This article provides a comprehensive overview of the top Solana decentralized exchanges (DEXs) currently available. It covers each DEX’s key features, fee distribution models, wallet support, and their place in the growing Solana DeFi ecosystem. Additionally, it discusses the advantages of trading on a DEX and clarifies any safety concerns that users might have.

Hundreds of decentralized applications (dApps) thrive on the Solana blockchain, taking advantage of its impressive capabilities in terms of high transaction processing speed, ability to handle large volumes, and compatibility with other applications.

There’s a reason it’s one of the largest DeFi ecosystems, with billions in total value locked.

As a crypto investor on Solana, I can’t help but be drawn to the vibrant ecosystem that decentralized exchanges (DEXs) have built here. These platforms hold the majority of the Total Value Locked (TVL) in this blockchain community. They equip users like me with essential trading tools, enabling us to exchange tokens on-chain and even offer liquidity for various pairs. The possibilities are endless!

As a dedicated researcher exploring the dynamic world of decentralized exchanges (DEXs) on the Solana blockchain, I aim to deliver in-depth insights into the top contenders. In this analysis, I will cover crucial aspects of each platform, such as their distinctive protocols and features, offering you an informed perspective.

- Key features

- Trading fees: critical detail when trading on-chain

- Supported self-custody wallets and more

“Solana boasts several features that make it an optimal choice for Decentralized Exchanges (DEXs). It has fostered the development of some of the most renowned decentralized trading platforms, not just within its own community but across the entire marketplace.”

Quick Navigation

- Should You Trade on a DEX?

- Advantages of Decentralized Exchanges

- Disadvantages of Decentralized Exchanges

- Comparison of the Top Solana DEXs

- Top 5 Best Solana DEXs

- Jupiter: Most Popular Solana DEX

- Raydium: Veteran Solana DEX

- Drift Protocol

- Orca

- Zeta Markets

- Future Outlook for Solana DEXs

- Is Trading on DEXs Safe?

- Frequently Asked Questions

- Best Solana DEXs – Final Thoughts

Should You Trade on a DEX?

As a seasoned analyst, I’d highlight that decentralized exchanges (DEXs) grant me an array of benefits compared to the conventional ones. Firstly, they provide improved privacy and autonomy by eliminating the need for intermediaries or central authorities. Secondly, DEXs expand my accessibility to a more extensive selection of tokens beyond those listed on traditional exchanges.

In contrast to centralized exchanges (CEXs), decentralized exchanges (DEXs) don’t require individual token verifications for regulatory compliance prior to listing. As a result, you may discover new projects on DEXs before they become available on CEXs, granting traders early access opportunities.

Decentralized exchanges provide unique trading functionalities and rewards systems that are distinct from those of centralized exchanges. Features like yield farming, automated liquidity pools, and others offer enhanced trading experiences.

If you value security, confidentiality, and autonomy in managing your cryptocurrencies, decentralized exchanges (DEXs) could be an excellent alternative for you. These platforms offer the advantage of dealing with niche tokens that aren’t accessible on centralized exchanges (CEXs). However, it is essential to note that using DEXs comes with a learning curve. Make sure you are well-versed in their complexities before engaging in trading activities.

Note: One thing to consider, though, is that you will need a self-custody wallet if you want to use a DEX. We have a comprehensive guide on the top Solana wallets that you can read and choose the one that best serves your needs.

Let’s have a condensed look at their advantages and disadvantages because there are some.

Advantages of Decentralized Exchanges (DEXs)

Here’s a suggestion for paraphrasing the given text in a more conversational and clear manner:

Ownership & Enhanced Security

As a researcher studying decentralized exchanges (DEXs), I would explain that these platforms minimize security threats compared to their centralized counterparts by eliminating the need for a central system to access internal issues or external vulnerabilities. Centralized exchanges pose risks due to their handling of users’ funds:

- Cybersecurity attacks

- Custodial risks, censorship, and account banning

- Your funds could be exposed or trapped in the platform.

- Privacy is severely compromised since exchanges store and manage your personal information.

DEXs, or Decentralized Exchanges, use smart contracts for executing trades and recording transactions on the blockchain. This results in trustless transactions where no intermediary is required. Additionally, you have full control over your digital assets as you manage your own wallet.

