The cryptocurrency plunged a staggering 7% in less than 24 hours, leaving us all scratching our heads. Could something fishy be afoot? 🐟💸

Unseen Hands: Are Whales Secretly Controlling Bitcoin’s Value?

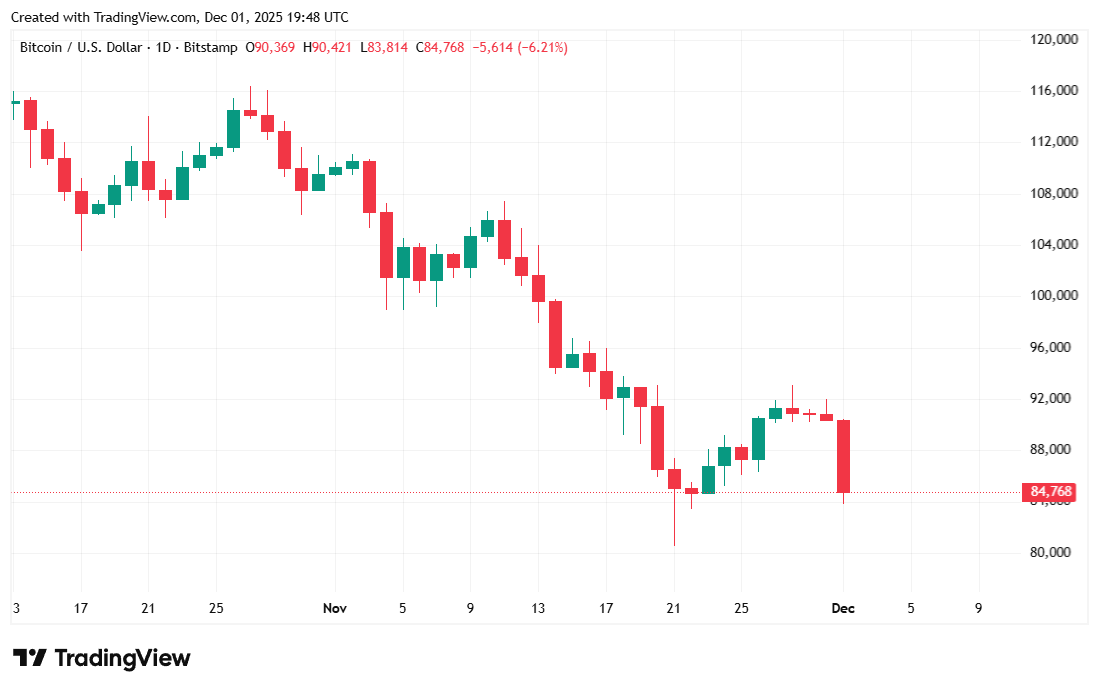

On the same day, six major exchanges experienced outflows of nearly 40,000 BTC – that’s over $3.6 billion in just 24 hours. 🤑 According to the ever-popular crypto trader “DefiWimar” on X, Bitcoin then nosedived from $91K to $87K, ultimately plummeting to $83,862.25 by Monday morning. Was this a “coordinated dump,” as DefiWimar insists, or just a series of harmless transactions – the usual Wednesday chaos of exchange operations? 🤔

Matt Law, partner at Web3 accelerator Outlier Ventures, chimes in: “These are major OTC and trading venues acting on behalf of clients. You’re shooting the messenger, not the mastermind!”

It’s important to note that outflows are not always sales. One helpful X user suggested these transactions might just be part of a month-end rebalancing. Oh, the sweet irony of things not being as dramatic as Twitter makes them seem. But let’s not forget, those outflows could still be real sell orders, caused by panicking investors or liquidated leveraged traders. The drama! 😱

Arthur Hayes, co-founder of Bitmex, offers a more ‘rational’ explanation: Japan’s looming interest rate hike has some traders running for cover. The BOJ’s 25-basis-point hike would hit the carry traders who’ve been using Japan’s low interest rates to fund Bitcoin buys. “$ BTC dumped ‘cause BOJ put Dec rate hike in play,” Hayes tweeted, trying to add some sense to the madness. 📉

