As an experienced analyst, I believe Polkadot’s recent price action is a clear indication of the market’s bearish sentiment towards the cryptocurrency. The failure to surpass the critical resistance at $7.5 resulted in a significant sell-off, causing a 7% decline. The current support level around $6.5 is crucial and will determine Polkadot’s future trend.

At a price of $7.5, Polkadot buyers encountered strong resistance and as a result, faced a substantial 7% drop as selling pressure intensified.

Reaching a pivotal point, the value of this cryptocurrency is presently at a significant support stage. The forthcoming market movements hold great importance as they will influence the direction Polkadot’s price trend will take.

Technical Analysis

By Shayan

The Daily Chart

As a crypto investor, I’ve been closely monitoring Polkadot’s daily chart for several weeks now. I’ve noticed that despite several attempts, buyers have failed to push the price above a crucial resistance area. This resistance zone encompasses the 100-day moving average, which hovers around $7.6, as well as the price range spanning between the 0.5 Fibonacci level at $7.4 and the 0.618 Fibonacci level at $7.8. The persistence of this resistance is reinforced by a significant amount of supply, which most likely stems from aggressive short positions in the perpetual markets.

The increased intensity in selling caused Polkadot’s price to drop by 7%, suggesting a bearish outlook in the market. Nevertheless, the price has now approached a significant support area close to the $6.5 mark.

As an analyst, I would interpret this situation as follows: The current price range exhibits strong buying interest that could potentially reverse the ongoing downward trend and prevent further losses. However, if this critical support level fails to hold, it’s likely that the bearish momentum will persist in the intermediate term.

The 4-Hour Chart

On the 4-hour chart, Polkadot’s price had been forming an uptrending triangle during its extended consolidation period. However, after hitting a roadblock at the notable resistance level of $7.5, the price plummeted, shattering the triangle’s lower boundary. This sudden breakdown triggered mass sell-offs among long position holders, leading to a domino effect that pushed the price down towards $6.5.

The cost has presently hit a vital area where it may find substantial support around the $6.5 mark. This region encompasses previous significant daily low points. It’s anticipated that a phase of stability close to this essential support will ensue prior to any notable price advancement or decline.

Sentiment Analysis

By Shayan

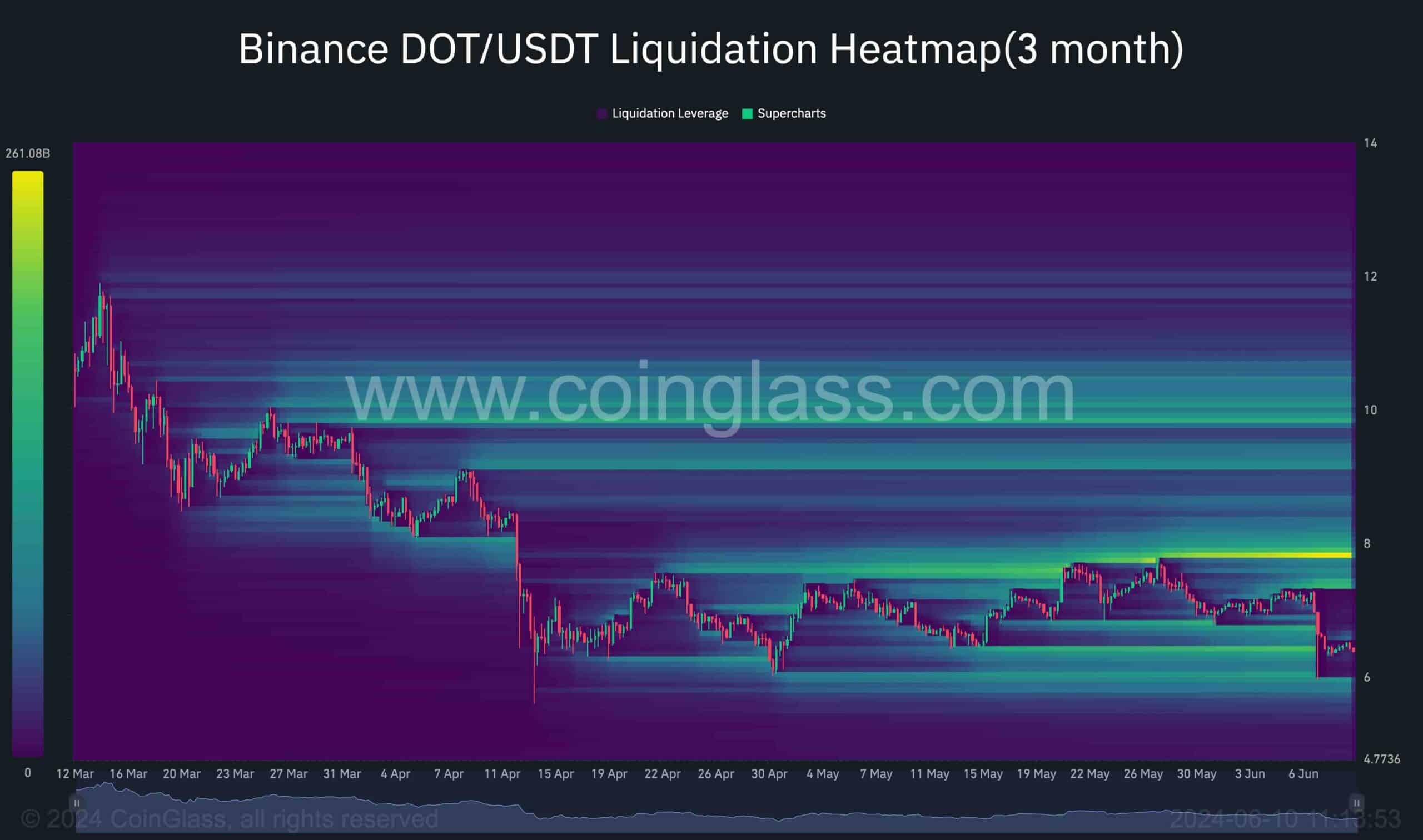

At present, Polkadot is taking a pause around the $6.5 level following a notable decline. By examining the futures market indicators, particularly the DOT/USDT Binance liquidation map, we can gain essential information regarding impending price shifts and available liquidity resources.

As a researcher studying market trends, I’ve observed that the heatmap reveals a significant drop in price, causing a large amount of liquidity to be absorbed between the $6.5 and $6 levels. Consequently, numerous long positions have been liquidated during this period. It’s important to note that there are no notable liquidity pockets beneath the $6 mark. This pattern often signals a pause or cooling-off phase in the futures market.

Significant liquidity exists around the $8 mark, implying it may serve as a hurdle for further price increases. Consequently, should the market experience a bullish recovery in the medium term, this area is expected to be the main objective for purchasers aiming for a reclamation.

Read More

- CKB PREDICTION. CKB cryptocurrency

- PBX PREDICTION. PBX cryptocurrency

- EUR INR PREDICTION

- PENDLE PREDICTION. PENDLE cryptocurrency

- USD DKK PREDICTION

- ICP PREDICTION. ICP cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

- USD VND PREDICTION

- CSIX PREDICTION. CSIX cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

2024-06-10 18:37