It is with no small measure of dismay that we observe the price of Solana, which has recently taken a rather alarming fall at the commencement of this month, leaving it languishing at an unseemly low of approximately $67.48. This unfortunate decline appears to have ushered in an air of fragility concerning its recovery, a state most unbecoming for any respectable cryptocurrency. Having lost a vital support zone, Solana finds itself quite out of sorts, as sellers have seized the opportunity to assert their dominance once more. While the buyers have made valiant efforts to stabilize the price during this phase of consolidation, their endeavors have been met with a conspicuous lack of robust follow-through, thereby perpetuating the ominous specter of downside risk and redirecting our attention toward the vicinity of $50 as a potential new threshold of support.

This disconcerting trend appears to be closely entwined with Bitcoin’s recent descent below a significant psychological barrier. Whereas Ethereum and XRP have managed to uphold their supports with a degree of dignity, Solana has struggled most grievously to foster any semblance of momentum following its brief uptick, raising eyebrows and concerns alike regarding whether the current circumstances might indeed herald a deeper plunge into despair.

Oh, Those Big Players Have Taken Their Leave

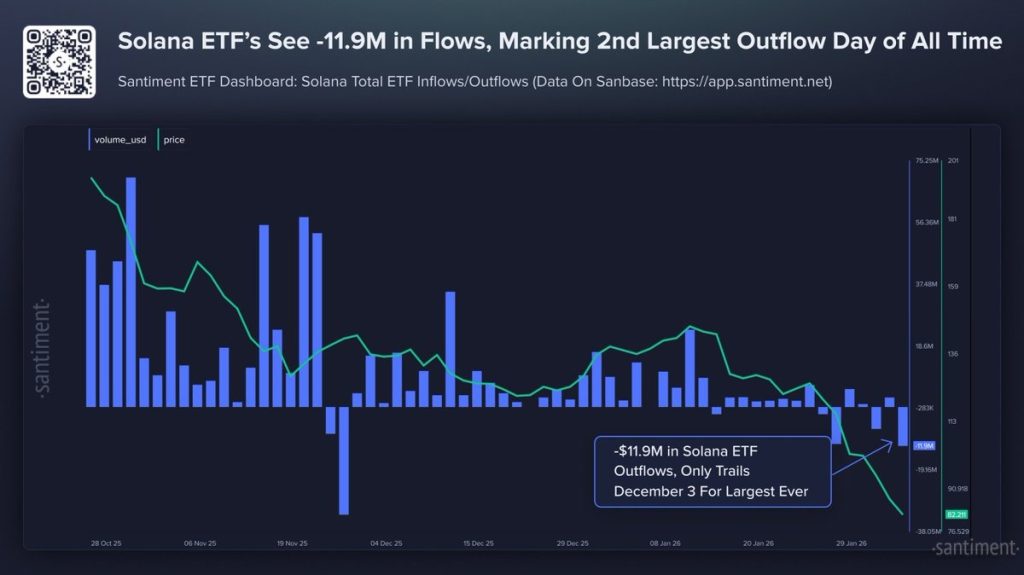

Since their debut upon the financial stage, Solana ETFs have enjoyed a rather consistent influx of net investments, with outflows remaining but fleeting and modest. Alas, the chart presented above tells a rather different tale, one of shifting fortunes and waning enthusiasm. There have been rare occasions when outflows momentarily eclipsed inflows, signalling a distinct cooling of institutional interest, and the most recent data indeed underscores one of the more significant shifts to date.

To elucidate further, the esteemed analysts at Santiment inform us that Solana ETFs have recently witnessed net outflows nearing a staggering $11.9 million, marking the second largest exodus on record, trailing only behind the calamitous events of December 2025. Such news comes at a most inopportune moment, as SOL has already shed over 62% of its market capitalization within the past four months, lending credence to the notion that institutional sentiment has indeed faltered alongside the plummeting price.

Historically speaking, sharp ETF outflows during prolonged downtrends have often coincided with what one might call a late-stage selling frenzy or capitulation, rather than the initiation of fresh declines. While this observation does not definitively confirm a market bottom, the magnitude of these outflows suggests that traders are adopting a decidedly cautious stance-a dynamic that has, in times gone by, preceded fortuitous periods of stabilization once the selling pressure begins to wane.

Is Solana (SOL) Price Destined for the Dreaded $50?

The weekly chart reveals an uptick in selling pressure upon our dear Solana, even after a fleeting attempt at recovery. As the chart illustrates, the buyers have woefully failed to provide sustained backing, leaving SOL ensnared beneath critical resistance zones. The sharp surge in trading volume last week precipitated a heightened state of volatility; however, with volume now receding and the price confined within a narrow range, it is abundantly clear that momentum has diminished.

More critically, the weekly Gaussian Channel has taken on a decidedly bearish hue, suggesting that SOL may have inadvertently stumbled into a broader downtrend phase rather than a mere, temporary correction. This unwelcome development aligns with the confirmed breakdown of a rather notorious head-and-shoulders pattern on the weekly timeframe-an arrangement that frequently precedes extended downward movement if the price fails to reclaim its former glories.

On a somewhat optimistic note, the weekly RSI appears to have reached its nadir and is tentatively attempting a rebound, which may indicate that the selling pressure is beginning to abate. Nevertheless, until such time as momentum improves and the price successfully reclaims pivotal resistance levels, the overarching sentiment remains one of prudent caution, perpetuating the risk of further decline as the month unfolds.

The Bottom Line

In conclusion, Solana remains ensconced in a precarious position as long as its price lingers beneath the $105-$110 resistance zone. Should it fail to reclaim this territory, it could very well find itself subjected to continued downward pressure, making way for a potential retreat towards $77-$75, where short-term demand may deign to intervene and halt the decline. A more profound breakdown would inevitably bring the $50-$55 region into sharp focus, aligning with historical support levels.

On a brighter note for the bulls, a robust weekly close above $115 would serve to invalidate the bearish narrative and redirect momentum toward the more sanguine realms of $135-$150. Until such fortuitous developments arise, the risk shall remain decidedly skewed toward further declines.

Read More

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- New survival game in the Forest series will take us to a sci-fi setting. The first trailer promises a great challenge

- These are the last weeks to watch Crunchyroll for free. The platform is ending its ad-supported streaming service

- Exodus Looks To Fill The Space-Opera RPG Void Left By Mass Effect

- Future Assassin’s Creed Games Could Have Multiple Protagonists, Says AC Shadows Dev

- Zombieland 3’s Intended Release Window Revealed By OG Director

- The Best Battlefield REDSEC Controller Settings

- Puzzled by “Table decoration that you can light up” in Cookie Jam? Let’s solve this puzzle together

- ‘Stranger Things’ Actor Gives Health Update After Private Cancer Battle

2026-02-09 22:13