As a seasoned analyst with years of market observation under my belt, I find it fascinating to witness the dynamic nature of the cryptocurrency market. Last week, XRP was the star performer, propelled by Grayscale’s Ripple Trust launch and persistent rumors of a Robinhood re-listing. It’s always intriguing to see how market sentiment can swing so dramatically based on such news.

TL;DR

- XRP gained 7.5% last week, boosted by Grayscale’s Ripple Trust launch and rumors of a Robinhood re-listing.

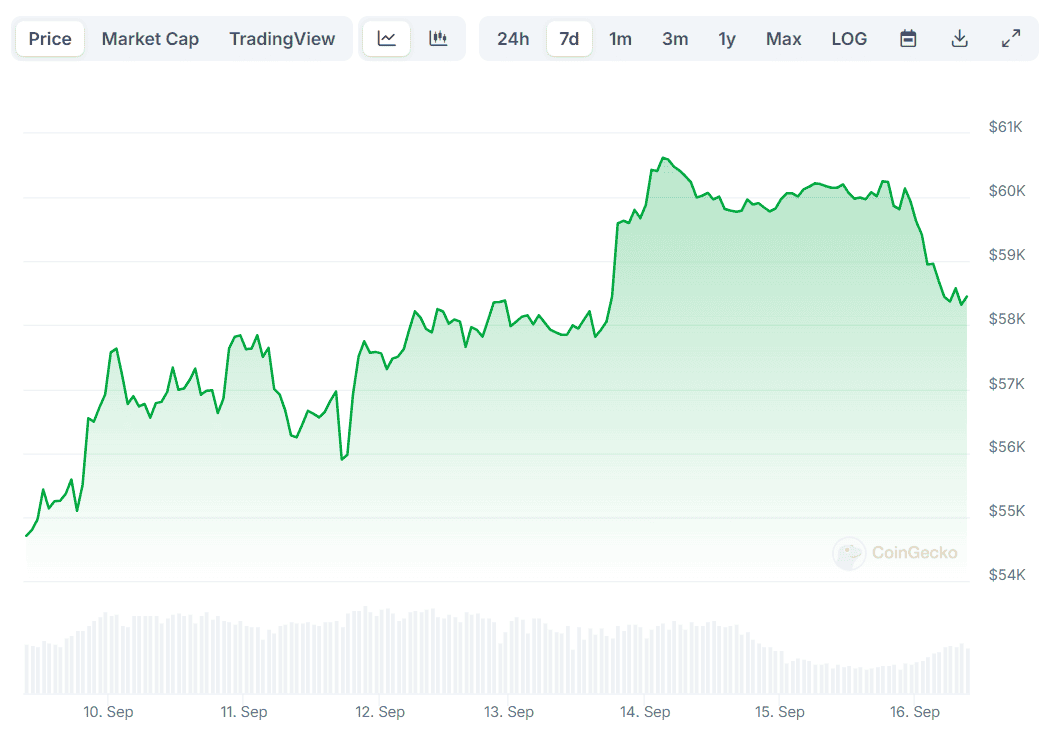

BTC dropped below $60,000 after briefly surpassing $60,500, affected by negative news in the broader market such as the supposed assassination attempt on Donald Trump.

SHIB increased by 2% over the week amid a high level of fear, uncertainty, and doubt (FUD) in the ecosystem.

