As a researcher with extensive experience in cryptocurrency market analysis, I believe that Polkadot’s (DOT) recent price action indicates a significant bearish sentiment in the market. The selling pressure has been intense, resulting in a break below the critical $6 support region. This development is not isolated to DOT but rather affects all altcoins.

The price of Polkadot has faced increased selling, causing it to fall beneath the important $6 mark, which had previously provided strong support.

As a researcher observing market trends, I’ve noticed this recent development signaling a bearish outlook among investors. It’s important to note that this bears the possibility of further declines in the market.

Technical Analysis

By Shayan

The Daily Chart

Each day’s graph demonstrates that DOT experienced significant selling pressure around the important $6 price mark, ultimately leading to a substantial break below this pivotal support point.

His statement emphasizes the significant selling pressure prevailing in the market, extending beyond DOT to encompass all altcoins. Notably, the price has fallen beneath the lower limit of a prolonged triangular formation and previous significant lows, indicating a strong bearish trend.

As a crypto investor, I’ve noticed an ominous signal in the market: the 100-day moving average has dropped below the 200-day moving average, forming what’s known as a “death cross.” This technical indicator typically suggests bearish sentiment and could indicate further price declines. With this in mind, I anticipate that the price may head downwards towards the significant $5 support area, where it could potentially consolidate before any potential recovery.

The 4-Hour Chart

I’ve analyzed the 4-hour chart for DOT and noticed an increase in selling pressure that caused bearish pullbacks. Consequently, these pullbacks shaped a bearish price channel where DOT is now trading near its lower limit.

After dropping below the significant $6 mark, the price reversed course, returning to the previous support level, thereby strengthening the bearish outlook.

As an analyst, I predict that DOT will experience increased price fluctuations in the near future and may retrace back towards the significant support level at $5.4. Looking further ahead, a stage of sideways movement between the $5.4 and $6 price ranges is projected in the intermediate term.

Sentiment Analysis

By Shayan

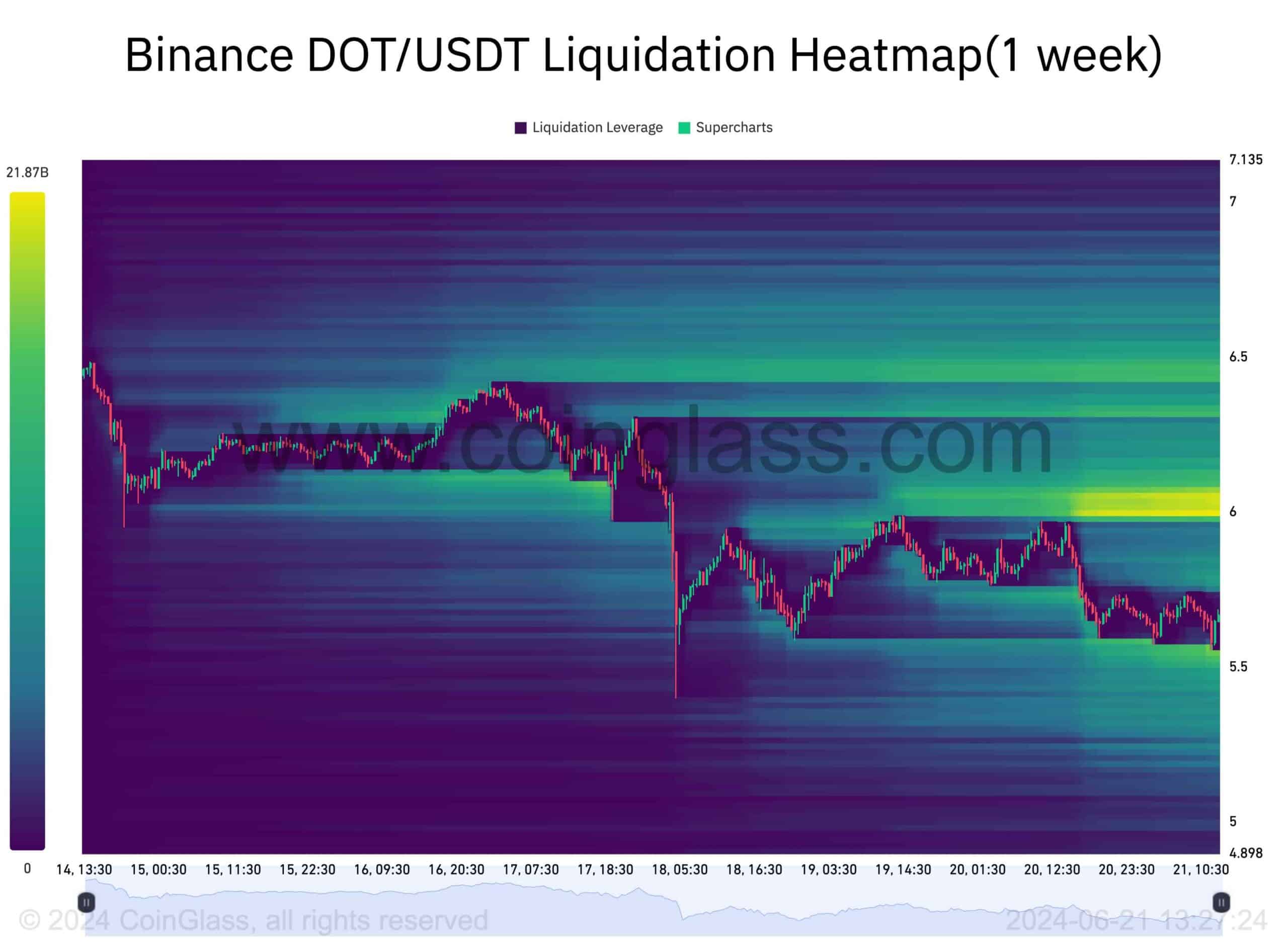

After hitting a critical low beneath the $6 mark, the value of Polkadot has caused a substantial short-covering rally, forcing out numerous long-standing investors. This occurrence holds significant importance in interpreting potential price actions moving forward.

As a researcher studying Polkadot’s price action, I’d like to share some insights based on the following chart. It highlights potential liquidation levels, indicating where large players in the market might focus their strategies in the intermediate term. At present, there is a substantial pool of liquidity hovering around the $6 price point. This concentration could be due to buy-stop orders set by cautious short sellers, positioning themselves near this pivotal level following earlier attempts to push prices down.

If there’s a bull market correction, the price level of $6 is likely where buyers will focus their efforts. They aim to profit from increased liquidity and possibly bring the price back to its previous resistance level, which was broken during the market uptrend.

At this price point, the market’s capacity to amass liquidity might fuel an extended downward trend.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- How to repair weapons & gear in Stalker 2

- SOLO PREDICTION. SOLO cryptocurrency

- Unlocking the Mystery of Brawl Stars’ China Skins: Community Reactions

- Dragon Quest III HD-2D Remake Review: History Repeats

- Team Fight Tactics (TFT) Patch 14.23 Notes: What to Expect from Set 13 Release

- W PREDICTION. W cryptocurrency

- Clash Royale: The Perils of Firecrackers and Cringe Decks

- POPCAT PREDICTION. POPCAT cryptocurrency

2024-06-21 14:47