As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I must admit that I’ve seen some wild market swings, but this one takes the cake! The crypto market has been on a rollercoaster ride, and it seems that the anticipated return of Donald Trump to the White House is fueling its surge.

The digital currency market appears to be gaining momentum due to speculation that Donald Trump, the Republican nominee, may secure a victory in the U.S. presidential election, given his increasing advantage.

In simpler terms, this news is beneficial for those who invest in stocks rising (bulls), but it’s detrimental to those who bet on their fall (short traders). On Binance, the most affected short trader suffered a massive loss of approximately $75 million due to liquidation.

According to CryptoPotato’s report, the possibility of Donald Trump returning as U.S. President is increasing, with current electoral college votes standing at 247 for him and 214 for his Democratic competitor, Kamala Harris.

As the self-declared “crypto advocate,” Trump’s lead in support resulted in an anticipated boost for the digital asset market. Bitcoin took the front line again, breaking past its previous record high from March ($73,737 on CoinGecko) and setting a new peak above $75,000.

A variety of alternative cryptocurrencies have mirrored this trend, posting remarkable double-digit increases. For instance, UNI rose by 35%, DOGE climbed up by 25%, POPCAT saw a 24% increase, BONK went up by 23%, and WIF experienced a 21% growth, among numerous others.

The overall value of the cryptocurrency market has soared by more than 7%, reaching a staggering $2.6 trillion. However, this growth has caused trouble for heavily leveraged traders, particularly those who had bet against the market, holding short positions.

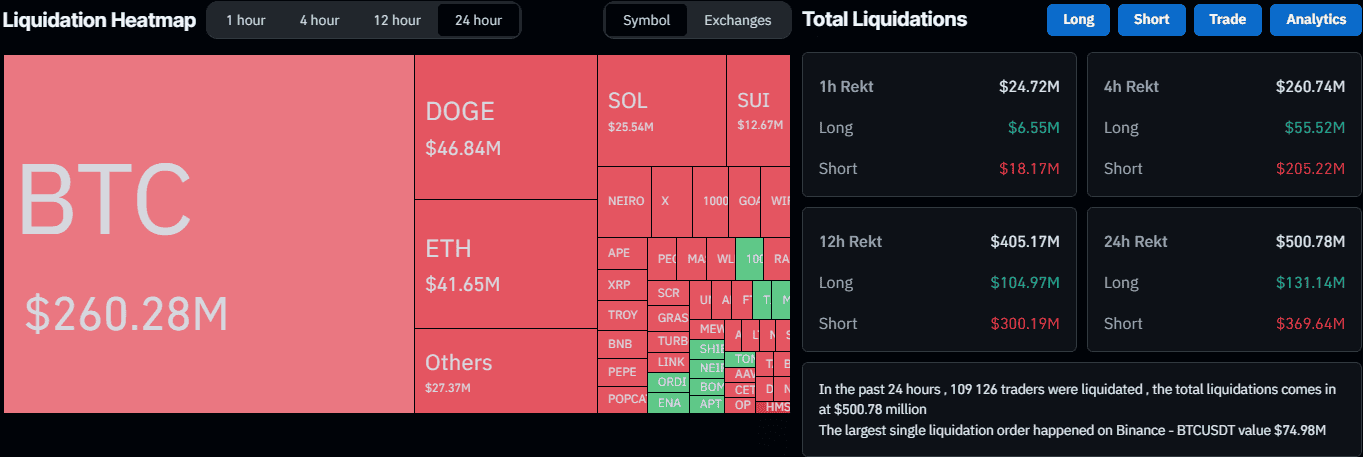

According to information from CoinGlass, approximately 110,000 traders have suffered significant losses over the last day. The combined worth of these liquidated positions amounts to a staggering $500 million, with shorts making up the majority.

The largest trade loss recorded an incredible sum of $75 million, which occurred within the BTC/USDT exchange on Binance.

It’s suspected that the large sum of Crypto X may have been held by a major investor, often referred to as a “whale,” who had wagered against Donald Trump in the elections. The significant increase following the election could have triggered this massive sell-off or liquidation.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

2024-11-06 13:40