XRP’s Performance as of Late

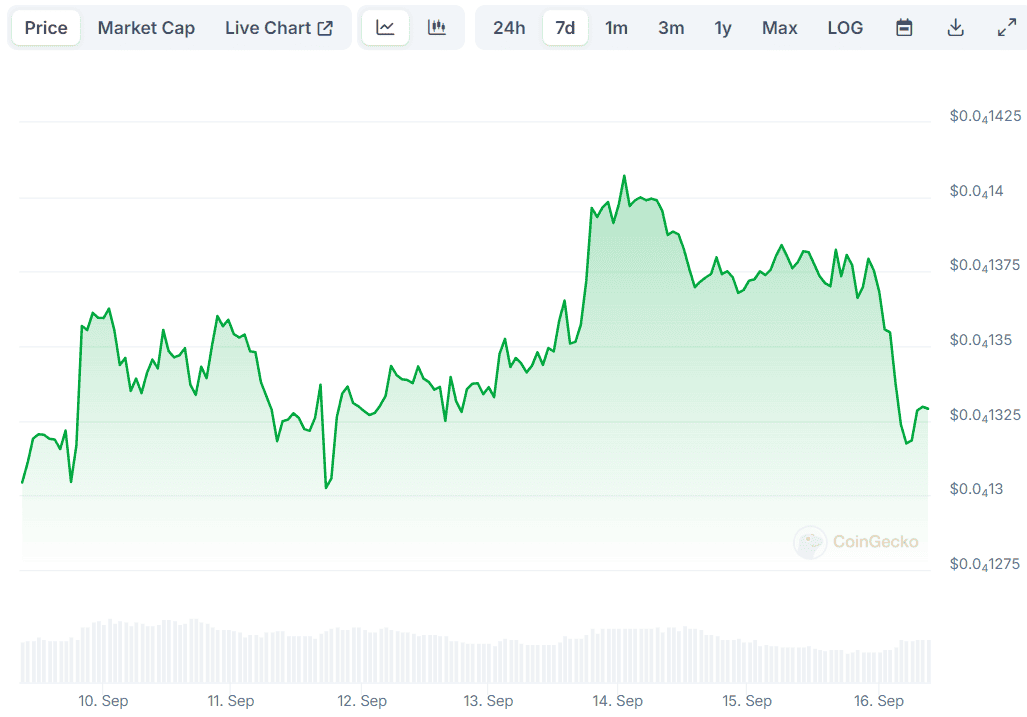

As an analyst, I found myself observing significant advancements with Ripple’s XRP last week. This positive momentum was fueled by Grayscale’s announcement to introduce a specialized Ripple Trust. Launched on September 12th, this product enables users to gain direct access to the asset without the hassle of purchasing, storing, or holding it themselves. In simpler terms, it brought the asset into the limelight for many investors.

As a crypto investor, I observed an impressive surge in XRP‘s price just minutes after the announcement, soaring as high as $0.57 on the chart. This uptrend persisted for several days, with the price nearly hitting $0.60 on September 15. One possible reason behind this rally is the heightened speculation that Robinhood has re-listed XRP on their platform. Interestingly, a visit to their website suggests that Ripple’s native token is indeed among the supported cryptocurrencies, fueling excitement among investors like myself.

Over the past several hours, XRP has lost some ground and currently trades at around $0.57 (per CoinGecko’s data). However, it remains in green territory on a weekly scale, up 7.5% for that period. Those willing to explore some interesting predictions from popular analysts can take a look at our article here.

BTC Lost the $60K Level

In the previous week, the main cryptocurrency experienced a substantial surge, pushing its value beyond $60,500 over the weekend. However, this upward trend was temporarily halted in recent hours due to news reports about an alleged assassination attempt on former President Donald Trump.

Based on a report from CryptoPotato, I’ve learned that the Federal Bureau of Investigation (FBI) has launched an inquiry regarding an incident at a golf club. During this time, it appears that multiple gunshots were discharged while a presidential candidate was engaged in a round of golf.

As a crypto investor, I’ve noticed a dip in the market today. The negative news has caused the overall value of cryptocurrencies to decrease by 4% on a daily basis, currently standing at around $2.12 trillion. At the time of writing, Bitcoin has dropped significantly and is now trading below $60,000, sitting at approximately $58,400.

It’s intriguing to predict if the asset’s decline will deepen or if it will rebound following the FOMC meeting on September 18. Many industry experts anticipate that the US Federal Reserve may reduce interest rates, which could make borrowing money more accessible and possibly stimulate investor enthusiasm for riskier assets like cryptocurrencies.

What About SHIB?

Over the past week, the second-largest meme cryptocurrency experienced a modest growth of 2%. Previously, the crypto analysis platform Santiment predicted a significant level of fear, uncertainty, and doubt (FUD) within the Shiba Inu community.

The term Fear, Uncertainty, and Doubt (FUD) refers to the spreading of pessimistic or misleading information, whispers, or anxiety that can induce fear among investors. This fear can lead to increased selling activity in the market, which is often interpreted as a warning sign for substantial price fluctuations ahead.

Read More

- EUR INR PREDICTION

- W PREDICTION. W cryptocurrency

- Michelle Yeoh Will Not Appear in ‘Avatar 3,’ Says James Cameron: ‘She’s in 4 and 5’

- IMX PREDICTION. IMX cryptocurrency

- Skull and Bones: Gamers’ Frustrations with Ubisoft’s Premium Content Delivery

- TANK PREDICTION. TANK cryptocurrency

- The first 5 players named to the 99 club in Madden 25

- OGV PREDICTION. OGV cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

2024-09-16 09:58