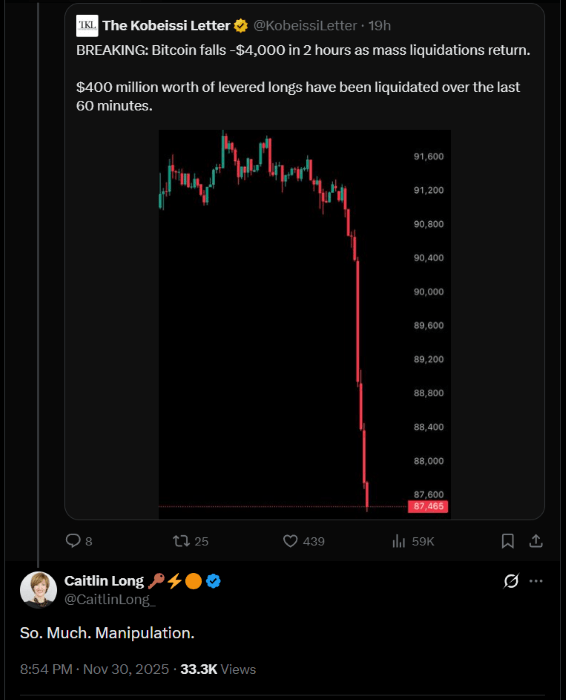

Despite Hayes’ more “thoughtful” reasoning, the whispers of Bitcoin price manipulation are growing louder. It’s not just the conspiracy theorists hiding behind Pepe avatars anymore. Even the big players like Caitlin Long, CEO of Custodia Bank, are joining the chorus. “So. Much. Manipulation,” Long said, calling out the recent plunge that wiped out $400 million in liquidations. Someone get the popcorn! 🍿🎬

Overview of Market Metrics

Bitcoin fell 7.12% over the last 24 hours and was trading at $84,916.12 at the time of reporting, according to Coinmarketcap. Weekly performance? Oh, it’s better, but still negative, shedding 3.85% in the last seven days. Volatility skyrocketed, with BTC dropping as low as $83,862.25 and soaring to $91,626.32 within the same 24-hour period. Buckle up! 🎢

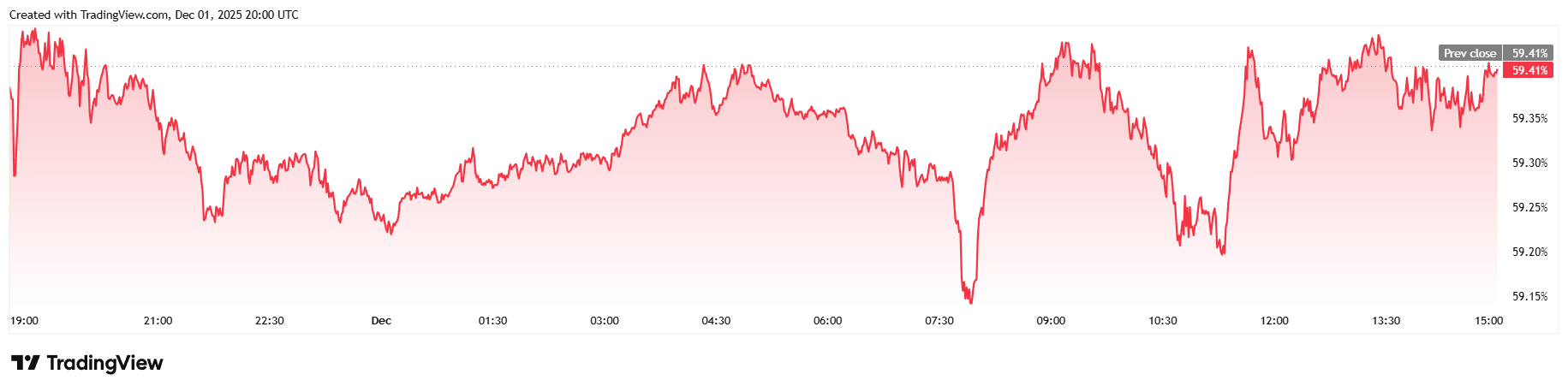

Trading volume soared by 120.48% to $83.48 billion, mostly due to Sunday-Monday’s sell-off. Market cap shrank to $1.69 trillion, but Bitcoin’s dominance barely budged, dipping just 0.01% to 59.40%. Is Bitcoin the Titanic of crypto? 🛳️

Total Bitcoin futures open interest fell by 3.94%, reaching $57.37 billion, according to Coinglass data. Liquidations quadrupled from Friday, totaling $392.55 million. Nearly all losses were from those long investors who thought Sunday was the day to hold tight. 😂 Short sellers, though? They lost a modest $32.625 million. That’s how the cookie crumbles!

FAQ ⚡

- Why did Bitcoin suddenly drop 7%?

Some say it’s the massive outflows and liquidation storm, while others blame macroeconomic forces like Japan’s rate hike. - Do massive outflows automatically mean price manipulation?

Not necessarily. These outflows could be just internal transfers, rebalancing, or other non-malicious activities. Calm down, folks! 🙄 - What role did the Bank of Japan play in the sell-off?

Japan’s rate hike could ruin the party for carry traders who’ve been borrowing yen to buy Bitcoin, forcing them to sell. Oops! 😬 - Are credible experts concerned about manipulation?

Yes! Even crypto veterans like Caitlin Long are calling foul play, adding fuel to the conspiracy fire. 🔥

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- Gold Rate Forecast

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- These are the 25 best PlayStation 5 games

- Landman Recap: The Dream That Keeps Coming True

- After Receiving Prison Sentence In His Home Country, Director Jafar Panahi Plans To Return To Iran After Awards Season

2025-12-02 00:19