As an experienced analyst, I’ve seen my fair share of market fluctuations in the cryptocurrency world. Last week was particularly noteworthy as Bitcoin (BTC) and Ethereum (ETH) led the charge with impressive gains. The approval of spot Ethereum ETFs in the United States fueled the hype, causing BTC to surge over $5,000 within a few days.

Bitcoin, like other assets in the market, experienced significant gains last week due to the excitement generated by the approval of the first-ever Ethereum spot Exchange Traded Funds (ETFs) in the US.

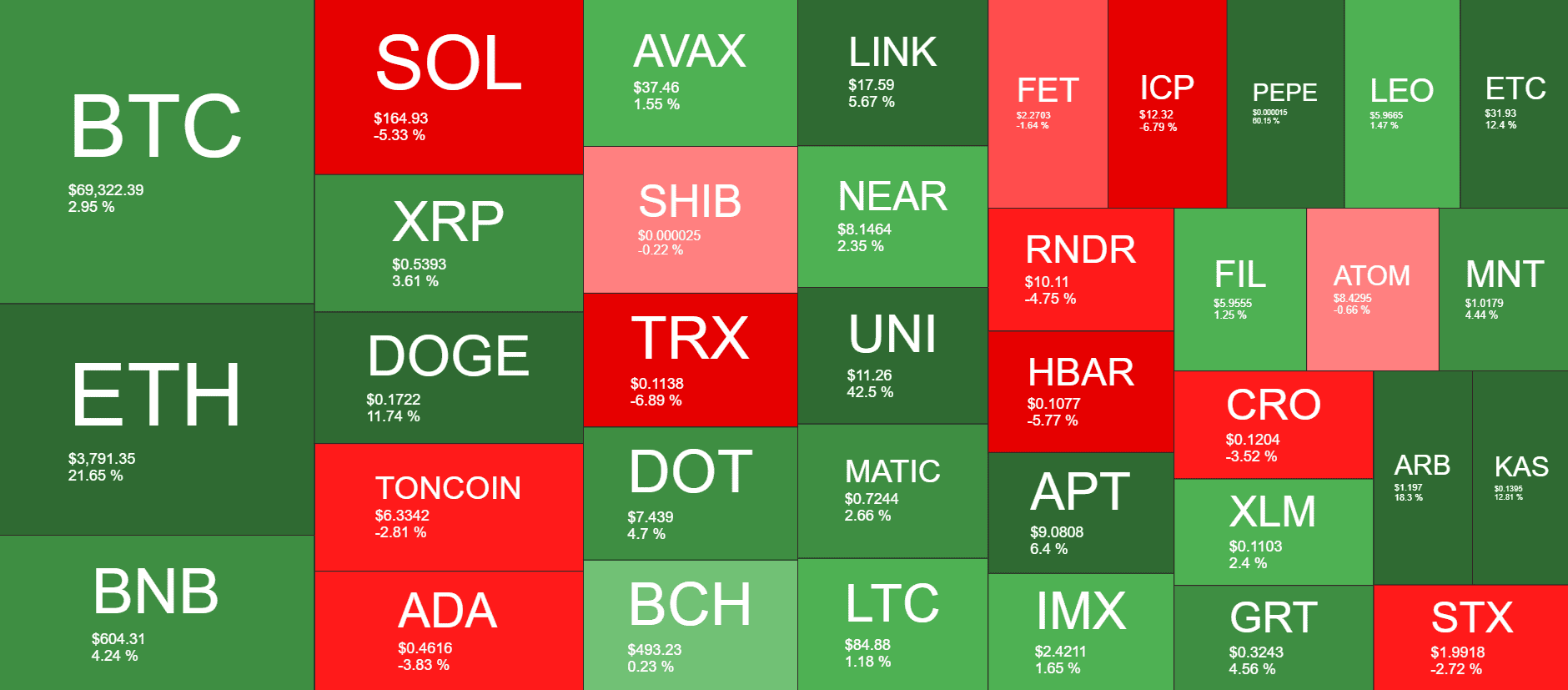

As a crypto investor, I’ve noticed that UNI, PEPE, LDO, and Ethereum (ETH) have been performing exceptionally well on a weekly scale among larger-alt coins. These digital assets have shown impressive growth in value.