Privacy

As a researcher studying decentralized exchanges (DEXs), I would describe it this way: With DEXs, users retain possession of their cryptocurrency wallets externally, ensuring greater privacy. This means traders don’t have to share their private keys, and DEXs are freed from liability for managing funds, making transactions more secure and confidential for all parties involved.

As a analyst, I’d point out that the lack of KYC and AML requirements for Decentralized Exchange (DEX) users offers convenience. However, it also brings potential legal complications to consider.

Essentially, Decentralized Exchanges (DEXs) enable enhanced security by virtue of their decentralized nature and shield user privacy since they don’t require sharing sensitive details like emails, home addresses, or phone numbers. Nevertheless, the absence of clear regulatory frameworks in specific jurisdictions could pose challenges due to potential regulatory uncertainties surrounding cryptocurrencies.

Accessibility

As a researcher studying Decentralized Exchange (DEX) platforms, I can tell you that one of their key advantages is the global accessibility they provide. With an internet connection and a compatible digital wallet, users from all corners of the world can easily tap into these markets. The beauty of DEXs lies in the fact that jurisdiction-based restrictions are generally non-existent.

Asset Diversity

As a crypto investor, I’ve noticed that Decentralized Exchanges (DEXs) offer a wider selection of cryptocurrencies compared to their centralized counterparts. These platforms are more welcoming to smaller or lesser-known projects, allowing me to expand my investment horizons and delve into a more diverse range of digital assets.

Disadvantages of decentralized exchanges (DEX).

Let’s explore the cons of DEXs below, starting with smart contract security.

Smart Contract Vulnerabilities

In the world of smart contracts, these self-executing agreements establish a trustless setting, eradicating the need for intermediaries. However, this innovation comes with its own set of challenges. Despite the absence of third parties, smart contracts remain susceptible to coding errors or vulnerabilities that cunning hackers can exploit.

Complexity

For newcomers, Decentralized Exchanges (DEXs) can present complexities. Their user interfaces may not be as self-explanatory as those found in traditional trading platforms, and executing trades often necessitates a higher level of technical proficiency.

As a crypto investor, I’ve noticed that tokens with fewer users come with their own set of challenges. The smaller pool of potential buyers and sellers for any given token makes it more difficult to find a good match for my trades. While decentralized exchanges (DEXs) utilize Automated Market Makers (AMMs), these mechanisms can’t quite replicate the efficiency of directly matching specific buy and order sizes in real-time transactions.

Liquidity Issues

Decentralized Exchanges, or DEXs, could experience lower trading volumes for less frequently traded tokens, posing a challenge in executing trades at the desired prices. The reduced liquidity on these platforms can result in larger price discrepancies during transactions, known as slippage. Consequently, traders might unwittingly pay more than expected for their purchases or receive fewer tokens than anticipated for their sales.

Comparison of the Top Solana DEXs

As an analyst, I have compiled a clear and concise visualization of their key attributes and additional features.

The 5 Best Solana DEXs

With all of the above out of the way, let’s explore the best Solana DEXs.

The selection was made considering factors such as trading activity, underlying structures, distinctive traits, costs, total value locked, market worth, and other significant aspects.

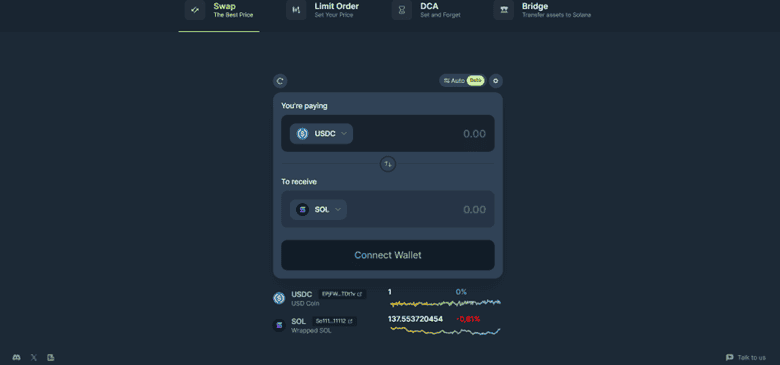

Jupiter: Most Popular Solana DEX

Quick summary:

- The most popular DEX on Solana. It’s behind one of the largest airdrops in crypto history: the JUP token.

- Leading DEX by total value locked (TVL).

- Leading DEX by derivatives volume.

