What to know:

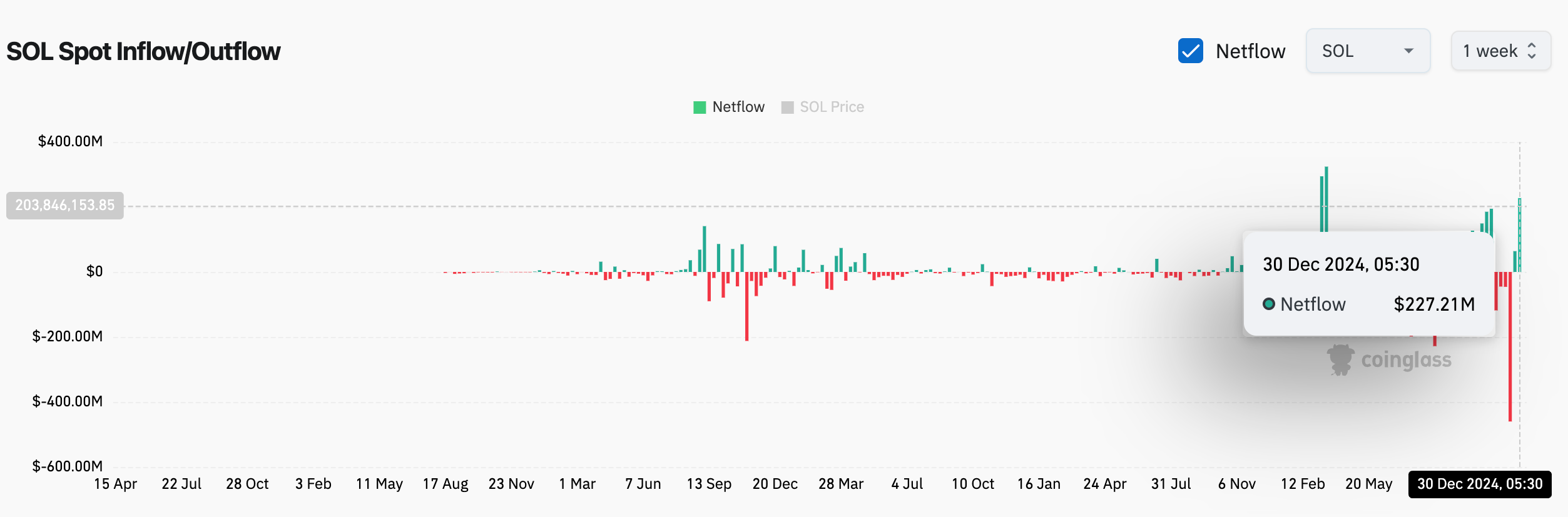

- SOL net inflows to centralized exchanges amounted to over $200 million last week, the highest since March.

- The March spike coincided with SOL’s the-then price rally losing steam near $200.

- SOL’s options market flows show a lack of bullish excitement.

The same market pattern seen in the price peak of March 2024 with the SOL token has resurfaced, casting a shadow over its optimistic technical analysis.

Over the past week, there was a significant deposit of $227.21 million worth of SOL, the token used on Solana’s smart contract blockchain, into centralized exchanges. This is the largest deposit recorded since the last week of March, as reported by Coinglass.

Previously, exchanges experienced an inflow of more than $300 million in SOL. Notably, this period corresponded with SOL’s price rally reaching nearly $200, setting the stage for a seven-month range game between $120 and $200.

Transferring a significant amount of coins to exchanges could suggest that the owners are preparing for one of two possibilities: they might choose to sell their coins, or they could use them in trading derivatives or DeFi (Decentralized Finance) tactics.

Recently arrived data has made it less clear that the optimistic technical forecast will hold, as this predicts that prices might return to surpass the November high of around $260 after they successfully protected crucial support in a bullish “reverse pullback.

The Deribit-traded SOL options market suggests a diminished bullish sentiment, as revealed by data from the analytics platform Amberdata, with traders predominantly buying downside (put options) for SOL.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2025-01-06 11:09