As an experienced analyst, I’ve been closely monitoring the price action of Polkadot (DOT) in recent days, and the selling pressure that has emerged has resulted in a significant plunge below the crucial $6 support region. The daily chart indicates a clear breakout from a multi-month triangle pattern and a substantial long liquidation event, suggesting a potential continuation of the downtrend in the short term.

As a crypto investor, I’ve noticed that Polkadot‘s price has taken a hit lately, with selling pressure causing it to drop significantly below the important $6 support level. The current price action indicates that we may be in for a continuation of the downward trend in the near term, as there are no clear signs of recovery at present.

Technical Analysis

By Shayan

The Daily Chart

The daily graph indicates a notable surge in selling pressure, causing Polkadot’s price to dip beneath the crucial $6 mark and exit a prolonged triangle configuration. Consequently, this breakout precipitated a considerable wave of long position closures.

As a researcher observing the market trends, I notice that the price hasn’t shown any signs of bouncing back on the daily chart. This lack of recovery suggests the potential for an extended downtrend. However, there might be a brief and transient dip below the previously breached $6 mark, serving as confirmation of the breakout and strengthening the bearish outlook.

Key Levels to Watch:

- Primary Target: The substantial support region at $5.

- Resistance: The significant resistance at $6.

Caution is advised for traders as the market could display increased instability and significant swings in value during the near future.

The 4-Hour Chart

On the 4-hour chart, Polkadot’s price trend exhibits a consistent pattern of successively lower troughs and crests. This pattern signifies a strong downward trend and persistent control by sellers over the market.

The value of the cryptocurrency is currently moving back within a bearish price trendline, highlighting persistent selling pressure from traders. Even though the market is showing a declining trend, the price has neared a notable support level of approximately $5.5 – a historically important area where it has previously found support during past occurrences.

Should selling intensity increase and push Polkadot below the $5.5 support mark, there’s a strong likelihood that the cryptocurrency will continue to decline, potentially reaching the significant price area around $5.

An alternative possibility is that the price may experience a brief period of stabilization around this crucial support level, with trading activity confined within the range set by the lower end of the downtrend line at $5.5 and the channel’s upper boundary.

Sentiment Analysis

By Shayan

Over the past several weeks, Polkadot has experienced a significant drop in value, dipping beneath the important price level of $6. Identifying the primary causes behind this downward trend is crucial for traders to decipher current market moods and predict forthcoming price fluctuations.

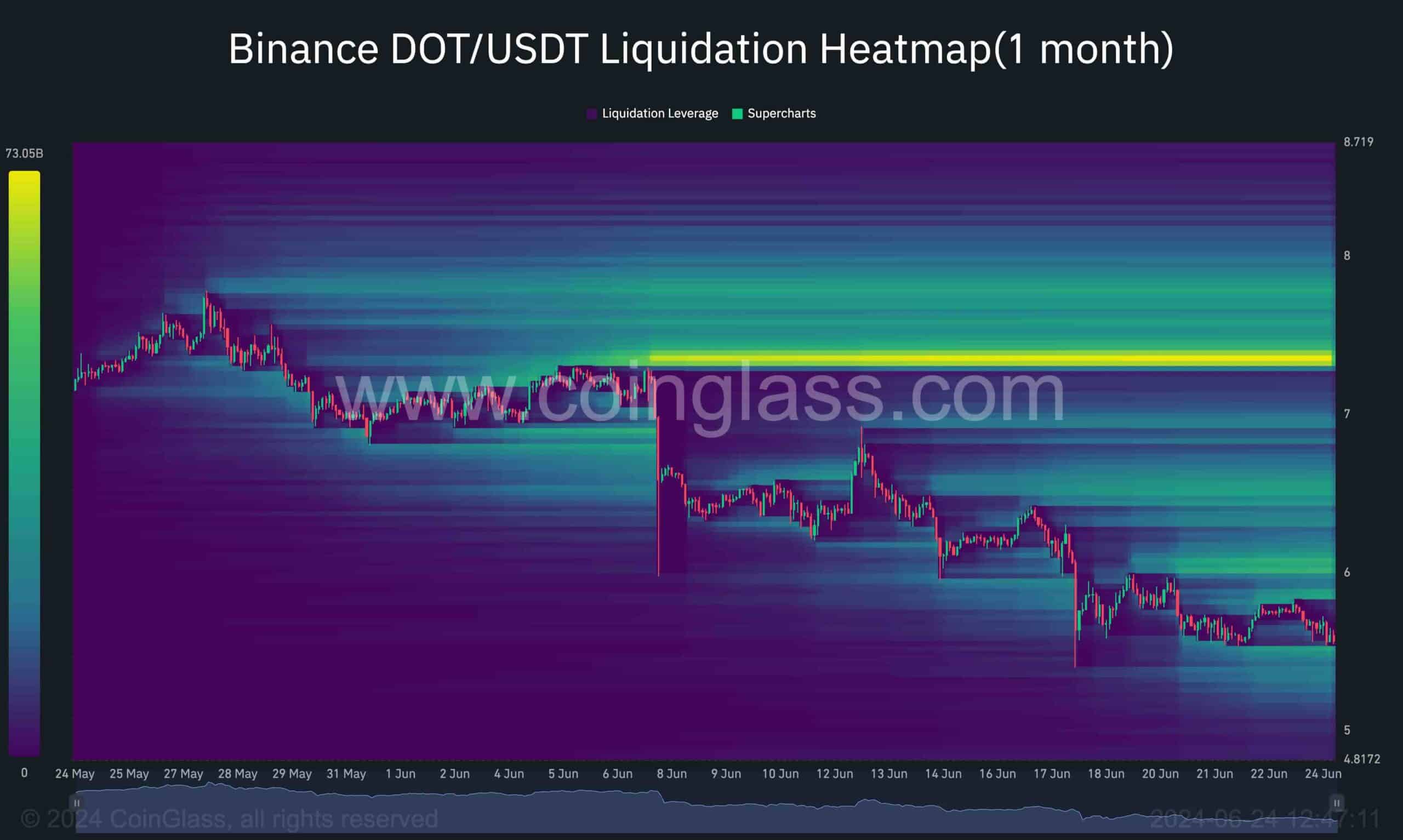

The enclosed graph showcases possible breaking points in Polkadot’s price trend, shedding light on key zones where astute investors might concentrate their strategies in the intermediate term.

As an analyst, I’ve observed a considerable buildup of liquidity residing above the significant swing high of $7.3 – the starting point of the current bearish trend. Given this positioning, it’s plausible that this area is populated with buy-stop orders, which serve as evidence of considerable selling pressure and aggressive short positions.

Liquidity pools with values exceeding $7.3 indicate a prominent bearish attitude among traders. Even amidst the prevailing market decline, sellers will ultimately seek to cash out their gains. Such situations typically result in extended phases of price stabilization, opening up possibilities for bullish market recoveries.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- PROM PREDICTION. PROM cryptocurrency

- DESO PREDICTION. DESO cryptocurrency

- INR RUB PREDICTION

- MOOV PREDICTION. MOOV cryptocurrency

2024-06-24 16:59