Polkadot has experienced a prolonged price drop, hitting a significant support zone where its 100-day moving average and the 0.618 Fibonacci retracement level intersect. Despite this bearish trend, certain signs point to a possible recovery approaching the important $10 threshold.

Technical Analysis

By Shayan

Polkadot’s Price on the Daily Chart

An in-depth analysis of the day-to-day price chart reveals that DOT experienced a prolonged downtrend after reaching its peak of $11.9 this year, despite an earlier strong bullish run.

Instead of this: “However, upon encountering a significant support zone marked by the 100-day moving average and the critical 0.618 Fib level at $8.2, the downward trend eased, causing minimal price swings.”

At this crucial point where various levels of support meet, there is a significant demand indicated, along with a considerable amount of sell orders waiting to be executed below this level.

In simple terms, if the current trend continues, the price may reach the significant resistance level of $10, causing an uptrend. However, there’s a risk of a sharp drop causing a domino effect, resulting in more losses.

DOT’s Price on the 4-Hour Chart

Examining Polkadot’s price action over a 4-hour span provides insights into its corrections. Lately, the price hit a significant support at approximately $8, resulting in a small bounce back.

Remarkably, among the corrections, there’s appeared a falling wedge chart pattern. This pattern often indicates a possible bullish turnaround once it breaks above its upper limit.

Despite hitting resistance at the upper edge of the wedge, DOT‘s price experienced a small decline. It’s plausible that the price will keep bouncing around within this crucial wedge formation and close to the significant support level of $8. However, there is a general belief among traders that an uptrend towards the $10 mark is imminent in the near future.

Sentiment Analysis

By Shayan

In the perpetual futures market, the process of closing positions (liquidating) plays a crucial role in causing price changes. This is an important factor for traders to consider as its impact on market movements is significant. Much like recognizing large amounts of buy and sell orders in the order book can benefit traders, being aware of the liquidation points of other traders can provide valuable information.

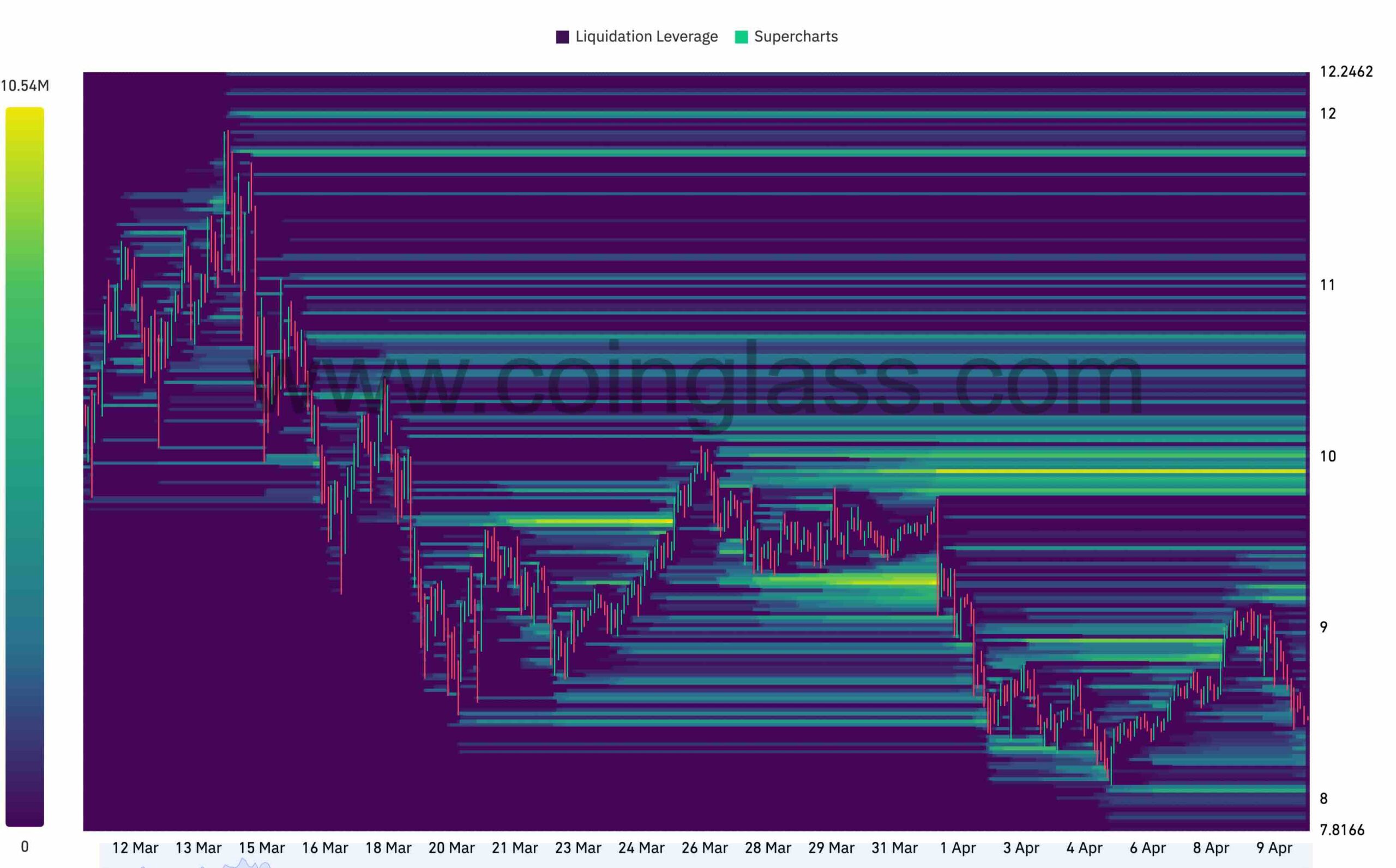

A liquidation heatmap for the DOT: USD pair from Coinglass is shown below, displaying potential zones for significant liquidations. The colors range from purple to yellow, with yellow representing higher expected liquidations. This heatmap assists traders in locating areas where liquidity is more concentrated.

After examining the market data closely, it is clear that a significant amount of liquidity exists close to the important resistance level at $10. The large number of potential sell points in this vicinity indicates a possible trend toward reaching the $10 mark in the near future.

While it’s important to consider the possibility of a prolonged decline in price, leading to lower levels, which should not be ignored.

Read More

- Skull and Bones: Navigating the Quest for Extra Teeth in the Game

- Uncovering the Mystery of Red King Players in Clash Royale – What Reddit Users Have to Say

- AAVE PREDICTION. AAVE cryptocurrency

- Discovering the Infinite Power: The Abiotic Factor that Could Change Everything

- UFO PREDICTION. UFO cryptocurrency

- Finding Resources in Palworld: Tips from the Community

- BONE PREDICTION. BONE cryptocurrency

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- Gaming News: Like a Dragon: Infinite Wealth’s Dondoko Island Takes Expansion to New Heights

- Unveiling the Mystery of Palworld IVs: What Redditors Have to Say

2024-04-10 18:45