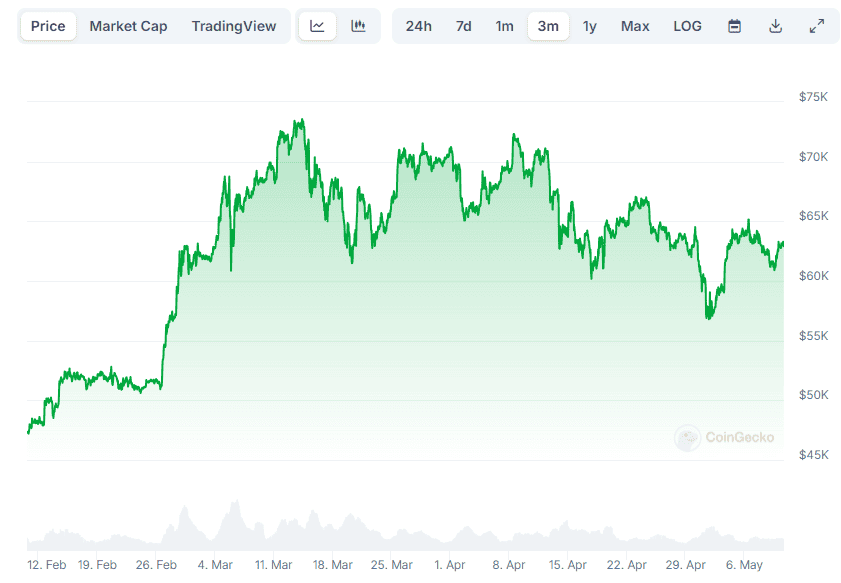

As a seasoned crypto investor with a few years under my belt, I’ve seen Bitcoin’s price fluctuations and market dynamics evolve significantly. The start of 2024 brought new hope as BTC reached an all-time high above $73,500. However, the subsequent dip below $60K and the current trading around $63,000 has left many investors uncertain about the future.

TL;DR

- Bitcoin kicked off 2024 on a high note, achieving a record high over $73,500, though it later dipped to around $63,000. A new bull run may hinge on factors like technological advances, adoption rates, and global events.

Key influences on BTC’s future price include potential changes in the US Federal Reserve’s interest rate policies and the outcome of Ripple’s lawsuit against the SEC, both of which could significantly impact investor sentiment and market dynamics.

The Overall Conditions

As a crypto investor, I’ve witnessed an encouraging beginning to 2024 for Bitcoin (BTC). In the initial quarter, its price steadily climbed higher, reaching new heights of over $73,500 by mid-March. However, the past two months haven’t been as fruitful. The asset dipped below the $60K mark for a brief period and is currently trading around $63,000 based on CoinGecko’s data.

In this context, instead of “As such, we decided to ask ChatGPT whether a new bull run is on the horizon this year. The AI-powered chatbot claimed that predicting Bitcoin’s price behavior is quite speculative and depends on several factors,” you could say:

A new bull run in the market could potentially be initiated through various factors including technological advancements, rising adoption, favorable investor attitudes, increasing public fascination, and geopolitical occurrences.

Diving Into Detail

In addition to the previously mentioned influences, ChatGPT highlighted two specific aspects that might lead to a Bitcoin price surge: the moves of the US Federal Reserve and the decision in the legal battle between Ripple and the US Securities and Exchange Commission.

Following the outbreak of COVID-19, the Federal Reserve in the United States implemented a bold anti-inflationary strategy to curb inflation in the world’s biggest economy. This was accomplished through a series of interest rate increases, potentially dampening investments in more volatile assets like cryptocurrencies.

Some signs point towards the Federal Reserve potentially shifting away from its current monetary policy later in 2023, an action that several Bitcoin optimists are eagerly anticipating.

“Reducing interest rates can boost the inflow of funds into Bitcoin, influencing investor decisions and risk assessments. Collectively, these elements may lead to an uptrend in Bitcoin’s value.”

As an analyst, I believe that a favorable outcome in Ripple’s ongoing legal battle against the SEC could significantly boost the entire cryptocurrency market. The trial phase commenced last month, and based on recent developments, there is growing optimism that Ripple may come out on top. In fact, the company has secured three partial court victories throughout 2023, increasing the likelihood of a positive verdict.

“A victory for Ripple could be perceived as a setback for excessive regulatory control by entities like the SEC. This perception might bolster investor faith in the durability of significant cryptocurrencies amidst regulatory hurdles. Consequently, both individual and institutional investors may consider expanding their investments in digital currencies, such as Bitcoin.”

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

- Brawl Stars: Exploring the Chaos of Infinite Respawn Glitches

- W PREDICTION. W cryptocurrency

2024-05-11 23:12