As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed numerous bull and bear cycles, from tech bubbles to real estate crashes. In my opinion, Bitcoin’s current surge past $80,000 is reminiscent of the dot-com boom, albeit with a more stable foundation due to its decentralized nature.

TL;DR

- Bitcoin (BTC) has surged past $80,000, with analysts eyeing further peaks potentially reaching $220,000.

- Despite the optimism, some metrics like the high RSI suggest the asset’s price may face a short-term correction, while some investors caution about a minor chance of a severe downturn.

Is There Room for More Growth?

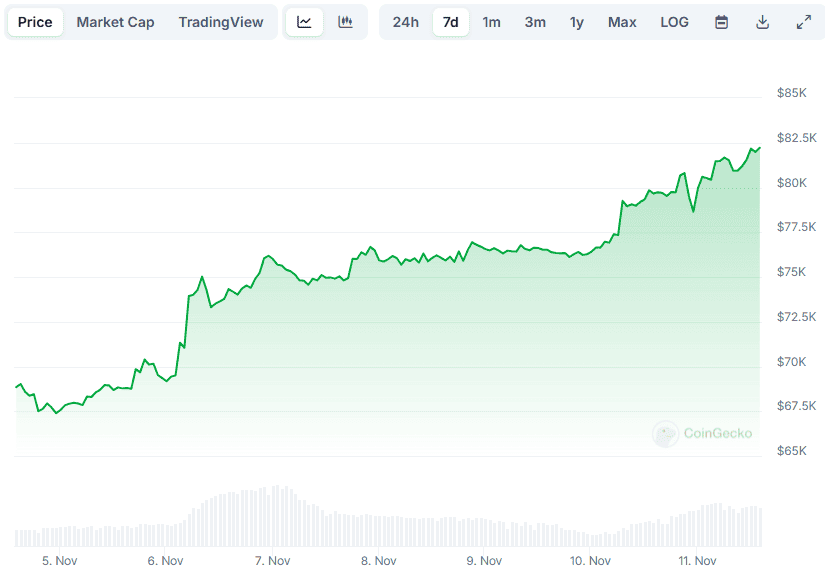

In the last seven days, Bitcoin (BTC) has experienced a significant surge, increasing by approximately 20% and reaching an unprecedented peak of more than $82,000 – a new record high for its price.

The increase could be linked to Donald Trump’s victory in the U.S. presidential elections. Remember that during his campaign, Trump positioned himself as a suitable option for those who support the asset class, hinting at letting the cryptocurrency sector (especially Bitcoin) flourish.

The surge in the market, represented by the bull run, has sparked immense excitement throughout the community. Many analysts believe that the current rally still has a lot of steam left to give and may not be ending anytime soon.

As an analyst, I find myself aligning with the perspective of Mikybull Crypto regarding the potential future price movement of the asset we’re analyzing. Mikybull anticipates that we could see a new peak at approximately $93,000, which might be followed by a period of consolidation. After this consolidation, there could be another strong upward push potentially reaching as high as $121,000. Interestingly, Bluntz also shares a bullish outlook, predicting the price to expand into the range of $130K-$150K.

Gert van Lagen pushed his ambitions even more, aiming for over $220,000. He believed that Bitcoin’s value had shattered beyond a specific phase called Base 4, entering what he referred to as “wave 5.

The Opposite Scenario

The surge in Bitcoin (BTC) has been nothing short of remarkable, yet some speculate that a catastrophic drop could still be on the horizon. Notably, the well-known investor known as Jason has commended Bitcoin’s network for its “genius” due to the fact that no nation or hacker group has managed to breach it so far.

He presented himself as a BTC investor who jumped on the bandwagon when the price was $100-$200 and “never sold.” However, Jason assumed there is still a minor chance (less than 5%) for the valuation to crash to zero. “Do your own financial underwriting, obviously,” he concluded.

It seems that some on-chain indicators are pointing towards a potential short-term correction for Bitcoin. One such indicator is the Relative Strength Index (RSI), which gauges the rate and magnitude of price changes. Remarkably, it has reached an 80 level, a bearish sign.

Readings exceeding 70 often suggest the asset might be overvalued, indicating a potential corrective phase. Conversely, readings falling below 30 are generally perceived as undervalued situations, potentially presenting opportunities for purchase.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Dead by Daylight Houndmaster Mori, Power, & Perks

- Brawl Stars: Exploring the Chaos of Infinite Respawn Glitches

2024-11-11 20:28