As a crypto investor, I can tell you that Jupiter is a platform I often use when making trades on decentralized exchanges (DEXs) within the Solana network. Instead of having to check multiple DEXs for the best available prices, Jupiter does the legwork for me by aggregating and comparing prices across various platforms. Its efficiency, low fees, and ample liquidity are some reasons why it has become a go-to choice for many traders in the Solana ecosystem.

Jupiter initially functioned as a liquidity supplier in the vein of 1inch on Ethereum. Yet, the business strategy underwent a transformation over the past year. Now, instead of simply offering liquidity provisioning, Jupiter has adopted a new approach, providing derivatives trading, much like GMX and dYdX do.

The governance token in the Jupiter ecosystem is referred to as JUP. This token grants users the power to cast votes on various proposals and modifications within the platform. Additionally, JUP functions as a discount token for traders. Notably, the JUP token gained significant attention due to its substantial airdrop. Approximately 40% of the 10 billion produced tokens were reserved for the community, distributed progressively over time.

Key Features of Jupiter

As a researcher studying decentralized exchanges (DEXs) on the Solana network, I’ve come across Jupiter as one of the most effective options for facilitating token swaps. It is renowned for minimizing slippage and offering affordable fees. Its interface is designed to be user-friendly, catering to both beginners and experienced traders. With support for over hundreds of tokens and thousands of trading pairs, Jupiter provides ample opportunities for diverse transactions.

Here’s a quick rundown of Jupiter’s key features:

- Limit Order: This feature enables users to place buy or sell orders at specific levels, aiding traders in avoiding slippage and securing optimal prices.

DCA (Dollar-Cost Averaging): Permits users to purchase a fixed amount of tokens within a specified price range over a set period, offering flexibility in time intervals (minutes, hours, days, weeks, or months).

Bridge: Facilitates bridging tokens from EVM blockchains like Ethereum, BNB Chain, Arbitrum, or non-EVM blockchains like Tron to Solana, ensuring optimal routes for low slippage and transaction fees.

Perpetual: This feature allows users to trade futures contracts for supported tokens with a maximum leverage of up to x100. It is powered by Pyth Network, Solana’s biggest oracle network.

Additionally, the platform emphasizes support for developer tools, facilitating the creation of DApps and user interfaces. A rich selection of tools, documentation, and development resources are available to developers, including:

- Jupiter Terminal, which allows DEXs to integrate the Jupiter UI

- A payments API, which allows users to pay for anything with any SPL token by using Jupiter and SolanaPay

- An open-source referral program to provide referral fees for projects integrating Jupiter Swap and Jupiter Limit Order

What are the Jupiter Fees?

Jupiter doesn’t impose transaction fees, but there are costs associated with utilizing some key functionalities within its protocol. Let me explain:

- Limit order fees: 0.2% on taker (partners integrating Jupiter Limit Order are entitled to a share of 0.1% referral fees. Jupiter collects the other 0.1% as platform fees, according to Jupiter’s documentation page).

- Jupiter DCA fee: 0.1% on order completion.

Which Wallets Does Jupiter Support?

Jupiter works seamlessly with well-known wallets such as those from Solana and Ethereum. For instance, you can use it with these wallets.

- OKX Wallet

- Phantom

- Ethereum Wallet

- Solflare

- Coinbase Wallet

- Trust

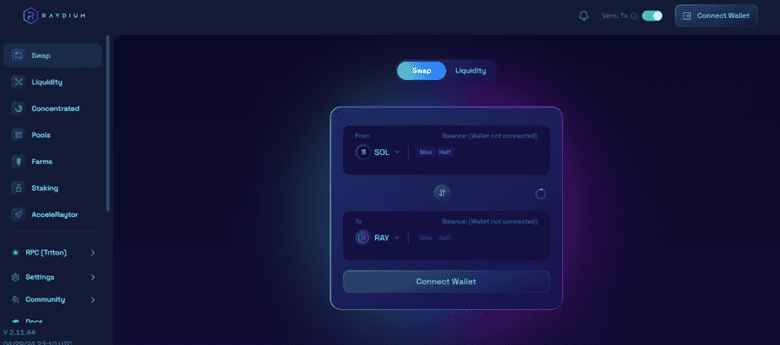

Raydium: Veteran Solana DEX

Quick summary:

- Top Solana DEX by trading volume — $109B.

