As a researcher with extensive experience in the cryptocurrency market, I’ve seen my fair share of volatility and unexpected price movements. This past week was no exception, with Ethereum taking center stage after Bloomberg’s ETF experts raised their prediction rate for SEC approval to 75%. The subsequent surge in ETH prices and the resulting ripple effect on Bitcoin were truly remarkable.

As a dedicated researcher delving into the intricacies of the cryptocurrency sphere, I’ve witnessed yet another week brimming with significant developments. This time around, Ethereum has taken center stage in our analysis. Let us explore the details.

Last weekend was unusually tranquil with minimal news or significant price fluctuations. However, the calm was disrupted on Monday evening when Bloomberg’s ETF analysts upped their estimate for the SEC approving Ethereum spot ETFs this week from 25% to 75%.

Immediate surprise swept through the markets as ETH experienced a significant surge, jumping more than 20% from its previous price of $3,100 to reach a multi-week high of $3,800. In the ensuing days, the second-largest cryptocurrency continued to gain momentum, briefly exceeding $3,930 as investors pondered if it could shatter the $4,000 threshold.

Bitcoin joined the trend and surged from $67,000 to nearly hit a new high of around $72,000 on Monday night. However, neither asset managed to sustain their gains towards the end of the week, despite the significant development that the Securities and Exchange Commission had given the green light for eight Ethereum ETFs to begin trading in the US at some point.

Within hours of the regulatory approval for Bitcoin (BTC) and Ethereum (ETH) Exchange-Traded Funds (ETFs), both cryptocurrencies experienced a significant decline of over 4%. Following this announcement, they faced substantial volatility and were unable to regain most of their losses. In contrast, Ethereum has underperformed Bitcoin on a daily basis and currently trades at around $3,700, while Bitcoin surpasses $68,000.

As a researcher, I’ve discovered that ETH has been one of the top performers in the past week with a significant surge of 18%. Other noteworthy gainers this week include BONK, which experienced a remarkable increase of 43%, and PEPE, which reached new all-time highs in several consecutive chartings.

