As a seasoned crypto investor, I have witnessed the volatile nature of Bitcoin’s price action firsthand. The recent downtrend and consolidation phase around $60K have been no exception to this trend. However, based on my technical and on-chain analysis, I believe that the current support zone holds significant importance.

After a lengthy period of lateral movement, Bitcoin experienced a decline and reached the notable support level near $60,000. There’s speculation that purchasing power will increase once more, possibly triggering an upturn.

Technical Analysis

By Shayan

The Daily Chart

As a researcher studying the market trends, I have conducted an in-depth analysis of the daily chart, revealing an extended phase of sideways movement within the crucial price band of $60,000 to $72,000. Lately, the price action has shown a downtrend, approaching the lower limit of this range.

At present, Bitcoin is located at a pivotal point, lying between the two significant support levels based on Fibonacci retracements. The first level is around $62,181 (0.5 Fib level), while the second one is at approximately $59,444 (0.618 Fib level). Additionally, Bitcoin is in proximity to the essential 100-day moving average, which hovers around $59,000.

This region of support carries great significance and may cause a bullish turnaround in the near future. Yet, if an unexpected drop occurs below this vital threshold, it could set off a prolonged squeeze, resulting in a substantial price decline.

The 4-Hour Chart

Examining the 4-hour chart, it’s clear that Bitcoin faced increased selling after failing to regain the upper limit of the descending triangle. Consequently, there was a significant drop in price, staying close to the lower trendline at approximately $60,000.

As I approached this significant point, the selling force met with enough buying interest, resulting in a brief period of sideways movement. Nevertheless, sellers continue to aim for breaking through the lower edge of the wedge.

If the buyers manage to regain control and the price holds steady at this significant level, there’s a good chance Bitcoin will rebound and reach its previous major peak of $68,000. However, the price movement around $60,000 is crucial and will most likely determine Bitcoin’s direction in the short term.

On-chain Analysis

By Shayan

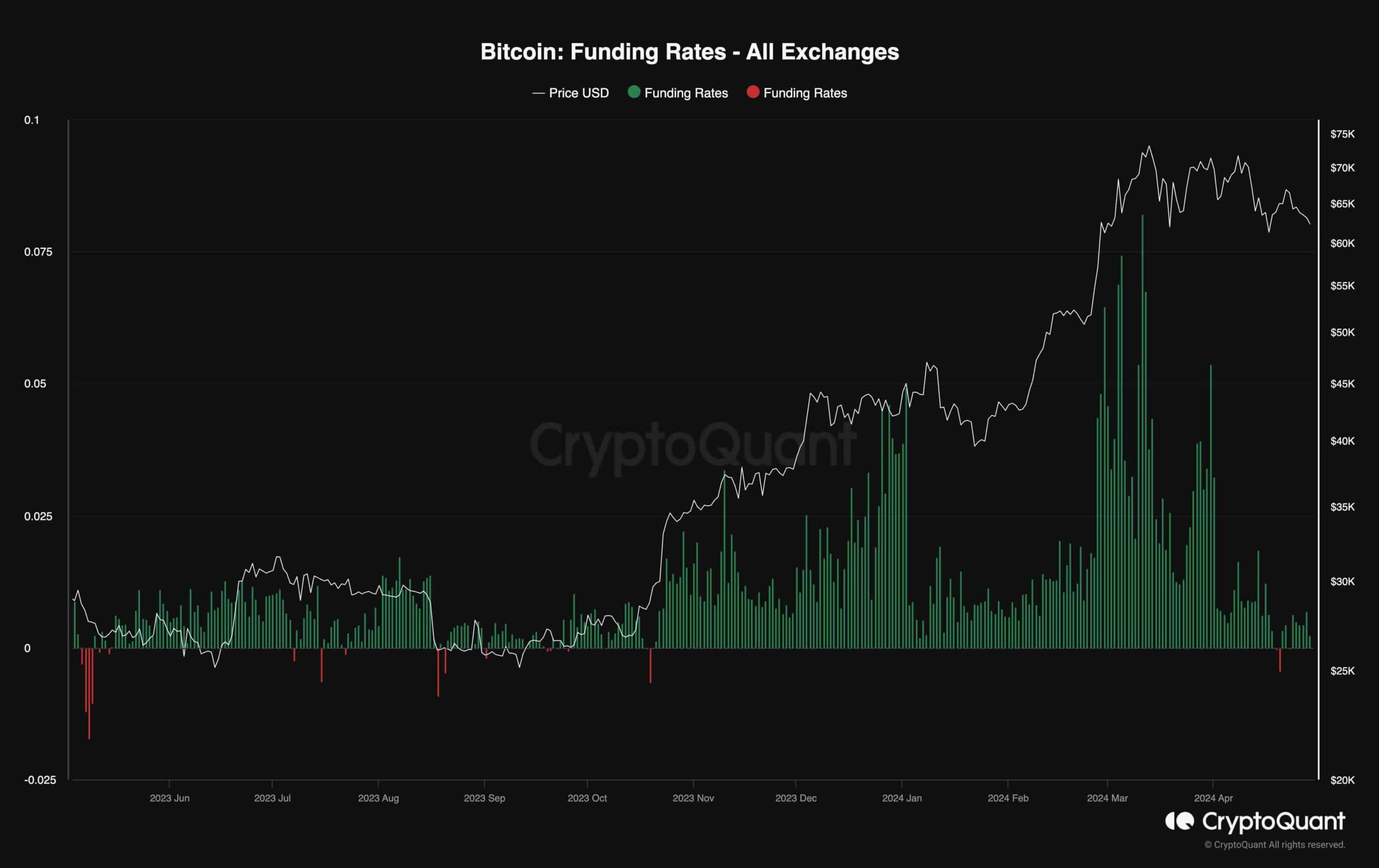

In the current situation where Bitcoin has been undergoing an extended period of price consolidation, hovering around the $60,000 mark, exploring sentiments in the futures market could provide significant clues about its future trend.

The chart we have given you provides some insight into funding rates, an important indicator that reveals the influence of buyers or sellers on market trends. Upon closer look, recent price corrections have led to a substantial decrease in funding rates, bringing them close to zero.

As a researcher observing the current market downturn, I believe this development holds promise for the future. The pressure to sell off assets is easing, paving the way for the reemergence of both long and short positions in the perpetual market. This sets the stage for an impulsive trend that could mark the end of the uncertain and sideways consolidation phase we’ve been experiencing.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PENDLE PREDICTION. PENDLE cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

- PBX PREDICTION. PBX cryptocurrency

- W PREDICTION. W cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- USD DKK PREDICTION

- LDO PREDICTION. LDO cryptocurrency

2024-04-29 16:17