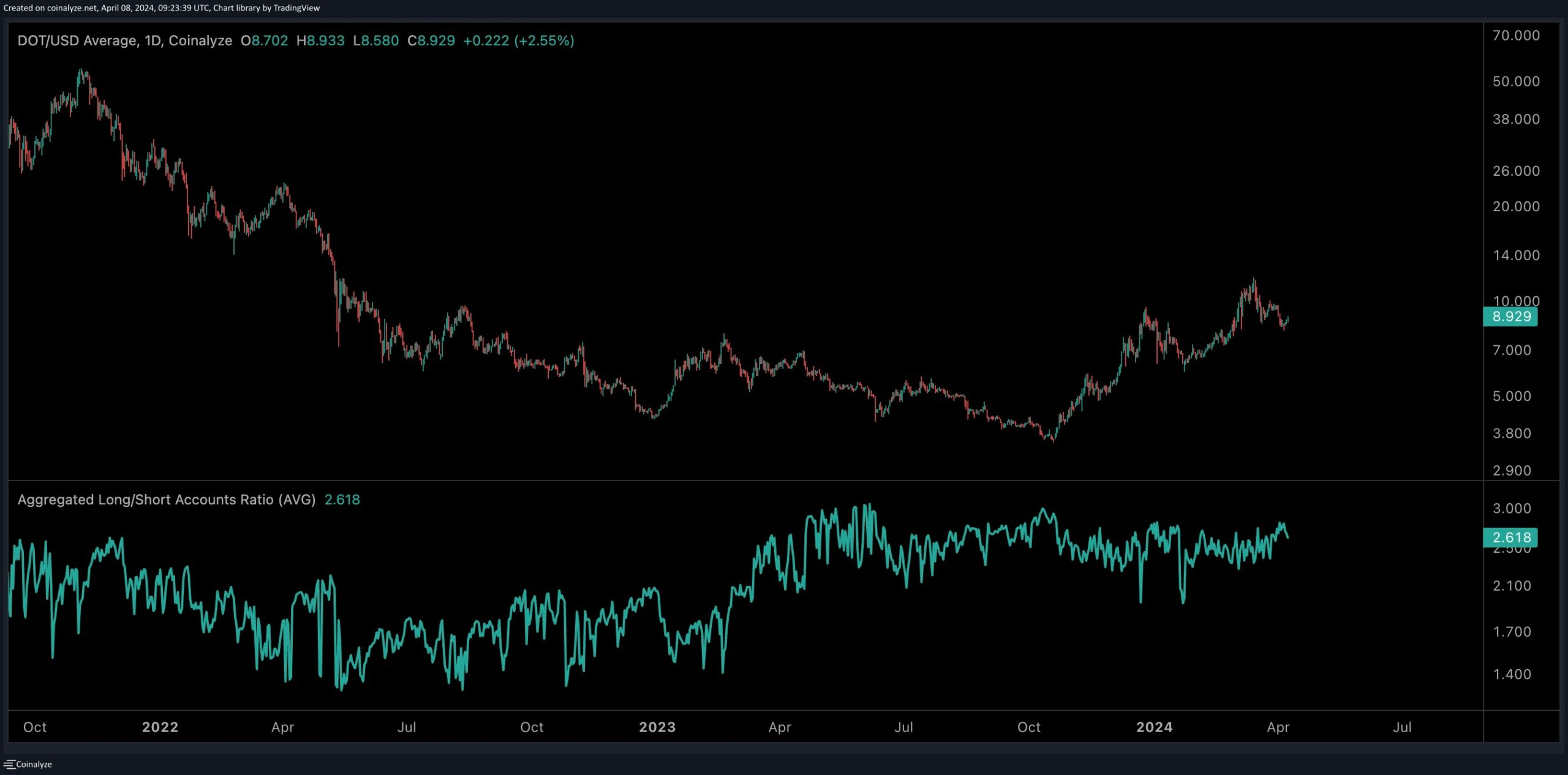

The following chart illustrates the aggregate long/short accounts ratio in conjunction with DOT’s price movements. This metric serves as a valuable gauge, depicting the proportion of net long and net short accounts on exchanges such as Binance and Bybit relative to the total accounts with positions. Values exceeding one signify a prevalent inclination towards long positions among participants.

Based on the chart’s data, the metric has experienced a notable change, showing a steady increase and reaching all-time highs. This trend indicates a strong bullish feeling among futures market investors, who mostly prefer holding long positions. As a result, Polkadot is likely to experience a powerful upward trend once the current consolidation period ends.

This post is powered by Polkadot.

Read More

- BONE PREDICTION. BONE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- Uncovering the Mystery of Red King Players in Clash Royale – What Reddit Users Have to Say

- Finding Resources in Palworld: Tips from the Community

- Discovering the Infinite Power: The Abiotic Factor that Could Change Everything

- Skull and Bones: Navigating the Quest for Extra Teeth in the Game

- The 10 Best Movies of 2024 (So Far)

- UFO PREDICTION. UFO cryptocurrency

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- Hazardous: Landing a Stunt With EVERY Vehicle In GTA 5 #6

2024-04-08 18:41