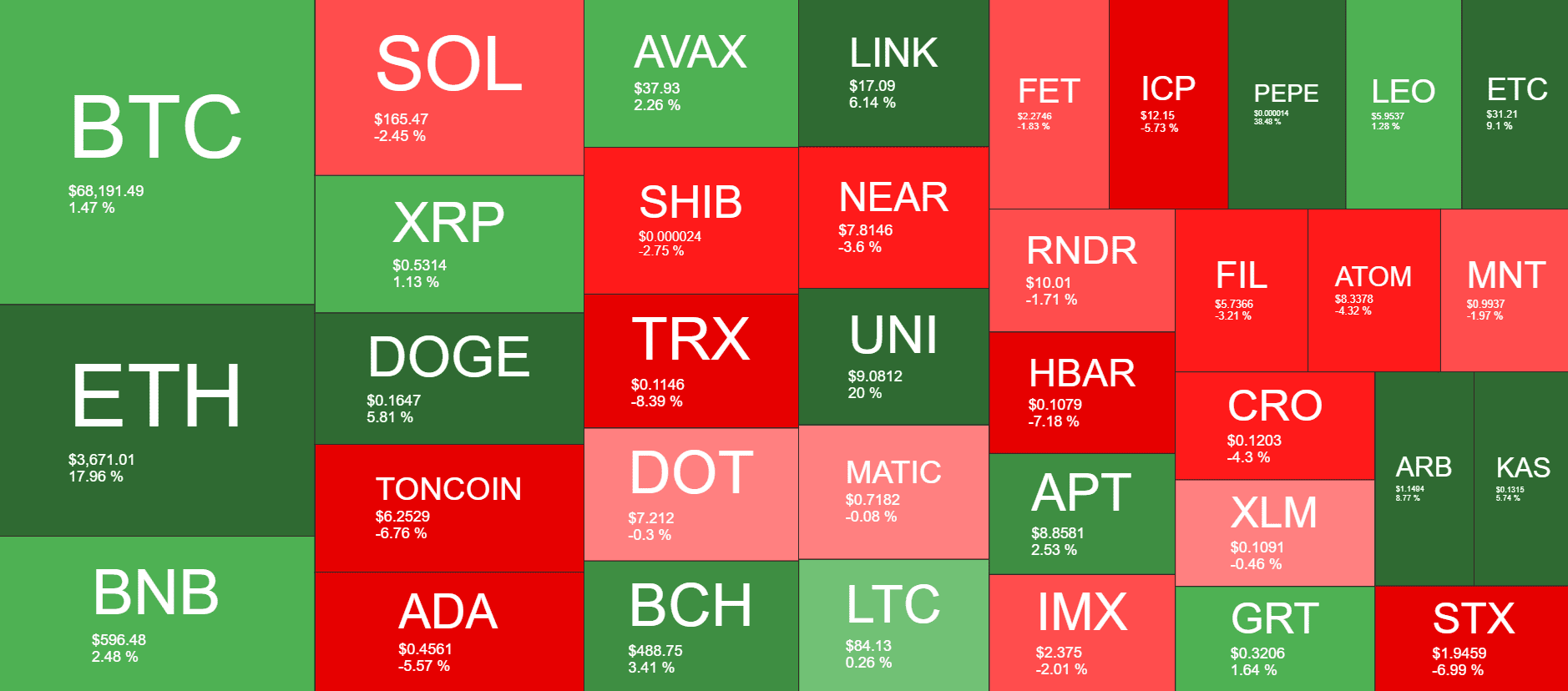

Market Data

Market Cap: $2.676T | 24H Vol: $133B | BTC Dominance: 50.2%

BTC: $68,191 (+1.47%) | ETH: $3,671 (+18%) | BNB: $596 (+2.5%)

This Week’s Crypto Headlines You Can’t Miss

As a researcher studying the latest developments in the cryptocurrency sector, I’m thrilled to report that this week brought significant news from the US Securities and Exchange Commission (SEC). Previously uncertain about the classification of Ethereum as a security, the SEC made a surprising decision to approve eight spot Ethereum Exchange-Traded Funds (ETFs) for public trading. This move could be a response to mounting political pressure within the industry.

Nine-Day Surge in Demand for Bitcoin ETFs: Robust Inflow Trend Continues

Fifteen years have passed since the memorable Bitcoin Pizza Transaction: A Delicious Milestone in Crypto History. On May 22, 2010, Laszlo Hanyecz made one of the earliest Bitcoin transactions by exchanging 10,000 BTC for two Papa John’s pizzas. We commemorated this significant event earlier this week.

Bloomberg analyst James Seyffart predicts that Solana Exchange-Traded Funds (ETFs) may experience increased demand compared to other alternative coin funds due to the recent success of Bitcoin and Ethereum ETFs. However, there is ongoing debate about the potential approval of Solana ETFs.

As a crypto investor, I’ve been closely following the developments at Grayscale, the leading institution in the Bitcoin ETF space. This week brought significant news from them when Michael Sonnenshein, who had spent an impressive decade with the asset manager, announced his departure as CEO. A new leader is set to take over, hailing from Goldman Sachs.

As a researcher studying the Bitcoin network, I’ve observed a noteworthy trend that warrants attention. Although Bitcoin has been making headlines for its positive developments, there’s been a significant decrease in the number of new addresses being created over the past few weeks. In fact, this figure has reached its lowest point since the bear market in 2018.

Charts

This week, I’d like to share an examination of Ethereum, Ripple, Cardano, Shiba Inu, and Polkadot through chart analysis. For a comprehensive look at their current pricing trends, please follow this link.

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Valorant Survey Insights: What Players Really Think

2024-05-24 19:41