This text describes the features and functionalities of BounceBit, a Web3 platform where users can customize and launch decentralized applications (dApps) and engage in various Web3 activities. For those who meet the criteria to own a BounceClub, they can select desired protocols and customize the space within the BounceBit App Store. Members without ownership can still browse and engage in different Web3 activities by connecting their wallets.

As a crypto investor, I’ve recently come across an intriguing concept called liquid staking that’s been generating quite a buzz in the industry. This innovative approach allows me to earn more value from my staked tokens by unlocking their liquidity while keeping them actively contributing to the network. It’s like having my cake and eating it too!

Predominantly, however, this has been applied throughout a variety of Ethereum-based applications.

Instead of “BounceBit, on the other hand, is delivering a BTC staking infrastructure designed to serve as a base for diverse staking offerings,” you could also say:

In this detailed exploration, we delve deeper into the inner workings of BounceBit, examining its operational mechanisms and the economic principles underlying its native digital currency. Let’s get started.

Quick Navigation

- What is Liquid Restaking?

What is BounceBit?

What Problems Does BounceBit Solve?

Understanding BounceBit’s Infrastructure

Dual-Token PoS Structure

Sustainable Validator Economics

EVM Compatibility

BounceClub: For Owners and Members

BTC Bridge

The Liquid Staking Tokens

BounceBit Economy: Everything You Need to Know About BB Tokenomics

The Binance Megadrop: Step by Step Guide

What is Liquid Restaking?

As a researcher exploring the topic of digital marketing, let me clarify the idea behind liquid retargeting before delving into the functions of BounceBit. Liquid retargeting refers to a marketing strategy where advertisers serve targeted ads to individuals who have previously engaged with their brand online but did not make a purchase or complete a desired action. By utilizing cookies or pixels, marketers can display personalized ads across various platforms and websites, increasing the likelihood of conversions.

1. Subsequently, users can leverage this synthetic ETH to engage with other platforms that support it for various transactions or operations.

Instead of liquid restaking, let’s call it the process of boosting the financial stability of external platforms. Essentially, by depositing your synthetic ETH (referred to as LST hereafter), you can earn another token – a liquid staking token.

Many LRT (Lightning Research Team) protocols are shifting their focus towards Ethereum due to its Proof of Stake structure.

Instead of “BounceBit, on the other hand, is building a BTC restaking infrastructure that’s designed to provide a layer for restaking products on the Bitcoin network,” you could say:

How do they do it? Well, let’s find out.

What is BounceBit?

As a researcher exploring innovative approaches to Bitcoin’s value proposition, I would like to propose BounceBit’s infrastructure concept. This design is grounded in the belief that the inherent worth of Bitcoin should primarily reside at its foundational level. In other words, we aim to create an infrastructure where Bitcoin functions mainly as a digital asset.

In simpler terms, BounceBit functions as a unique Proof of Stake platform where both Bitcoin (BTC) and the native BounceBit token are required for validators. This innovative setup enhances network security and adds value to Bitcoin by involving its holders in validating transactions within the BounceBit ecosystem.

Our aim is to establish a mutually beneficial connection between BounceBit’s indigenous token and Bitcoin, thereby creating a dynamic and robust network.

“BounceBit utilizes compatibility with other networks that use EVM technology, including Binance Smart Chain (BSC) and Polygon (previously Matic Network), allowing for the usage of staked assets like BTCB on BSC and WBTC.”

As a researcher studying yield generation in the cryptocurrency space, I’ve come across an intriguing distinction between Bitcoin and Ethereum when it comes to generating returns. Unlike Ethereum-based protocols, Bitcoin’s yield generation is complicated by its inability to produce rewards while coins are stored in multi-signature wallets. To tackle this issue, BounceBit employs a centralized finance (CeFi) strategy. Leveraging Mainnet Digital’s custodial services and Ceffu’s MirrorX technology stack enables us to generate yields on Bitcoin held within their systems.

In simpler terms, this means that Bitcoin can continue being a part of the blockchain network, while at the same time participating in transactions facilitated by centralized trading platforms.

