As a seasoned researcher with extensive experience delving into the intricacies of digital currencies, I find the ongoing saga surrounding Tether to be a constant source of intrigue and concern. The lack of transparency regarding its reserves is indeed troubling, and the persistent refusal to undergo independent audits only adds fuel to the fire.

As a crypto investor, I’ve been made aware of concerns raised by consumer watchdogs regarding Tether, the stablecoin I’m invested in. They’ve expressed worry about Tether’s transparency with regards to the reserves backing it and their seeming indifference towards the criminal activities facilitated by USDT.

The organization Consumers’ Research has issued a caution to both the cryptocurrency community and others about Tether, as they have been criticized for not disclosing enough information about the assets supporting their USDT stablecoin. This advice follows an evaluation by S&P Global, which gave it a 4 out of 5 in terms of risk, with a score of 5 being the lowest possible rating.

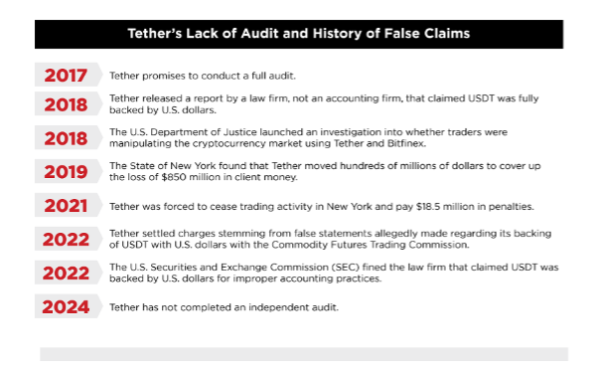

The Consumer Research report alleges Tether on several accounts, notably for not allowing third-party verification of its USDT tokens to ensure proper backing. The report states, “Tether persistently raises a significant concern by refusing external audits or conducting self-audits effectively. Since at least 2017, Tether has pledged to conduct a comprehensive audit, but has yet to fulfill this promise.

Source: tetherwarning.com

Additionally, the watchdog organization sent letters expressing their worries about Tether to each state’s governor nationwide. They also utilized radio broadcasts to spread the word and established a dedicated website outlining issues related to Tether.

The Consumers’ Research letter, addressed to state governors, cautions about Tether, noting similar concerns to those that preceded the fall of FTX and Celsius. These issues could lead to substantial financial losses for consumers, estimated in billions of dollars. This is due to deceptive marketing strategies that do not align with the truth, according to the letter.

The non-profit organization not only emphasized the importance of transparency regarding their reserves, but they also criticized Tether for having a negligent approach towards anti-money laundering laws. This leniency, according to them, has allowed criminal elements to use USDT as a means to illegally launder money.

Tether Has Worked to Reduce USDT-Related Crime Lately

In response to allegations that have painted a dismal scenario for Tether, the leading stablecoin by market capitalization, Tether has taken steps to minimize risks. For example, it collaborates with law enforcement agencies to freeze and recover funds stolen via its stablecoin. Notably, it assisted law enforcement in confiscating over $108 million from cybercriminals. Additionally, the issuer of this stablecoin teamed up with Tron and TRM Labs to establish the T3 Financial Crime Unit (T3 FCU), aimed at curbing illegal activity involving USDT on the Tron network.

Read More

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- UFO PREDICTION. UFO cryptocurrency

- BONE PREDICTION. BONE cryptocurrency

- Abiotic Factor: Players Discuss the Need for Quick Character Adjustments in-game

- EUR INR PREDICTION

- IMX PREDICTION. IMX cryptocurrency

- NUUM PREDICTION. NUUM cryptocurrency

- Last Epoch: Why Keystroke Registration Issues Are Frustrating Players

- Michelle Yeoh Will Not Appear in ‘Avatar 3,’ Says James Cameron: ‘She’s in 4 and 5’

- PBX PREDICTION. PBX cryptocurrency

2024-09-15 19:22