Largest DEX on Solana by TVL —$850M

RAY market capitalization: $410M

Raydium (RAY) holds a strong position next to Jupiter when it comes to daily trading volume. Frequently, they exchange places at the top. Notable features of Raydium include its sleek design, affordable transaction fees, and compatibility with a vast array of cryptocurrencies, potentially numbering in the hundreds or even thousands.

Main Features

Raydium simplifies the process of exchanging tokens, adding liquidity, and participating in yield farming for users. The platform employs an automated market maker (AMM) algorithm for seamless asset trading. Furthermore, it introduces Acceleraytor, a launchpad where new Solana projects can debut through Initial DEX Offerings (IDOs).

Raydium stands out due to its connection to OpenBook’s main limit order book. This link enables users and liquidity pools on Raydium to access the wider liquidity and order activity present in the entire OpenBook network, while simultaneously allowing OpenBook to leverage Raydium’s user base and liquidity pools.

Raydium offers an opportunity for anyone to establish a liquidity pool for a specific token combination. This feature enables permission-free engagement, thereby increasing liquidity across the platform.

What are Raydium Fees?

Raydium implements a intricate fee system. For every transaction within a pool, there is a minimal charge, which amounts to approximately 0.25% of the trade value. This fee gets distributed among several purposes: it incentivizes liquidity providers, facilitates RAY buybacks, and bolsters the Raydium fund.

Fees generated from transactions in the CLMM pool are instantly transformed into USDC and moved to a multi-signature wallet managed by the Squads, which is utilized to reimburse costs related to Remote Procedure Calls (RPC).

In concentrated liquidity pools (CLMM), fees for trading are distributed among four levels: 100 basis points (bp), 25 bps, 5 bps, or just 1 bp. Of each fee, 84% is returned to the liquidity providers, while 12% goes towards RAY buybacks, and the remaining 4% is directed to the treasury.

To set up a typical Automated Market Maker (AMM) pool, users are required to pay a fee amounting to 0.4 SOL. This charge serves as a deterrent against unwanted pool creation and helps maintain the longevity of the protocol.

What Wallets Does Raydium Support?

Raydium accommodates various wallet options, among which are hardware wallets like Ledger. In simpler terms, you can use Raydium with a range of wallets, including hardware wallets such as Ledger.

- Solflare

- Phantom

- OKX Wallet

- Trust Wallet

- Sollet

- Exodus

Drift Protocol

Quick summary:

- It has raised over $23 million, with lead investors including Multicoin Capital and Jump Capital.

- Focus on both spot and derivatives DEX Trading

- Cumulative volume of over $22B as of April 2024.

Drift Protocol represents one of the most significant decentralized exchanges (DEXs) operating on the Solana network. Designed with an open-source framework, it caters to traders seeking spot markets and perpetuals without the need for custody or excessive capital requirements.

As a data analyst, I would describe it as follows: I analyze that this platform provides various functionalities including spot markets, perpetual swaps, lending and borrowing, and passive liquidity provision. However, the primary focus often falls on perpetuals due to their appeal. Users can either go long or short on supported assets with a maximum leverage of 10x.

Key Features of Drift Protocol

Using a cross-margined risk engine, a network of keepers, and various liquidity solutions, Drift Protocol delivers users with affordable transaction fees, minimal price discrepancies, and exceptional functionality.

Additionally, it offers benefits including automated interest accrual and boosted staking, which can potentially generate returns of up to 10% per year (though yields may vary).

As a researcher examining the Drift v2 platform, I’ve discovered that it incorporates intricate trading and liquidity mechanisms aimed at providing a smooth user experience. Some of its primary features include:

- Drift v2 AMM uses an external Backstop AMM Liquidity (BAL), which, in simple terms, allows users to provide backstop liquidity to specific markets, increasing the depth and collateralization within the market and earning them a rebate from taker fees.

Drift’s decentralized orderbook (DLOB): Limit orders are executed in two ways: they either match opposing orders at the same price or trigger against the Automated Market Maker (AMM) under specific conditions.

Keepers: They listen for, store, organize, and execute valid limit orders, compiling them into off-chain order books. Each Keeper maintains its own decentralized order book. They execute trades by matching crossing and limit orders against the AMM when certain conditions are met. They earn fees for executing trades.

What are Drift Protocol Fees?

The intricate design of Drift incorporates the maker-taker fee system. Fees are assessed based on individual trades and the extent of your open positions. For further details, please refer to our documentation.

What Wallet Does Drift Protocol Support?

