As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market volatility. Yesterday’s sudden plunge in Bitcoin’s price was a stark reminder of the rollercoaster ride that comes with investing in cryptocurrencies.

Over the last few days, Bitcoin‘s value has experienced significant volatility, leading to numerous margin calls and liquidations worth hundreds of millions in total.

Experts in the trading and analysis community are currently debating future possibilities, as cryptocurrency expert Willy Woo offers his perspectives on Bitcoin’s near-term price objectives.

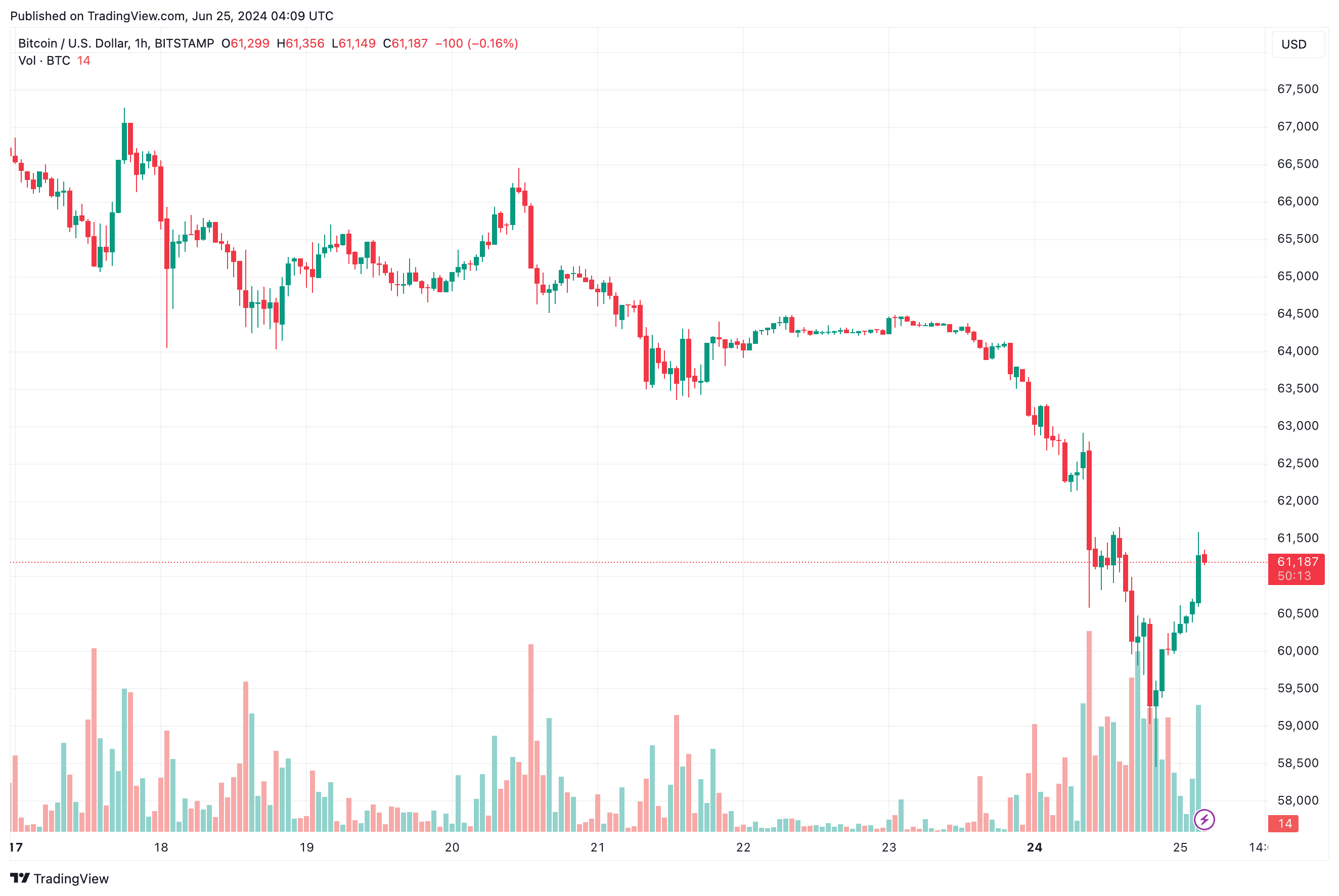

BTC Bounces Back Above $61K

The BTC price went off a cliff yesterday, plunging to a low not seen since the beginning of May.

I noticed in the graph before me that the value of the cryptocurrency dipped down to approximately $58,400 before bouncing back.

The recent surge in market volatility resulted in significant liquidations in the futures market, totaling approximately $360 million over the past 24 hours. A large proportion of these liquidations involved long positions, which was anticipating given current market conditions.

According to data from Coinglass, around $280 million of the liquidations were long.

Willy Woo, a renowned figure and seasoned cryptocurrency expert, offered insights into recent developments with Bitcoin and proposed potential actions moving forward.

What’s Next for the Bitcoin Price?

Based on Willy Woo’s analysis, the significant price movement observed yesterday can be attributed mainly to a prolonged chain reaction of liquidations in the futures market.

He contended that the initial goal for reducing leverage was set at $62.5K, but as speculators continued to open new long positions, this only intensified the liquidation process in a successive long squeeze.

An additional factor for the crash was the capitulation of miners:

As a researcher studying the cryptocurrency market, I’ve observed that the ongoing liquidation squeeze is compounded by a post-halving miner capitulation. Miners are currently selling large quantities of Bitcoin to cover expenses for upgrading their hardware, as the older equipment becomes unprofitable. The least profitable miners are shutting down operations and facing liquidation. – Expressed by Woo.

According to Woo’s analysis, short-term technical indicators suggested a price reversal for Bitcoin. Indeed, the cryptocurrency’s value rebounded, reaching approximately $61,000 once more.

The analyst issued a cautionary note, stating that Bitcoin’s turbulence was far from over. He emphasized the significance of keeping an eye on the extent of speculative bets being liquidated in the market.

Without purging futures open interest, the system is not ready to move up.

As a researcher studying the Bitcoin market, I’ve observed that only around 3% of the total open interest for Bitcoin has decreased within the last 24 hours based on available data.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- CEL PREDICTION. CEL cryptocurrency

- CTSI PREDICTION. CTSI cryptocurrency

- USD HUF PREDICTION

- EUR PHP PREDICTION

2024-06-25 07:40