As an experienced analyst, I have closely watched the Polkadot price action over the last couple of months. The recent downtrend has been quite relentless, with the price dropping below key support levels like $12 and $7 on the daily chart. The bearish trendline and the broken 200-day moving average further confirm this trend.

The value of Polkadot has been declining significantly over the past few months without any indication of letting up. Nevertheless, it’s possible that this downturn could soon give way to an uptrend.

Technical Analysis

By TradingRage

The Daily Chart

I’ve observed a noticeable downtrend on the daily chart following the price rejection at the $12 resistance level. Additionally, the market has breached the uptrend line that had been in place since October 2023.

As a market analyst, I’ve noticed that the 200-day moving average, approximately at the $7 level, has been breached. The stock price appears to be headed towards the $4 support area.

As a crypto investor, I’m observing that the RSI (Relative Strength Index) is indicating values under 50%. This suggests that the market momentum is leaning towards a potential continued downtrend.

The 4-Hour Chart

The four-hour timeframe provides a significantly clearer representation of recent price trends. Currently, it appears that the market is shaping up as an ascending channel.

These formations are normally considered bearish continuation patterns inside a larger downtrend.

If the channel ruptures, it’s plausible that the market will head towards the $4 support level for a potential crash. Conversely, should the price breach the channel’s boundaries, it could trigger an uptrend and shift the market dynamics toward bullish conditions.

As a researcher studying market trends, I can tell you that the immediate future of the market hinges significantly on whether the current trend continues upward or takes a downturn.

Sentiment Analysis

By TradingRage

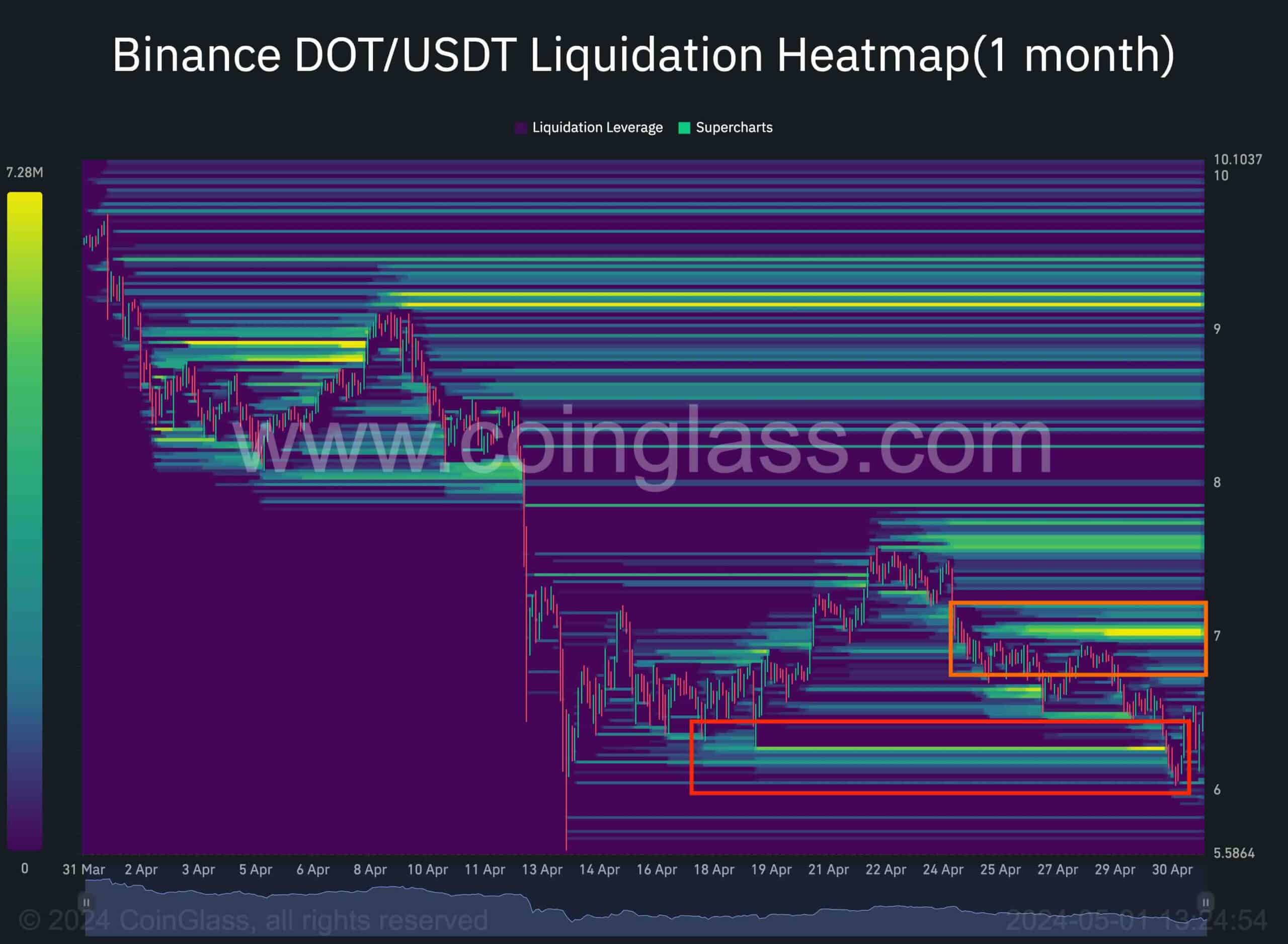

Polkadot Liquidation Heatmap

Although the technical analysis indicates a persistent downtrend for the DOT price based on the chart, the data from the futures market implies a possible short-term recovery.

As an analyst examining the Binance DOT/USDT pair’s chart, I can observe that a significant amount of liquidity was concentrated beneath the $6.5 mark – a level the price has recently dipped below. Interpreting this data point, it seems that the demand has successfully absorbed the supply at this price point, halting the market’s descent any further.

At present, there exists a possible reservoir of liquidity that could influence the price reaching towards the $7 mark. Consequently, a temporary price correction or dip may occur towards this level.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- How to repair weapons & gear in Stalker 2

- SOLO PREDICTION. SOLO cryptocurrency

- Unlocking the Mystery of Brawl Stars’ China Skins: Community Reactions

- Dragon Quest III HD-2D Remake Review: History Repeats

- Team Fight Tactics (TFT) Patch 14.23 Notes: What to Expect from Set 13 Release

- W PREDICTION. W cryptocurrency

- Clash Royale: The Perils of Firecrackers and Cringe Decks

- POPCAT PREDICTION. POPCAT cryptocurrency

2024-05-01 21:28