Drift Protocol supports multiple crypto wallets, including:

- Phantom

- Solflare

- Trust Wallet

- WalletConnect

- Coin98.

Orca

Quick summary:

- One of Solana’s biggest DEX by TVL

- ORCA’s market capitalization surpassed $133M

- Only DEX on Solana to use a CLAMM (concentrated liquidity AMM)

As a researcher studying the cryptocurrency market, I’ve come across Orca, a decentralized exchange that gained popularity for its uncomplicated design and intuitive user interface since its launch in February 2021.

As a crypto investor, I’ve come to appreciate the allure of decentralized exchanges (DEXs) that boast impressive depth of liquidity spread across various pools. This feature is particularly enticing for active traders seeking to maximize their returns in their DEX trading endeavors.

Key Features of Orca

Orca facilitates the exchange of tokens and distributes a portion of trading commissions via its aquafarms. This idea of collecting liquidity for trading was initially introduced by decentralized exchanges on Ethereum, such as Uniswap.

Among Solana’s exchange platforms, Orca holds unique characteristics that set it apart.

- Orca’s interface includes a Fair Price Indicator, aligning with its trader-centric design philosophy. This tool helps traders ensure that a cryptocurrency’s price remains within 1% of CoinGecko’s aggregated exchange prices, offering a comprehensive market overview within a single interface.

- The protocol provides a convenient panel displaying user balances without requiring separate browser extensions.

- Another key feature is the Magic Bar, a user-friendly search feature enabling quick access to desired token pairs by typing their tickers.

As a researcher studying the financial technology industry, I’ve come to observe that Orca stands out for its commitment to streamlining trading and liquidity provision processes. Their focus on putting users first is clearly apparent in their offerings.

One captivating aspect of Orca is that each transaction conducted on its network adds a contribution to the Orca Climate Fund. This self-governing business entity then channels investments into environmentally sustainable technologies and groundbreaking inventions.

What are Orca Fees?

Fees on the Orca DEX vary, depending on the percentage each pool charges independently.

Pools with a fee tier of ≥0.3%:

- 87% of the trading fee goes to the maker (Liquidity Provider)

- 12% is allocated to the DAO treasury.

- 1% is contributed to the Climate Fund.

Pools with a fee tier of <0.3%:

- All fees are paid to the maker (aka the liquidity provider).

As an analyst, I would explain that this fee structure is designed to motivate providers of liquidity, all the while bolstering our platform’s decision-making processes through governance, and making a positive impact on the environment by contributing to our Climate Fund.

What Wallet Does Orca Support?

Orca supports multiple wallets, including hardware wallets like Ledger. Here’s a quick rundown:

- Trust Wallet

- OKX Wallet

- Phantom

- Solflare

- SafePal

- BitGet

Zeta Markets

Quick summary:

- Backed by prominent VCs, including Solana Ventures

Has raised over $23M in funding

Near-zero gas fees and up to 20x leverage

Zeta Markets is a perpetual trading platform built on the Solana blockchain. Established in 2021, it has gained support from notable venture capitalists such as Jump Capital, Wintermute, and Solana Ventures.

Key Features of Zeta Markets

Zeta Markets takes advantage of the Solana blockchain to facilitate swift transactions and issue trade orders, all while maintaining robust security measures. Let me walk you through the key aspects of this protocol:

- Security: Users have full control over their assets with self-custody, and trading is margined in USDC, enhancing safety.

- Capital Efficiency: Traders can access up to 10x leverage through cross-margining, optimizing capital utilization.

- Decentralized Price Discovery: The exchange employs a fully on-chain limit order book (CLOB), ensuring price discovery without centralization.

- Institutional Liquidity: Zeta Markets facilitates programmatic connectivity through its SDK/CPI programs, enabling smart contract integration for Market Makers and other institutional players.

- Gamification: The platform introduces gamified elements such as leaderboards, referral programs, and trading rewards, enhancing user engagement and interaction

What are Zeta Market Fees?

As a researcher examining Zeta Markets, I’ve discovered they adopt a tiered pricing structure for their fees. You can access these fee tiers by visiting the dedicated Fee Tiers documentation page. It is important to mention that compared to other derivatives exchanges on Solana, Zeta Markets offer relatively lower fees.

What Wallet Does Zeta Markets Support?

