As an analyst with a background in financial markets and a keen interest in the cryptocurrency space, I find the current state of Bitcoin (BTC) intriguing. The asset’s recent surge past $71,000, accompanied by a market cap exceeding $1.4 trillion, is a testament to its growing acceptance as a legitimate investment option.

TL;DR

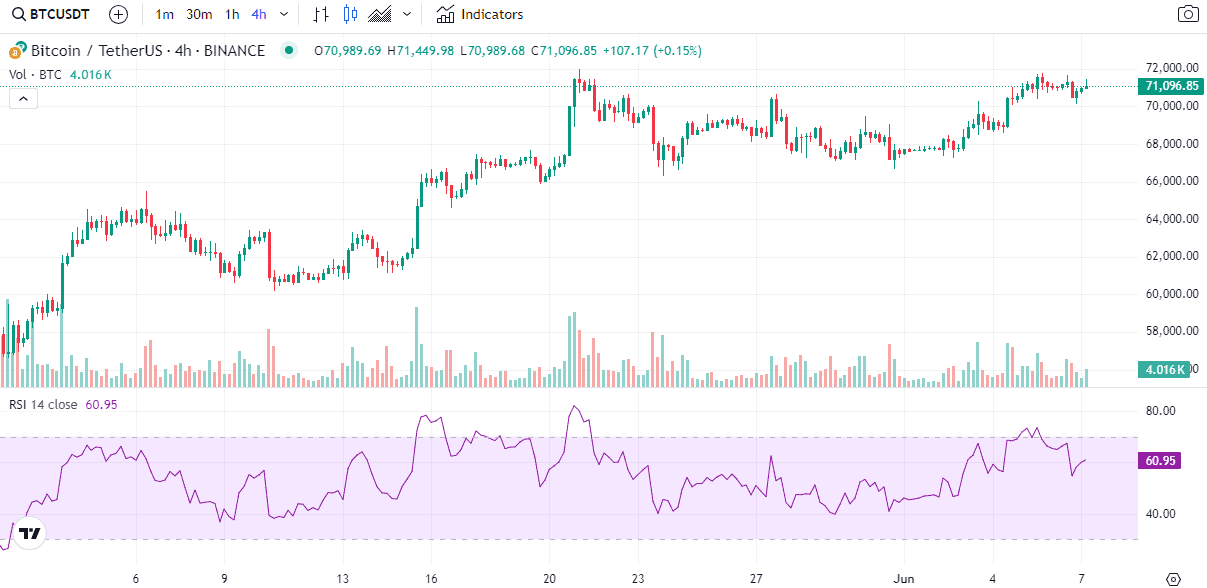

- Bitcoin has surpassed $71,000 with a market cap of over $1.4 trillion, showing potential for further growth due to low trader euphoria (FOMO) and a stable RSI at 60.

Negative BTC exchange netflow suggests reduced selling pressure as investors move to self-custody, indicating bullish market sentiment.

No FOMO

Bitcoin (BTC) has experienced significant growth recently. The cryptocurrency’s price has broken through the $71,000 barrier, while its market capitalization has reached over $1.4 trillion according to CoinGecko’s figures. Bitcoin has risen by 14% in the past month and an impressive 165% this year. Several key signals suggest that a further price increase may be imminent.

One element among these is the absence of the Fear of Missing Out (FOMO) amongst traders, as indicated by the market intelligence platform Santiment. Currently, trader euphoria is not as pronounced as during past market peaks.

FOMO refers to the feeling of apprehension and unease when one believes they’re missing out on exciting or enjoyable experiences that others are having. This can lead to an overwhelming urge to stay informed about social trends and events.

As a crypto investor, when I come across a digital asset that’s surging in value, I can’t help but feel a sense of unease if I don’t already own it. This anxiety is often referred to as FOMO, or the Fear Of Missing Out. In other words, I’m worried that by not investing in this asset right now, I might be missing out on significant returns in the future.

As an analyst, I’ve observed that the allure of certain phenomena in the market can sometimes cloud people’s judgment and prompt them to make emotional decisions instead of rational ones. Consequently, they might overlook important due diligence processes and investment strategies, resulting in hasty purchases at inflated prices. This behavior, if unchecked, could prove detrimental in the face of a significant market correction.

As a crypto investor, I’ve witnessed FOMO (Fear of Missing Out) driving up prices during market peaks only for significant price declines to follow. Currently, with FOMO seemingly absent from the market, it could be an indication that Bitcoin’s bull run still has room to grow and hasn’t yet reached its full potential.

RSI

“A significant indicator suggesting that Bitcoin’s price may rise further in the imminent period is the Relative Strength Index (RSI). This technical indicator determines if an asset is overbought or oversold.”

It ranges from 0 to 100, with a ratio above 70 signaling that a correction might be imminent. The latest data shows that BTC RSI is 60, crossing the aforementioned level only four times in the past 30 days.

Abandoning Exchanges

Before concluding, let’s discuss the recent trend in Bitcoin exchange netflow. Based on data from CryptoQuant, this flow has predominantly been outgoing in the past week.

As a researcher exploring the cryptocurrency market, I’ve noticed that transitioning from relying on centralized platforms for custody to adopting self-custody methods is often viewed as a positive sign. This shift can decrease the urge to sell right away, making it an optimistic indicator in the eyes of many investors.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PBX PREDICTION. PBX cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- USD DKK PREDICTION

- ICP PREDICTION. ICP cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

- O3 PREDICTION. O3 cryptocurrency

2024-06-07 11:30