As a seasoned researcher with a penchant for cryptocurrencies, I have been tracking the dynamic world of digital assets for quite some time now. Over the years, I have witnessed the ebb and flow of various coins, their price fluctuations, and the impact of regulatory decisions on market sentiment.

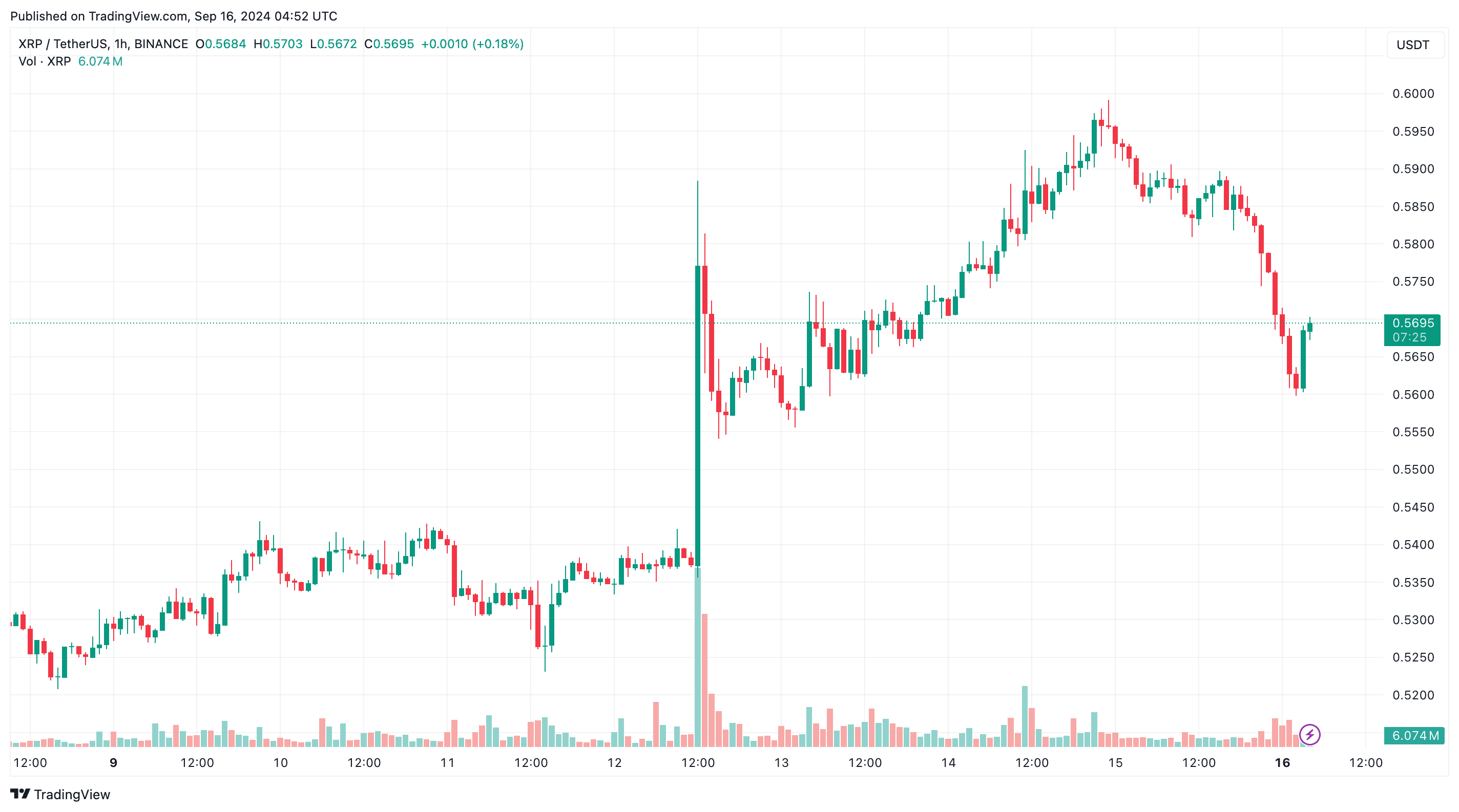

XRP’s price experienced a slight dip, accounting for a few percentage points of its weekly advance, yet it remains 7.2% higher over the past seven days, following a vigorous surge during the latter part of the week.

Over the weekend, the collective value of RippleNet‘s tokens surpassed $30 billion, and these tokens unexpectedly soared in price on crypto exchanges last Thursday, reaching over $0.57 per token.

However, only the next day did Bitcoin, Ether, and leading cryptocurrencies show an increase in value on the stock exchange. The announcement of Grayscale’s new XRP investment trust significantly boosted the Ripple market.

Is it likely that the price increase for Ripple (XRP) will continue, or are we expecting a broader impact on other cryptocurrencies in September?

Here are three bullish indicators for XRP in September, and two bearish ones.

1. Grayscale’s XRP Trust

On Thursdays announcement, Grayscale – a prominent Park Avenue crypto asset manager focusing on private placements for high net worth individuals (HNWIs) – unveiled an opportunity for investors to invest in XRP through the launch of the first U.S.-based XRP trust product.