In contrast to other Decentralized Exchanges (DEXs), the available wallet choices with this protocol are more restricted. Currently, it supports only a few wallets such as Solflare, WalletConnect, Backpack, OKX Wallet, and Phantom.

Future Outlook for Solana DEXs

Since their launch, with a few notable exceptions like Solana’s slumps in 2021 and 2022 caused primarily by FTX’s collapse, the network and its token have generally thrived.

As a crypto investor, I remember that FTX was a significant supporter of Solana, holding a substantial amount of SOL tokens. However, when FTX defaulted due to issues with SBF, my fellow investors became wary and either scaled back or completely exited their positions in Solana out of concern for the network’s overall stability because of FTX’s influence.

Despite initial concerns, the protocol has demonstrated robustness in the face of challenges. Solana’s ability to withstand the repercussions of FTX’s issues underscores its resilience, suggesting minimal long-term consequences for the platform.

I’ve noticed some impressive growth in this cryptocurrency network recently. It’s clear that things are going well based on various indicators. For instance, I’ve observed several key aspects of the network flourishing. These elements include, but aren’t limited to:

- SOL’s price

Transaction count on Solana

New addresses on Solana

Development activity and more

As a market analyst, I would put it this way: The thriving decentralized exchanges (DEXs) on the Solana blockchain owe much of their success to the teams behind them. These teams play a crucial role in supporting the entire local Decentralized Finance (DeFi) ecosystem by providing robust and efficient platforms for trading digital assets.

If Solana protocol developers keep enhancing and expanding Solana’s features, it’s reasonable to expect a promising future for decentralized exchanges (DEXs) built on this platform.

Is Trading on DEXs Safe?

To answer this question, we must first make a few important clarifications.

As a crypto investor, I’ve discovered that using a Decentralized Exchange (DEX) for my trades involves more steps and technical know-how than utilizing a centralized exchange. To begin with, I need to set up my own self-custody wallet, which comes with its unique set of challenges. For instance, ensuring the security of my private keys and managing the wallet software myself are crucial aspects that I must master in order to successfully transact on a DEX.

As a trader with confidence in navigating decentralized finance (DeFi) ecosystems, you’ll find that interacting with a Decentralized Exchange (DEX) carries certain advantages. In this setting, you are the sole master of your funds. There isn’t any intermediary, such as a central authority or exchange, capable of intervening in your transactions. They cannot censor your activities, restrict deposits or withdrawals, or manipulate trading in any manner.

Despite the advantages of decentralized exchanges (DEXs), most users may find them technically challenging and could face difficulties during trading. Consequently, it’s crucial to thoroughly understand their complexities to avoid costly slippages and potential risks to your digital assets.

Frequently Asked Questions

Which Solana DEX has the most volume?

As a researcher studying the decentralized exchange (DEX) landscape on the Solana blockchain, I’ve noticed that Jupiter has consistently held the top position in terms of daily trading volume. However, this ranking is not without competition. Raydium, another prominent DEX on Solana, frequently challenges Jupiter for the second spot.

What is the first DEX on Solana?

As a solar-powered crypto investor, I’m always on the lookout for innovative projects, and Solar Dex was one of the early Decentralized Exchanges (DEXs) to join the Solana blockchain scene. Unfortunately, its status as a leading player in this space has waned over time, making it a fascinating piece of crypto history.

What is the best Solana DEX?

As a dedicated researcher in the field of decentralized exchanges (DEXs) on the Solana blockchain, I would advise that the most suitable option for you depends on your specific requirements. If your trading strategy primarily involves executing spot trades, then Raydium could be an ideal choice for you. On the other hand, if you’re in search of advanced features such as limit orders and dollar-cost averaging (DCA), then Jupiter might cater better to your needs.

What is the best DEX crypto?

The coins that are specific to a decentralized exchange’s system and serve as its governing tokens are commonly referred to as DEX’s native cryptocurrencies.

Best Solana DEXs – Final Thoughts

To summarize, the Solana network is home to various decentralized exchanges (DEXs), all showcasing distinct characteristics and benefits.

The network remains robust in all significant indicators, and the growth of Decentralized Exchanges (DEXs) has significantly contributed to this success.

Teams engage in competition to introduce captivating add-ons for traders, including limit orders, on-chain derivative trading, adaptable pools, among other innovations. These offerings are expected to draw traders into the expanding platform in the long run.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Dead by Daylight Houndmaster Mori, Power, & Perks

2024-05-01 12:12