As a long-term crypto investor with some experience under my belt, I’ve seen market fluctuations like this before. The constant drops in Bitcoin’s price throughout the past few days have left me feeling a mix of frustration and cautious optimism.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin‘s price has been on a downward trend this week, failing to regain momentum for a rebound. The same pattern holds true for the broader cryptocurrency market, with most coins experiencing value declines within the past 24 hours.

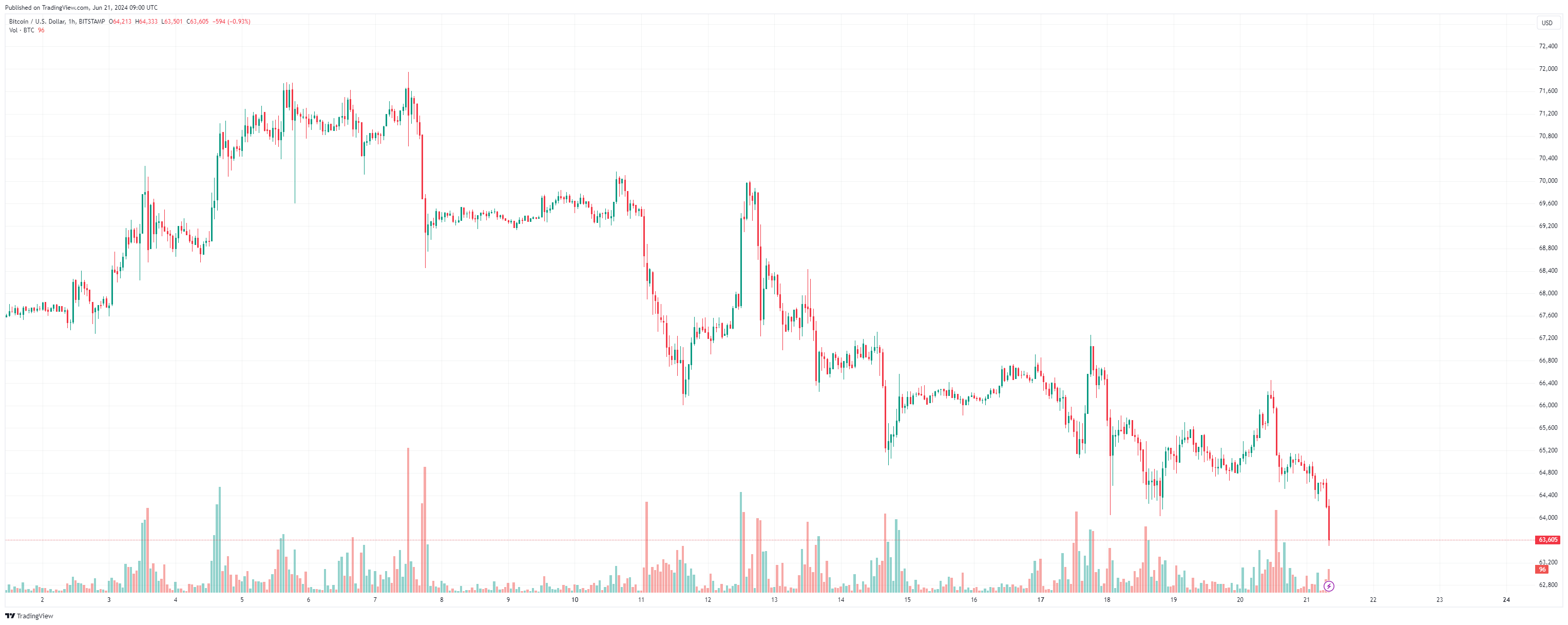

Bitcoin’s Price Tumbles Below $64K

Over the past few days, Bitcoin has struggled significantly, failing to bounce back despite facing adversity.

In my analysis as a cryptocurrency market observer, I’ve noticed that according to CryptoPotato’s recent report, Bitcoin’s price made an attempt to surge past the $66,000 mark earlier this week. However, sellers managed to thwart this advance and reclaimed their positions. Currently, Bitcoin is trading below the $64,000 threshold.

As an analyst, I’ve observed that this recent move led to a significant number of liquidated positions, primarily those holding long positions. The data from the previous 24 hours indicates approximately $150 million in total liquidations. A noteworthy portion, equating to around 73%, fell under the category of long positions.

The drop coincides with a relative decline in the stock market throughout the past day as well.

From my analysis of the heatmap presented, I notice that several top-performing stocks in the index, including NVDA, AAPL, and MSFT, are currently showing a downward trend.

Other Reasons Why is the Bitcoin Price Down Today

Previously, we shared that the sentiment among Bitcoin traders has reached unprecedented exhaustion as they expect the price to bounce back. Essentially, this signifies that a majority of traders are expressing fear or apathy towards the current pricing scenario, according to analytics provider Santiment.

In simpler terms, the prolonged fear, uncertainty, and doubt among Bitcoin traders is not common. Traders are giving up in large numbers, but this situation often triggers rebounds that benefit those who wait it out. The exhaustion of BTC traders, coupled with whales’ stockpiling, typically results in such rebounding trends.

Yet, it’s important to note that there are further considerations. For instance, studies indicate that the retail population has yet to arrive.

Additionally, there have been significant redemptions from Bitcoin exchange-traded funds (ETFs) in the United States over the past week. Approximately $900 million worth of Bitcoin was offloaded through these ETFs during this period.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- How to repair weapons & gear in Stalker 2

- SOLO PREDICTION. SOLO cryptocurrency

- Unlocking the Mystery of Brawl Stars’ China Skins: Community Reactions

- Dragon Quest III HD-2D Remake Review: History Repeats

- Team Fight Tactics (TFT) Patch 14.23 Notes: What to Expect from Set 13 Release

- W PREDICTION. W cryptocurrency

- Clash Royale: The Perils of Firecrackers and Cringe Decks

- POPCAT PREDICTION. POPCAT cryptocurrency

2024-06-21 12:26