As a seasoned crypto investor with a few years under my belt, I’ve learned that the market is never a dull place, especially when it comes to ETF approvals. The past 24 hours have been particularly eventful, with the entire sector experiencing heightened volatility.

It appears that the crypto market is particularly reactive to Exchange-Traded Fund (ETF) decisions, leading to heightened volatility within the sector over the past 24 hours.

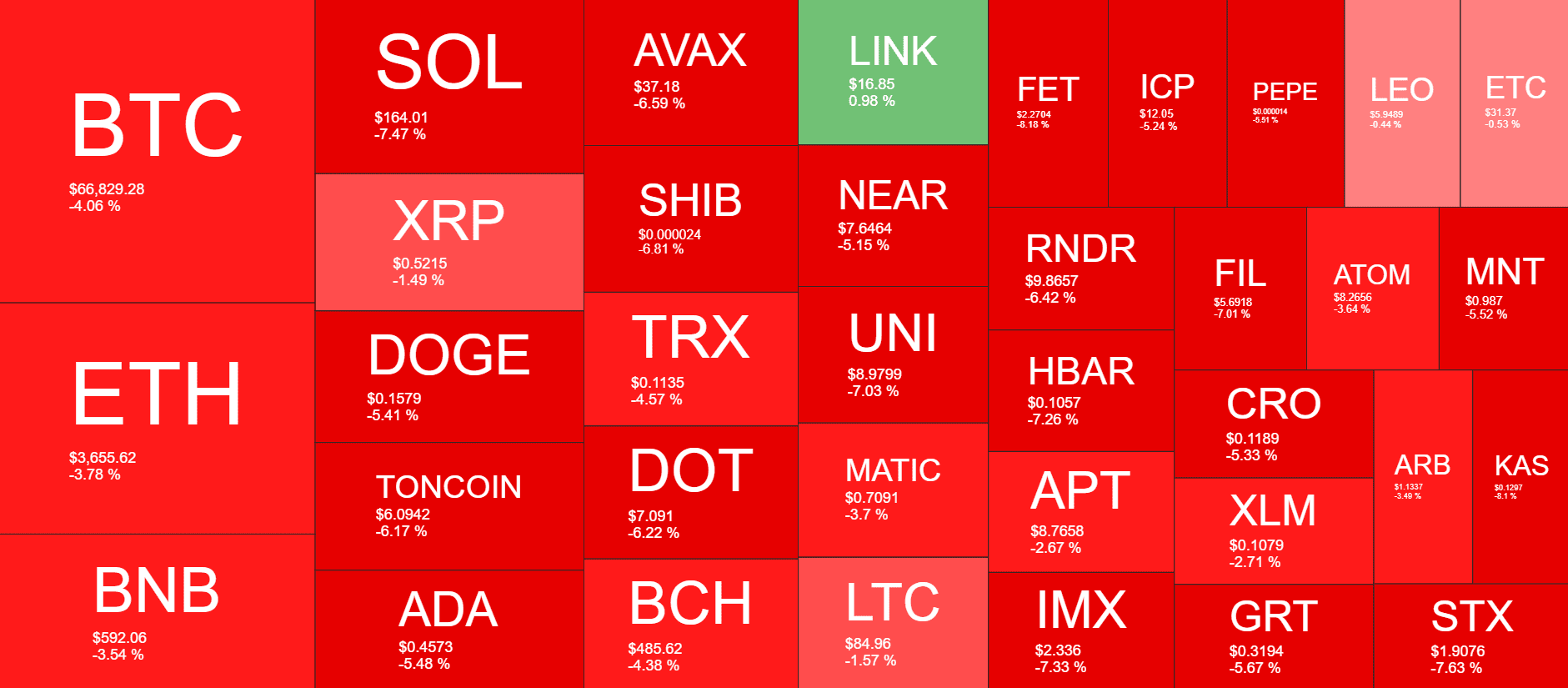

Following the initial excitement of the business week, the biggest cryptocurrencies, including the one approved by the SEC, have shifted from gains to losses, displaying red figures.

BTC Drops Below $67,000

At the outset of this business week, unforeseen events unfolded. Bitcoin had settled around $67,000 following a tranquil weekend. However, the serenity was disrupted on Monday evening as news broke that the SEC might approve an Ethereum spot ETF by week’s end.

As a cryptocurrency analyst, I can tell you that Bitcoin experienced an unprecedented surge, propelling it to reach a new high of approximately $72,000 – the highest price point in the past two months.

At that point in the rally, BTC‘s value began to decrease gradually. Despite this, its trading remained within the vicinity of $70,000 until last night. Suddenly, its price dropped by several thousand dollars, causing it to fall below $68,000. This unexpected decline occurred just before the SEC made a decision regarding all pending ETF applications.

When the regulatory approval for eight Ethereum Exchange-Traded Funds (ETFs) was granted, market volatility increased significantly, causing Bitcoin’s price to dip down to $66,400. Subsequently, it surged by $2,000. However, Bitcoin has since experienced further losses and is now attempting to hold above the $67,000 mark.

Its market cap is down to $1.310 trillion, and its dominance over the alts is 50.2%.

Alts in Red

As previously mentioned, the recent advancements concerning Ethereum ETFs significantly influenced the price of Ether (ETH). The anticipation proved accurate as ETH experienced a remarkable surge of over 20% on Monday, reaching a six-week high of $3,900. However, the asset saw fluctuations in value the previous day, rising and falling prior to the SEC’s decision, which resulted in a current decline of 4% or $3,655.

As a crypto investor, I’ve noticed that the larger-cap altcoins aren’t faring much better than the rest. Solana, Dogecoin, Toncoin, Cardano, Avalanche, Polkadot, and Shiba Inu have all taken a hit, with losses ranging from 5-8%. Even some of the other well-known coins like BNB, XRP, TRX, and BCH are in the red.

The cryptocurrency market capitalization has experienced a significant decrease, amounting to over $100 billion, since the previous day, now standing at approximately $2.617 trillion according to CoinMarketCap.

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Valorant Survey Insights: What Players Really Think

2024-05-24 11:44