As a seasoned researcher with over a decade of experience in the ever-evolving world of cryptocurrency, I find myself constantly intrigued by the potential that lies within this nascent industry. The predictions for 2025 outlined in this article resonate deeply with my own observations and analysis.

2024 is undeniably a groundbreaking year for cryptocurrencies, with BTC and ETH ETFs launching, BlackRock leading bitcoin adoption, the election of a pro-crypto president, and BTC surpassing its 15-year high. However, the true turning point for cryptocurrency is yet to come. Here are three predictions for 2025 that could set off this transformation:

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

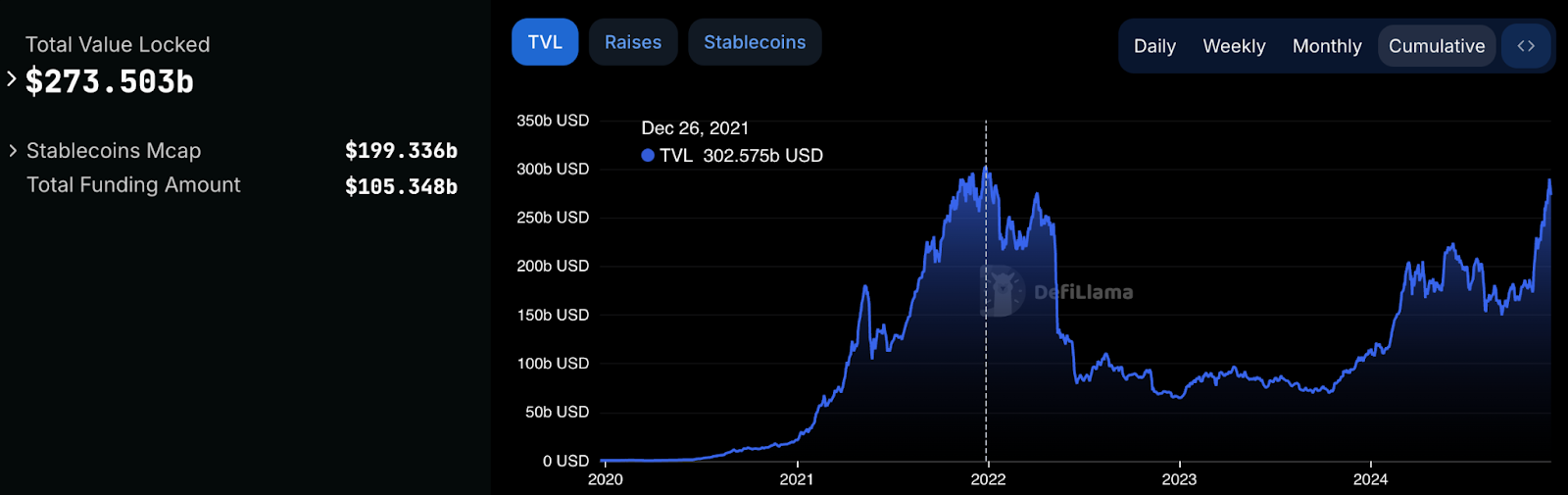

1. DeFi is about to skyrocket

As Decentralized Finance (DeFi) evolves, it’s starting to mirror traditional finance in terms of the variety of financial products available. This shift has been evident with the introduction of services such as Pendle, Ethena, EtherFi, and Lombard. By 2025, we can expect a significant increase in DeFi usage, with an influx of adoption for advanced financial tools like options, swaps, and other derivative markets, similar to the interest rate swap market in traditional finance, which boasts a massive market size of $465.9 trillion USD.

As a researcher delving into the dynamic world of cryptocurrencies, I’ve noticed an intriguing development: fresh institutional players are making their mark, contributing to a burgeoning sector known as On-chain Finance. This shift signifies that engagement in the crypto ecosystem no longer solely revolves around purchasing established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Instead, these newcomers are proactively broadening the on-chain market by employing strategies such as lending markets and liquidity provision with asset-backed digital tokens, notably stablecoins. Companies like Securitize and BlackRock are pioneering this frontier, expanding its horizons.

2. Stablecoins will continue to grow as the crypto killer use case

Stablecoins aren’t just another crypto product; they’re poised to become the digital backbone of the global financial system. Tether is the most profitable crypto company with a $5.2 billion profit in H1 2024, surpassing BlackRock.

The political environment is undergoing significant change, leaning towards the acceptance of stablecoins. With Operation Choke Point 2.0 concluded, they are now seen as a valuable national resource that can bolster the power of the U.S. dollar and help manage increasing public debt. This transformation also opens up opportunities for prominent banks and payment service providers such as Visa, Mastercard, Stripe, and potentially Revolut, to intensify their involvement in this sector. Notably, Stripe’s acquisition of a stablecoin platform Bridge for $1.1 billion (the largest crypto deal yet) and whispers of Revolut launching its own stablecoin are indicative of this trend.

3. The race for retail adoption

Exchange-Traded Funds (ETFs) are expected to play a significant role in attracting fresh investments into the crypto sector. The Bitcoin ETF has already made its debut, and we anticipate that Ethereum ETFs will also see success soon. If the growth trajectory of Solana (SOL) continues, we might witness the launch of a SOL-based ETF in the first half of 2025. However, there’s a possibility it could be delayed until 2026 or even later.

Alongside the debut of LensChain’s mainnet and Farcaster’s continued growth, we’ll witness significant Web3 social platforms vying for dominance. Over time, this competition could lead to the emergence of prominent “crypto-Twitters” and “crypto-Facebooks”.

Significantly, the concept of “Super Wallets” gained momentum during Q4 2024. These innovative tools aim to provide a broad, user-friendly alternative to traditional centralized exchanges for newcomers in the market. Key players include Infinex, spearheaded by Kain Warwick, and DeFiApp, developed by experienced builders within the DeFi sector. Both platforms are actively addressing user experience issues, an area where our industry has historically fallen short.

Bonus prediction: MiCA will power crypto expansion in Europe

Regulations governing cryptocurrencies serve as a base for upcoming initiatives, establishing a solid framework for both rules and organizational structure. The Markets in Crypto-Assets Regulation (MiCA) endeavors to deliver this foundation, with the objective of elevating the significance of assets tied to the Euro. This could theoretically foster crypto innovation collaboration between the United States and Europe.

In this article, the opinions presented are those of the writer; they may not align with CoinDesk, Inc., its proprietors, or associated parties’ perspectives.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-18 20:58