As an experienced financial analyst, I find the current focus on the legal battle between Ripple Labs and the SEC overshadowing the significant progress made by the XRP Ledger. The recent achievement of over 10 million XRP tokens being locked in automated market maker (AMM) pools is a notable milestone that warrants attention.

As a crypto investor, I’ve noticed that the focus in the community lately has been heavily on the ongoing legal battle between Ripple Labs and the SEC. However, it’s important not to overlook the significant progress made by the XRP Ledger itself. Recently, this versatile blockchain platform has reached an impressive milestone.

XRPL Hits an Important Milestone

As a researcher studying decentralized finance systems, I would describe the XRP Ledger (XRPL) as my go-to platform for facilitating swift, affordable, and real-time transactions of various assets, including fiat currencies, XRP, and other digital tokens.

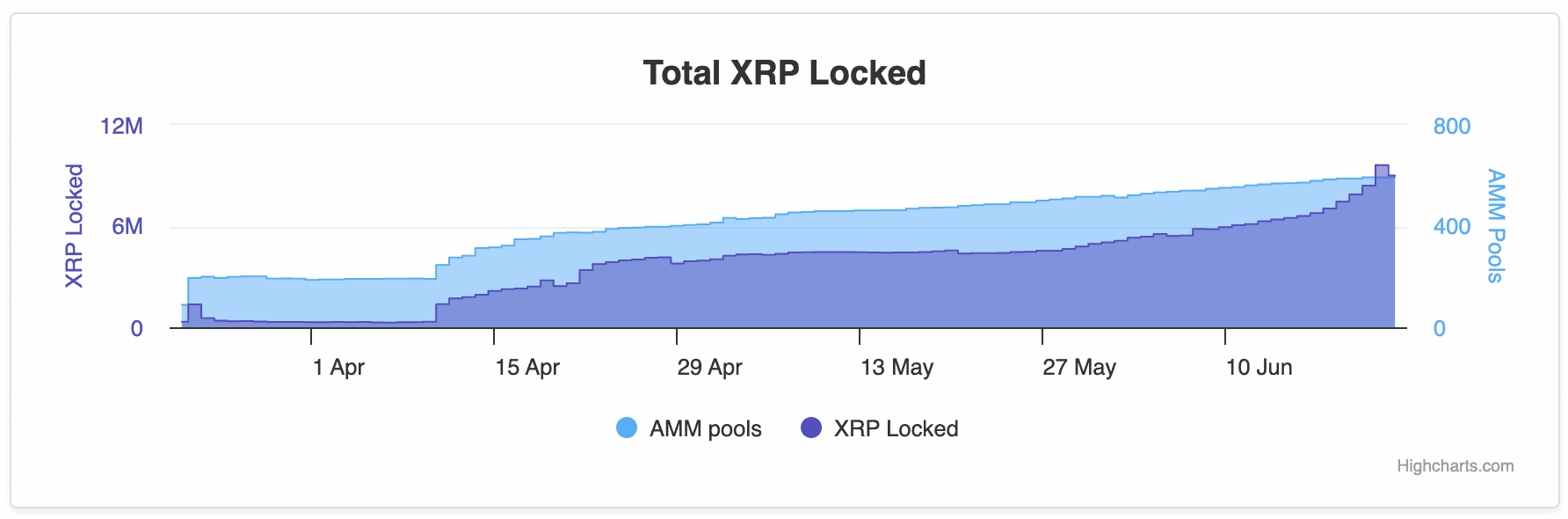

Over 10 million XRP tokens have been deposited in the Automated Market Making (AMM) pools of the network, marking a significant achievement.

I’ve observed a slight decrease in the number of XRP tokens secured in Automated Market Makers (AMMs) pools recently, with approximately 8.9 million XRP now held across nearly 600 such pools.

What is an AMM, and Why is This Important?

As a market analysis expert, I can explain that an Automated Market Maker (AMM) functions with the primary objective of supplying liquidity within the XRP ledger’s decentralized exchange. Essentially, this means that AMMs aim to facilitate smooth and continuous trading of assets by maintaining a reserve pool and adjusting their asset prices accordingly based on market conditions.

Essentially, every pool holds two distinct assets. Users have the ability to exchange one asset for the other at a predetermined rate according to a specific formula.

Individuals who deposit XRP into liquidity pools function as liquidity providers. In compensation for their contribution, they obtain LP tokens issued by the automated market maker as rewards.

Therefore, an increased stake in AMM pools generally signals rising investor confidence.

As a crypto investor, I’ve noticed that XRP‘s price action over the past few weeks has been rather lackluster. Despite the market fluctuations, XRP hasn’t managed to make a significant price shift, remaining stuck in its current range.

According to recent news from CryptoPotato, the value of this cryptocurrency appears to be gearing up for a significant shift. The reason being, its price has been confined within the present range for an extended period, reflecting an equilibrium between purchasing and selling forces. Such situations seldom persist.

However, the direction of the breakout is likely to determine Ripple’s trend in the mid term.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- FIO PREDICTION. FIO cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- BONE PREDICTION. BONE cryptocurrency

- WALV PREDICTION. WALV cryptocurrency

- Bitcoin’s Unreliable Death Cross Is Looming Again

- Did the Megalopolis Trailer Make Up All Those Movie-Critic Quotes?

- Ethereum Suffers $61M Outflows, Worst Performance Since August 2022

- Decoding the Cosmic Conundrum in Honkai: Star Rail – Why So Serious?

2024-06-23 19:44