As a researcher with extensive experience in cryptocurrency markets, I have closely monitored Ethereum’s (ETH) recent price action and conducted a comprehensive technical and sentiment analysis.

As a crypto investor, I’ve noticed that Ethereum‘s price has been facing some resistance when trying to dip below the crucial $3K support level. The market seems to be evenly balanced between sellers and buyers, resulting in a period of sideways movement. However, if Ethereum were to unexpectedly break through this key threshold, it could lead to a domino effect with potentially significant consequences for the price trend.

Technical Analysis

By Shayan

The Daily Chart

After closely analyzing the day-to-day Ethereum price chart, there’s been a shift in trend towards bearish territory following a significant price rejection close to the $4K threshold. This development has instilled a sense of pessimism amongst traders in the crypto market.

Despite experiencing a decline, the market took a brief pause around the substantial $3,000 support zone, which includes the important $3K mark and the price range between the $3133 (0.5 Fibonacci level) and $2906 (0.618 Fibonacci level). This support region aligns closely with the significant 100-day moving average, suggesting a strong demand for the market near this important threshold.

Ethereum is presently in a holding pattern, with its value lingering near the important $3,000 mark. This could indicate that buyers are amassing, preparing for a strong price increase in the near future. However, if this significant support level is unexpectedly breached, a downward spiral may ensue, with the next major resistance points located at $2,500 and the 200-day moving average of $2,600.

The 4-Hour Chart

As a crypto investor, I’ve been closely monitoring Ethereum’s 4-hour chart and have noticed that its prolonged downtrend has resulted in the formation of a descending wedge pattern. This pattern, characterized by contracting highs and lows, has provided support for the price on several occasions as it bounced off the lower boundary.

As a crypto investor, I’m observing that Ethereum is currently exhibiting sideways price action around the lower limit of its wedge formation, which aligns with the $3K support level. This suggests that there’s growing buying interest in the market, making me optimistic about potential price increases.

Despite current circumstances, the cryptocurrency appears set to maintain its trading between the $3.4K resistance and $3K support. The market anticipates that the price will manage to surmount this crucial level, resulting in a resurgence of bullish momentum, propelling the price towards the $3.6K milestone.

Sentiment Analysis

By Shayan

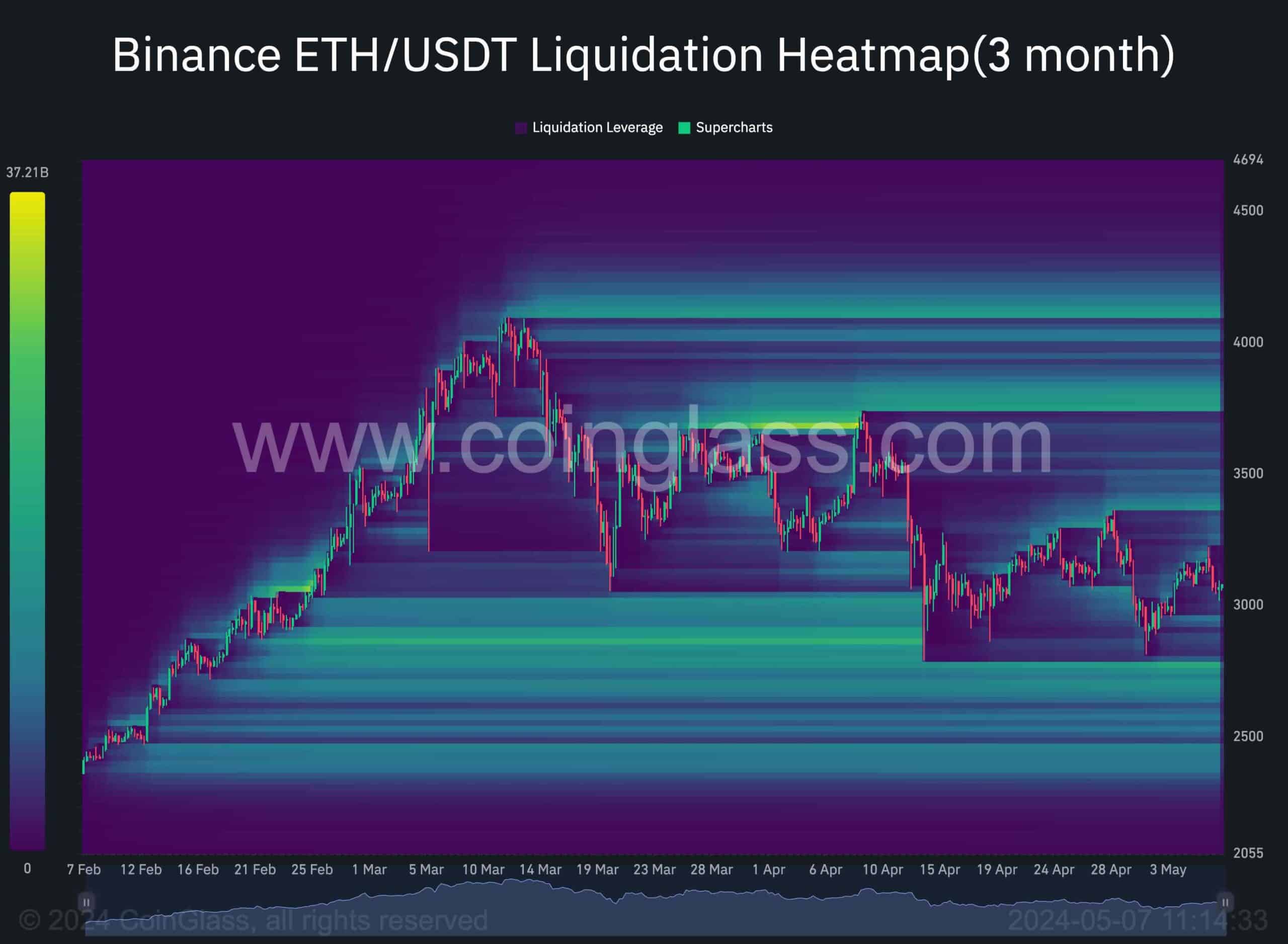

In Ethereum’s prolonged decline, triggered by its failure to break through the $4K barrier, investors keep a keen eye on the actions of traders in the futures market. The enclosed chart illustrates the Binance ETH/USDT pair’s liquidation heatmap, marking price points with substantial liquidity that could influence the price trend.

As a researcher observing market trends, I’ve noticed that the unexpected dip below the critical $3K mark led to a significant number of long positions being liquidated, causing a chain reaction of sell-stop orders being triggered. However, it’s important to note that since then, the price has remained relatively stable around the crucial and psychologically significant $3K support level. This could potentially indicate an accumulation phase in the market as investors may be buying up assets at this price point.

Based on the current market conditions and the expected demand beyond a significant turning point, it’s predicted that the price will begin a new bullish trend once the accumulation phase ends. Keep an eye on the price around the $3,000 mark, as a sudden drop below this critical level might lead to a chain reaction towards the $2,500 threshold.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- Is Granblue Fantasy’s Online Multiplayer Mode Actually Dead? Unpacking the Community Sentiment

- Honkai: Star Rail’s Comeback: The Cactus Returns and Fans Rejoice

2024-05-07 16:32