What Problems Does BounceBit Solve?

- Tackling Lack of Transparency

As a researcher looking back at the events of 2022, I recall the significant challenges surrounding transparency that affected various entities within the industry, most notably Celsius and others.

“BounceBit utilizes on-chain verification of reserves (PoR) alongside clear and open transactions, aiming to rebuild trust and provide a reliable service for Bitcoin owners to generate returns.”

- Underutilized BTC Assets

Unquestionably, Bitcoin (BTC) owners grapple with the issue of their holdings lying dormant. BounceBit aims to address this concern by offering them an opportunity to put their assets to work within the bustling realms of decentralized finance (DeFi) and Non-Fungible Tokens (NFTs).

- Improving Bitcoin Utility by Enabling Additional Use Cases

Expanding upon the previous statement, BounceBit is dedicated to enhancing the versatility of Bitcoin (BTC) and the Bitcoin network as a whole. The aim is to increase the range of possibilities for Bitcoin owners and establish it as a significant financial asset by fully utilizing its potential.

- Unifying BTC Across Chains

“BounceBit recognizes that the lack of a smart contract platform in Bitcoin’s infrastructure hinders the advancement of decentralized applications (dApps). To address this issue, BounceBit aims to offer a solution.”

Understanding BounceBit’s Infrastructure

“Instead of traditional staking systems that rely solely on one type of token, BounceBit is constructing a network based on the widely-used Proof-of-Stake consensus algorithm. They refer to this innovative method as Dual-Token PoS.”

Dual-Token PoS Structure

As a researcher studying the BounceBit protocol, I’d like to clarify that its design includes several node operators. These operators serve as validators, which is a role requiring them to hold stakes of BB, the native token of BounceBit, and/or BBTC, staked BTC on the BounceBit chain. Their primary responsibility is to process and authenticate transactions taking place on the network. In return for their efforts, they are compensated with transaction fees. Since it’s a hybrid model, validators have the flexibility to opt for receiving BBTC and/or BB as rewards.

The reason for incorporating staked Bitcoin into the consensus mechanism is twofold. First, it allows us to leverage the extensive liquidity present in the Bitcoin network to kickstart the protocol. Second, it takes advantage of Bitcoin’s relatively stable price fluctuations compared to other cryptocurrencies.

Sustainable Validator Economics

To maintain the network’s operation while meeting various requirements, BounceBit enables its validators to collect a fee on the rewards earned from staking. This strategy aims to fairly compensate validators for their significant role in preserving the network’s resilience and efficiency.

EVM Compatibility

BounceBit’s chain can work with both the Ethereum Virtual Machine and Solidity, which is widely used to write smart contracts on Ethereum. This ease of transition for developers, coupled with Ethereum’s proven security and extensive ecosystem, makes it an attractive choice.

BounceClub: For Owners and Members

In the spirit of Apple Inc.’s relentless pursuit of novelty, the BounceClub represents a self-governing, blockchain-based ecosystem. Here, members have the freedom to create, introduce, and interact with diverse decentralized applications (dApps).

Owners of BounceClub who meet the necessary qualifications have the ability to choose preferred protocols from the BounceBit App Marketplace and effortlessly personalize their spaces through a user-friendly interface. Detailed instructions for doing so can be found here.

If you’re not a member of BounceClub but are interested in exploring Web3 activities, you have the option to browse through the clubs created by other users without having to manage one yourself. All you need is to link your digital wallet.

- BTC Bridge

The primary function of the BTC bridge in BounceBit’s system is to ensure safe and seamless transfer of Bitcoin (BTC) between the Bitcoin blockchain and other Ethereum Virtual Machine (EVM) chains, including BounceBit.

As a researcher studying BounceBit, I can assert that this essential element plays a pivotal role in realizing the functionality and achieving the mission and goal of our organization.

Network validators play a crucial role in ensuring the security of the bridge by maintaining it. Each validator runs a bridge node and participates in the signing of cross-chain messages, employing a multi-signature approach with added steps. For further information on the BounceBit BTC bridge, please check it out here.