According to Grayscale’s Head of Product & Research, Rayhaneh Sharif-Askary, it is thought that the Grayscale XRP Trust offers investors an opportunity to invest in a protocol with a significant practical application in the real world.

Sharif-Askary stated that by quickly processing cross-border transactions within seconds, XRP could revolutionize the traditional financial system’s structure.

Social media buzzed with excitement among XRP enthusiasts, viewing this development as a significant stride towards a U.S.-based XRP ETF. Similar to how Grayscale played a crucial role in launching the first Bitcoin ETFs by challenging the SEC in court and emerging victorious.

The difference between an ETF and a trust is the number of shares issued by an ETF can change to meet demand. Furthermore, ETFs are traded through the day. Trusts have a fixed number of shares and are traded once daily near the market close.

Positive news about Ripple’s economy can significantly boost investor interest from the Wall Street market, potentially leading to an increase in XRP‘s price.

2. Fine XRP Technicals

Meanwhile, XRP’s price on crypto charts is showing some fine technical signals for Ripple bulls.

On Sunday, TradingView recommended a strong buy for XRP, considering its short to long-term trend indicated by both simple and exponential moving averages across various timeframes: 10, 20, 30, 50, 100, and 200 days.

Additionally, on Friday, the Moving Average Convergence Divergence (MACD) signal line for Ripple’s cross-border payments token crossed over its signal line, indicating a potential bullish trend.

If XRP‘s chart technicals are considered, breaking through the significant barrier at $0.60 might trigger a surge in the price of Ripple, potentially reaching $0.68.

3. Robinhood Expected to Lists XRP in EU

A significant sign pointing towards a rise in XRP‘s value this month is that the well-known mobile trading platform, Robinhood, seems ready to offer XRP for trading to its users based in the European Union.

On Saturday, European users discovered they could track the price of XRP on a commission-free trading platform, although the company hadn’t officially announced anything yet by Sunday.

Robinhood provides various cryptocurrencies in its platform, such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Shiba Inu (SHIB), Avalanche (AVAX), and more. Last June, Robinhood ceased trading for Cardano (ADA), Polygon (MATIC), and Solana (SOL) following a Wells notice from the Securities and Exchange Commission (SEC).

The addition of XRP to the trading platform indicates a promising outlook for the token, given the approaching clarity in regulations following the resolution of the protracted lawsuit with the U.S. Securities and Exchange Commission (SEC).

4. Fmr XRP Bull Raoul Pal Flips

Following the resolution of the SEC case, the XRP community is enthusiastic about the Ripple network, yet not every investment analyst considers it the optimal pick for cryptocurrency investors at present.

Raoul Pal, the head of Real Vision Group and a former executive at Goldman Sachs who is well-known in crypto circles on social media, was once a strong advocate for Ripple. However, he now believes that it may not be the ideal choice for individuals looking to invest their funds in blockchain technology.

Pal, who had expressed his strong belief in XRP as “an opportunity of a lifetime” when he initially purchased the tokens back in December 2020, has since experienced a significant shift in his stance. In a recent podcast conversation with John Deaton, Ripple’s amicus brief lawyer, he encouraged investors to actively invest in cryptocurrencies that offer practical applications.

However, in interviews with Good Morning Crypto this past August, Pal advised against purchasing older coins such as Ripple (XRP) and Cardano.

It seems he strongly believes in his fresh perspective on emerging altcoins, as he warned that those who support Ripple might be drawing in cryptocurrency beginners into a “devoted following” of “outdated coins.

Pal stated, “We’re essentially hired guns in this field, our goal is primarily financial gain.” He continued, “Cryptocurrencies like Cardano and XRP are numerous in this realm. However, relying on hope isn’t a sound investment approach.

5. Competition From Other Altcoins

Following a surge in the Bitcoin market on Friday, some key rivals of XRP experienced larger weekly growth, such as Binance Coin (BNB), Dogecoin (DOGE), The Open Network (TON), Near Protocol (NEAR), Internet Computer (ICP), Taotiuandi (TAO), and Nervos Network.

For the week (prior to a dip on Monday), XRP‘s price climbed approximately 10%, while TON and ICP saw increases of over 13%. SUI and AAVE experienced growth of around 15% in their market cap just a week prior. Another Layer-1 chain, Bittensor (TAO), surged by almost 30% on cryptocurrency exchanges.

Over the past week, Nervos Network (CKB) saw a 100% increase in value. With stiff competition from other foundation chains in the Web3 sector, Ripple faces a challenge maintaining and expanding its market capitalization.

Read More

- EUR INR PREDICTION

- Skull and Bones: Gamers’ Frustrations with Ubisoft’s Premium Content Delivery

- W PREDICTION. W cryptocurrency

- Michelle Yeoh Will Not Appear in ‘Avatar 3,’ Says James Cameron: ‘She’s in 4 and 5’

- IMX PREDICTION. IMX cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- Understanding the Spectrum of Gameplay in Team Fight Tactics (TFT): A Reddit Discussion

- Why ‘Smite 2’ is the Next Big Thing: Insights from Players on Reddit

- OGV PREDICTION. OGV cryptocurrency

- The first 5 players named to the 99 club in Madden 25

2024-09-16 08:21