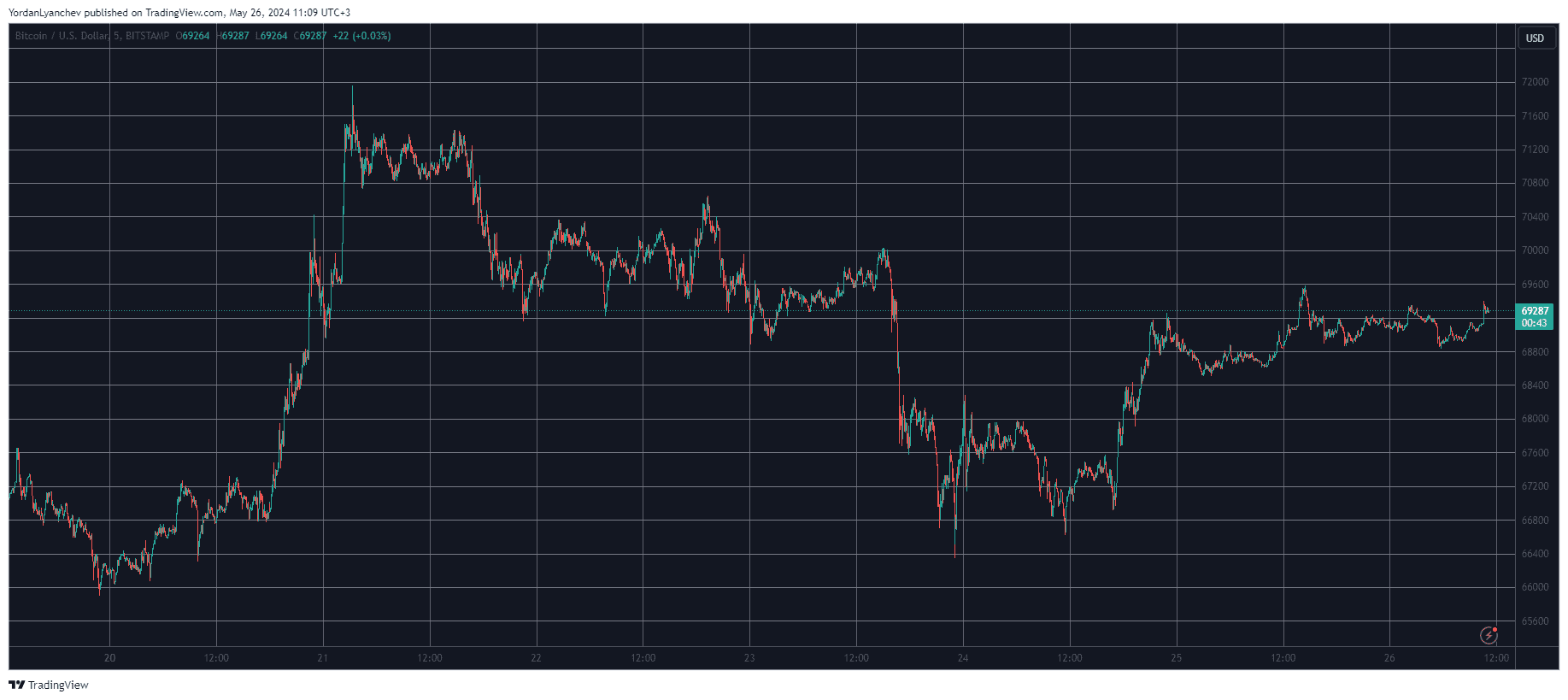

BTC’s Weekly Surge

Last Sunday, the leading cryptocurrency had a tough time staying above the $66,000 mark and dipped below it multiple times. However, things took an unexpected turn on Monday. The day began much like the previous one but ended in a remarkable fashion.

Amidst rumors that the US Securities and Exchange Commission (SEC) could give the green light to as many as eight Ethereum spot ETFs that week, Bitcoin experienced a significant surge, reaching over $72,000 for the first time in six weeks, with an increase of more than five grand. However, the asset’s momentum did not last long and began to decline in value shortly thereafter.

Just hours prior to the US securities regulator granting approval for those financial products on Thursday, Bitcoin experienced its steepest price decline, dropping down to $66,400. However, it managed to recover and surge up to $69,000 by Friday.

Over the past weekend, Bitcoin held its ground and successfully defended the $69,000 mark. The cryptocurrency’s market capitalization currently hovers around $1.37 trillion, while it maintains a commanding dominance of approximately 50.3% over the alternative cryptocurrencies.

PEPE’s Week

As a crypto investor, I’ve come to anticipate that major news events can significantly impact the value of specific tokens, including Ethereum’s ETH. Recently, such news caused quite a stir, pushing ETH prices from $3,100 up to an astonishing high of over $3,900 – a level not seen since early April. Ethereum, the second-largest crypto, experienced both volatility and growth following the SEC’s approval. Currently, ETH hovers around $3,800, having risen by approximately 22% in just the past week.

Doge, Link, and Apt have experienced significant gains over the past week, but Uniswap and Pepe are currently taking the limelight. Uniswap has soared by 44% and surpassed $11, reaching new heights. Pepe, on the other hand, set multiple record highs this week.

On the other hand, the week-long performance of SOL, TRX, TON, and ADA shows a decrease. However, the overall cryptocurrency market capitalization has risen by over $200 billion during this period, surpassing $2.7 trillion as of now.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

- Dead by Daylight: All Taurie Cain Perks

- Dead by Daylight Houndmaster Mori, Power, & Perks

2024-05-26 11:20