As a seasoned crypto investor with several years of experience under my belt, I’ve learned to keep an eye on Binance’s announcements. The recent news about Binance halting trading services for some cryptocurrencies, such as OmiseGO (OMG), Waves (WAVES), Wrapped NXM (WNXM), and NEM (XEM), was a stark reminder of the volatile nature of this market.

TL;DR

- Binance will halt trading services for some cryptocurrencies. The announcement was followed by significant price drops for the involved assets.

It recently introduced new trading pairs like BTC/MXN and removed some older ones, continuing to adjust its offerings to enhance user experience and respond to latest market trends.

The Affected Cryptocurrencies

Starting from September 18, Binance will no longer support trading for the following tokens: OmiseGO (OMG), Waves (WAVES), Wrapped NXM (WNXM), and NEM (XEM). Trading in these assets on both spot and margin markets will be discontinued. After September 17, users will not be able to withdraw these coins from the platform. However, Binance may convert delisted coins into stablecoins on behalf of their users starting from September 18.

“Binance Simple Earn will delist the tokens mentioned above after 2024-06-13 03:00 (UTC). Users may choose to redeem their Flexible and Locked Products positions beforehand. Otherwise, these Flexible and Locked Products positions will be automatically redeemed at the above-mentioned time and subsequently transferred to users’ Spot Wallets, together with any accrued rewards, from 2024-06-13 03:00 (UTC).

starting on June 8, Binance Auto-Invest will no longer support trading of the mentioned tokens. Meanwhile, Binance Loans and VIP Loans will conclude their token offerings on June 12.

As a crypto investor, I understand that Binance regularly assesses the cryptocurrencies listed on its platform to maintain a high standard. The company hasn’t explicitly stated why they made a particular move, but I trust their process. Factors like the development team’s dedication and effectiveness, trading volume, liquidity, and more, are all taken into account during these evaluations.

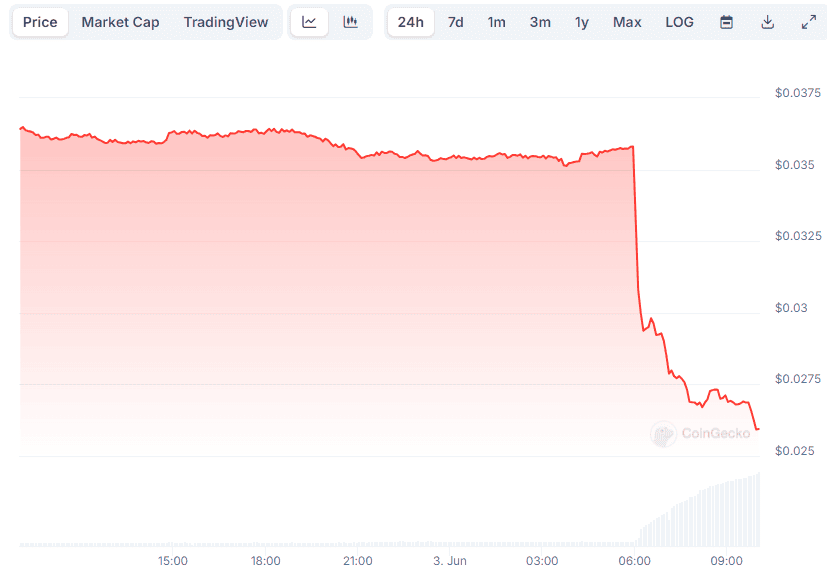

Some digital assets like OMG and WAVES experienced significant price decreases of more than ten percent after the recent announcement. XEM saw the most substantial decline, dropping by over 30% in just 24 hours. At present, its trading price hovers around $0.025, which is its lowest point in the past seven months (according to CoinGecko’s data).

As a researcher studying the cryptocurrency market, I can tell you that having a cryptocurrency delisted from a prominent exchange like Binance can have a substantial impact on its price trajectory. The removal process may instill a sense of doubt in investors regarding the tokens’ trustworthiness and future prospects, potentially damaging their reputation and leading to various other unfavorable outcomes.

In February of this year, a price decrease similar to what we’re seeing now occurred with an affected token. At that time, the exchange suspended trading services for Monero (XMR) and three other altcoins. Notably, Monero, the well-known privacy coin, experienced a drop in value exceeding 20% following this announcement.

Other Recent Binance Updates

I, as an analyst, have observed that the company has implemented several modifications to its platform in the recent past. Among these changes are the addition of new trading pairs.

Last week, Binance Spot introduced new trading pairs: BTC/MXN, XRP/MXN, ENS/USDC, and LDO/USDC. Among these, two involve the Mexican peso (MXN), which is the currency of Mexico. Early in the year, Binance had already initiated a direct pair between USDT and MXN.

Instead of adding new token pairings, Binance chose to delist some existing ones, including CAKE/TUSD, DYDX/BNB, and LAZIO/BTC.

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-06-03 13:00