As a seasoned crypto investor with battle-hardened nerves and an eye for trends, I find myself intrigued by the recent developments surrounding Shiba Inu (SHIB). After weathering numerous market storms, I’ve learned to read between the lines of market indicators and spot opportunities that others might miss.

TL;DR

- Shiba Inu saw a surge in token burning and large transactions, indicating higher whale interest.

- Netflow trends suggest reduced selling pressure, while RSI levels hint at potential room for price recovery.

The Bullish Indicators

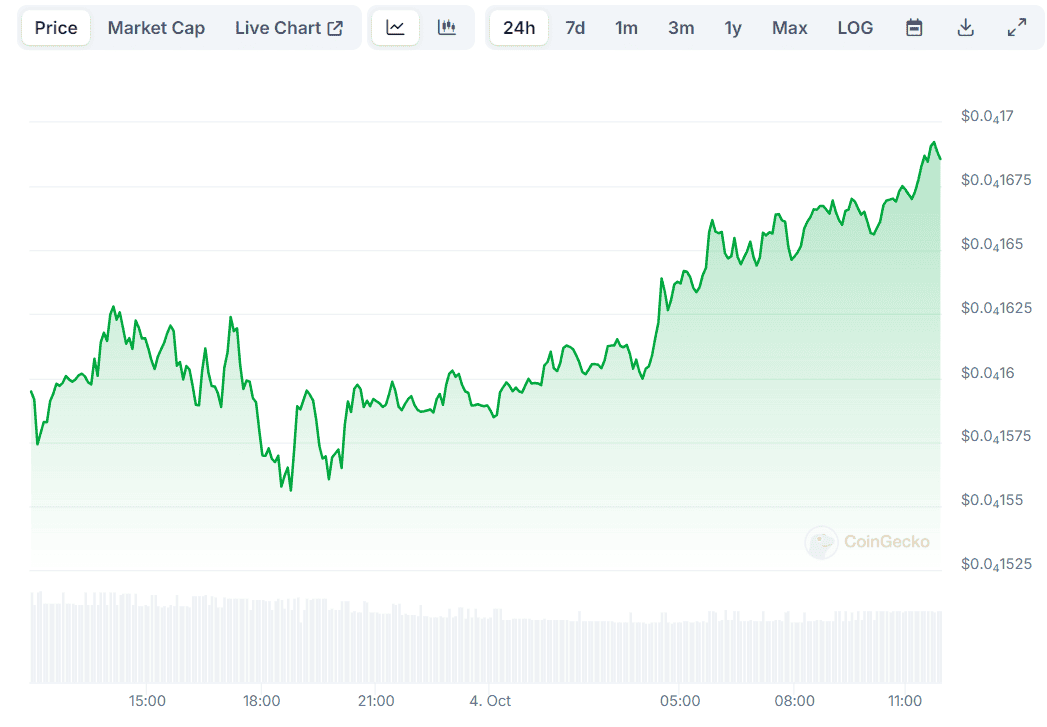

Recently, Shiba Inu (SHIB), the second-largest meme coin, has seen increased price fluctuations. Reaching a peak three-month high towards the end of September, its value significantly dropped at the start of October, coinciding with a major sell-off across the entire crypto market.

Over the last day, there has been a significant increase in SHIB‘s performance. According to data from Coingecko, it surged by almost 7%. This rise coincides with a broader revival within the meme coin market.

The resurgence of Shiba Inu happens alongside significant improvements within its ecosystem. A key factor is the successful implementation of the token burning program. Over 2.3 billion tokens have been destroyed across September, marking a 250% increase compared to August’s numbers. Furthermore, the rate at which tokens are being burned has skyrocketed by over 5,000% in just the past week.

As a researcher studying SHIB, my objective is to decrease its current supply in circulation. This strategy could theoretically ignite a price surge, given that demand remains steady or increases. To date, we’ve successfully burned over 410 trillion tokens since implementing this mechanism, leaving around 583.5 trillion Shiba Inu coins still in circulation.

Up next is the Large Transactions momentum indicator, which has seen a 12.5% increase in the past day, as reported by IntoTheBlock. This indicator monitors transactions over $100,000, typically indicating heightened activity from ‘whales’. Such substantial investors’ participation might stimulate interest among smaller players and potentially lead to an influx of new capital into the system.

Last but not least, we will touch upon SHIB’s exchange netflow which has been negative in the past four days. This could be interpreted as a shift from centralized platforms toward self-custody methods and could result in a reduced immediate selling pressure.

Bonus: the RSI

A useful indicator to watch is the Relative Strength Index (RSI), which has been decreasing for several days now. This index measures the rate and direction of price changes, with readings above 70 often indicating an overbought market that could potentially lead to a correction. On the contrary, values below 30 might suggest a good buying opportunity.

Toward the end of September, the ratio surged past 80. But on October 2nd, it fell close to the optimistic region of 30 and has now stabilized around 45.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- REF PREDICTION. REF cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- ERG PREDICTION. ERG cryptocurrency

- PROM PREDICTION. PROM cryptocurrency

- DESO PREDICTION. DESO cryptocurrency

2024-10-04 21:46