The Liquid Staking Tokens

With a native liquid staking mechanism, BounceBit enables users to participate by committing their BB or BTC. In return, they’ll be issued LST tokens (liquid staking tokens).

- stBB – derived from staking BB

stBBTC – derived from staking BBTC (BTC staked on BounceBit)

Staked tokens (LSTs) can be transferred to Shared Security Clients with the objectives of pooling security and making staked assets more liquid. You can redeem these tokens here by undoing the staking process. Once you submit a redemption request, there is a 24-hour waiting period before you can receive your tokens again.

BounceBit Economy: Everything You Need to Know About BB Tokenomics

Let’s begin by clarifying that BounceBit’s economic structure consists of three distinct groups. Each group is rather straightforward in its definition:

- Users

- BB Holders

- Node operators

The BounceBit platform is fueled by BB, which serves as its native digital currency. Its total issuance is limited to 2.1 billion tokens in tribute to Bitcoin’s supply cap of 21 million.

BB tokens can be used in multiple ways, so we will list a few of them:

- Use BB to take part in the on-chain governance process

- Stake BB to participate in the PoS Dual-token mechanism (read above)

- BB is paid out as a reward for validators who secure the network

- It’s the denomination of gas fees on the network

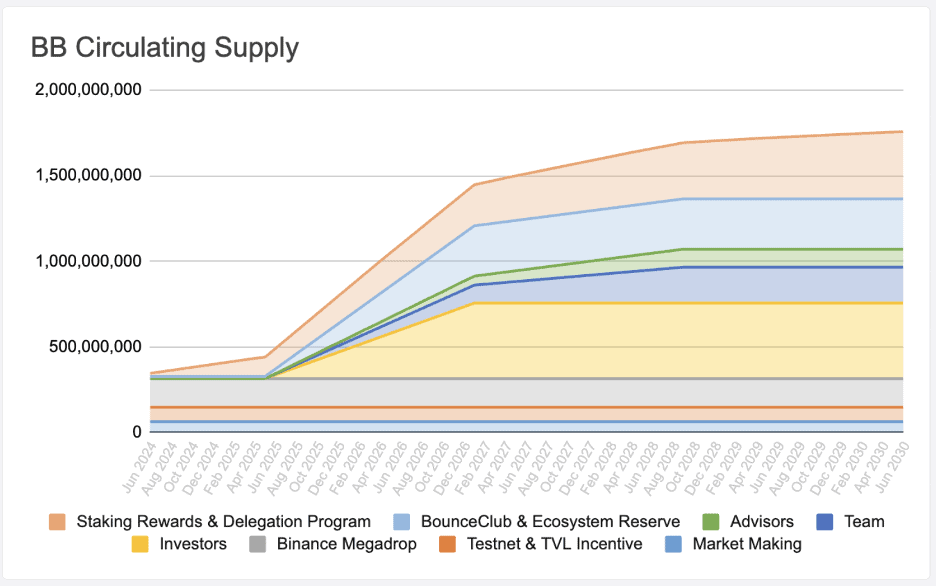

Here’s what the token release schedule looks like:

This is the BB token distribution:

Testnet & TVL Incentive: 4%

Investors: 21%

Team: 10%

Advisors: 5%

Binance Megadrop: 8%

Market Making: 3%

BounceClub & Ecosystem Reserve: 14%

Staking Reward & Delegation Program: 35%

The Binance Megadrop: Step by Step Guide

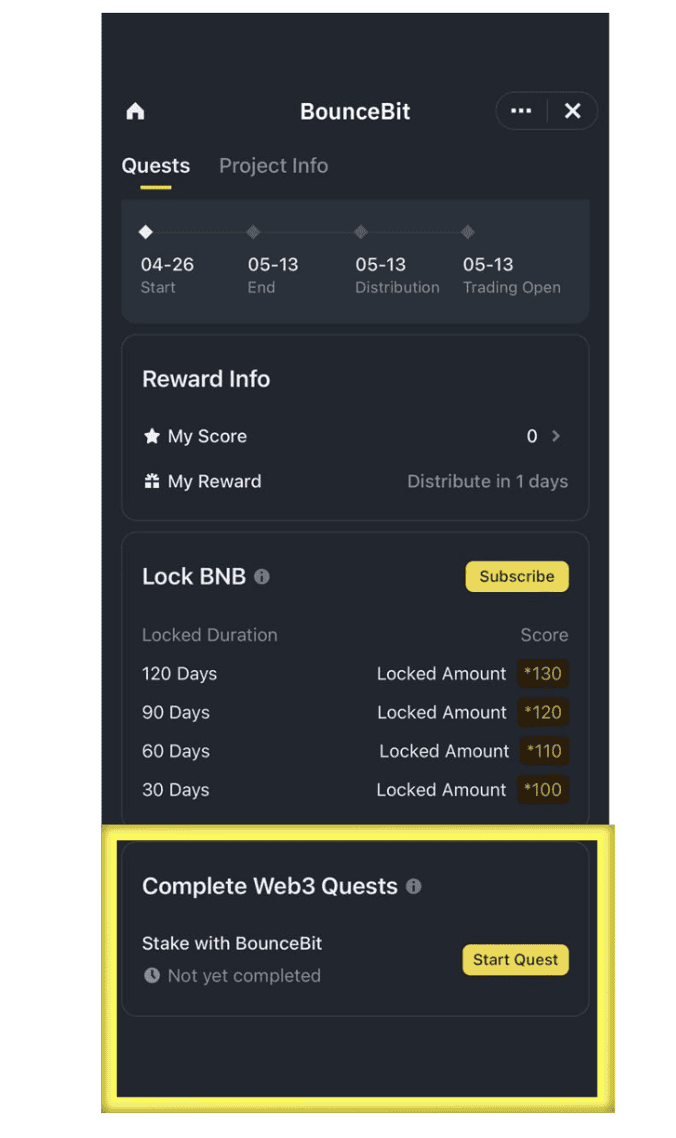

The Binance Megadrop sets aside 8% of its overall supply for this event. This is an innovative token launch platform, which combines Binance’s Simple Earn feature and their Web3 Wallet in its design.

The platform offers users the opportunity to gain access to select Web3 projects prior to their public listing on exchanges.

The following is a step-by-step guide on how to participate in the Binance Megadrop for BounceBit.

There are two ways to participate, and both require a Binance account.

By clicking on this link, you can sign up and secure a special $600 welcome incentive for CryptoPotato audience members!

After setting up your account, begin by visiting the Megadrop area to secure your BNB and accumulate points. Subsequently, subscribe to your BNB and lock it for a designated term to collect scores.

As you can see, the longer the subscription period, the higher the multiplier is.

Moving forward, you have the option to accomplish tasks on the Web3 platform. To carry out these tasks, you will require a Binance Web3 Wallet. You can easily set up this wallet through your Binance mobile app. Simply visit the “wallets” tab at the bottom of the app’s interface and tap the “Web3” label located at the top.

After generating your wallet instructions are straight ahead. Once your new Web3 wallet is set up, return to the Megadrop area and click “Start Quest” at the bottom; remember, you’ll need to stake with BounceBit for this step.

From there on, you can follow the instructions, which will guide you toward quest completion.

From there on, you can follow the instructions, which will guide you toward quest completion.

Your final score is calculated by adding your Locked BNB score, multiplying it by your Web3 quest multiplier, and then adding any Web3 quest bonuses you may have earned.

Total Score = (Locked BNB Score * Web3 Quest Multiplier) + Web3 Quest Bonus.

If you fail to finish all the quests, you will receive a multiplier of just 1.

This post has been powered by BounceBit.

Read More

- W PREDICTION. W cryptocurrency

- ACT PREDICTION. ACT cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- Unlocking Destiny 2: The Hidden Potential of Grand Overture and The Queenbreaker

- ESO Werewolf Build: The Ultimate Guide

- Mastering Destiny 2: Tips for Speedy Grandmaster Challenges

- Rainbow Six Siege directory: Quick links to our tips & guides

- Exploring Izanami’s Lore vs. Game Design in Smite: Reddit Reactions

2024-05-11 15:18