As a seasoned cryptocurrency trader and analyst with extensive experience in the market, I’ve closely observed Bitcoin’s price action over the past few weeks. The lack of continuation beyond the $75K level and the subsequent consolidation have left many investors uncertain about the future direction.

The price of Bitcoin has halted its upward trend above $75,000 and has been stabilizing for some time now. However, it’s important to note that the cryptocurrency market can be unpredictable, so the next significant price movement is yet to be decided.

Bitcoin Price Analysis: Technicals

By TradingRage

The Daily Chart

From my perspective, the daily price chart continues to fluctuate between the $60K and $70K thresholds without managing to surpass either boundary. Meanwhile, the Relative Strength Index maintains a steady presence near the 50% mark, indicating a balance in momentum.

If the price of Bitcoin seems to be falling back towards the $60,000 support point, there’s a good chance that this level will give way, leading to a significant drop in price down to the $52,000 region. Conversely, if the market manages to surpass the $70,000 mark, a new record high would be just around the corner.

The 4-Hour Chart

The four-hour Bitcoin chart displays erratic price fluctuations, with the digital currency exhibiting a prolonged downward trend in the form of a large channel since March. After touching the channel’s lower limit lately, BTC has rebounded but now appears to be heading back towards it yet again.

Observing the RSI’s figures in this timeframe, I notice values falling beneath the 50% mark. This observation points towards a bearish momentum trending on the 4-hour chart. Although bullish trends usually follow descending channel patterns, their breakdowns can prove disastrous and lead to substantial selloffs.

On-Chain Analysis

By TradingRage

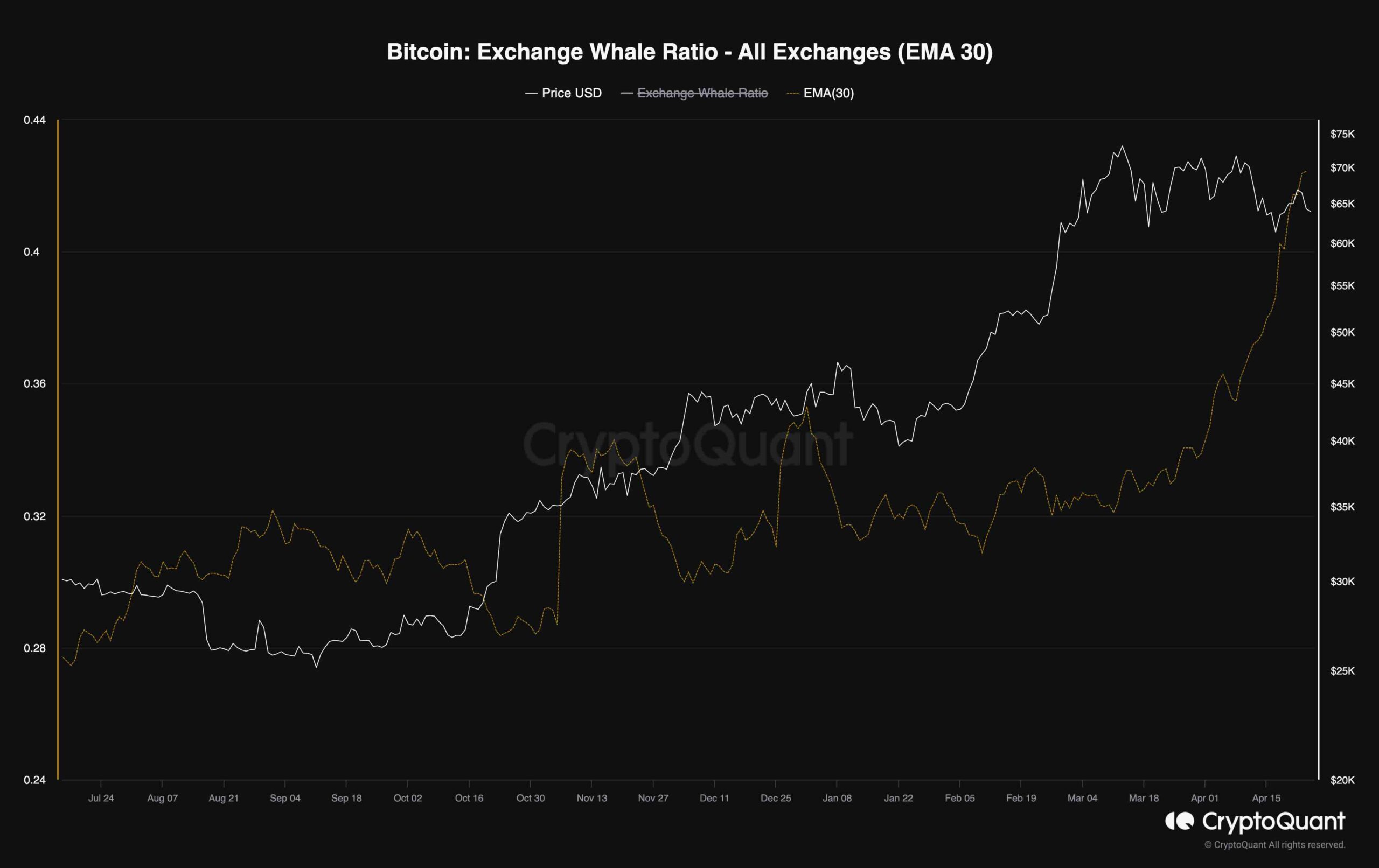

Bitcoin Exchange Whale Ratio

As Bitcoin’s price hovers around the $70K mark, causing a pause in its bull market, traders ponder the identities behind this market halt. The following chart illustrates the 30-day moving average of the exchange whale ratio metric. This measure represents the proportion of inflows from top ten transactors to overall inflows on the exchange. Elevated figures suggest whales are actively using exchanges in substantial quantities.

I’ve noticed an intriguing development in the whale ratio metric as of late. According to the graph, this indicator has spiked noticeably during the past few weeks. This surge can be seen as a signal of selling activity from the “whales” – large investors or traders – who are offloading substantial quantities to exchanges. As a result, their selling pressure could potentially explain why the price hasn’t been able to maintain its upward trend.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- How to repair weapons & gear in Stalker 2

- SOLO PREDICTION. SOLO cryptocurrency

- Unlocking the Mystery of Brawl Stars’ China Skins: Community Reactions

- Dragon Quest III HD-2D Remake Review: History Repeats

- Team Fight Tactics (TFT) Patch 14.23 Notes: What to Expect from Set 13 Release

- W PREDICTION. W cryptocurrency

- Clash Royale: The Perils of Firecrackers and Cringe Decks

- POPCAT PREDICTION. POPCAT cryptocurrency

2024-04-25 16:36