As a crypto investor with some experience under my belt, I’ve seen my fair share of false breakouts and price movements that indicate potential bullish retracements. Polkadot’s recent surge above the $5.5 support region is one such instance that has caught my attention.

As a researcher studying the cryptocurrency market, I’ve noticed an uptick in buying interest around the $5.5 support level for Polkadot lately. This surge in demand has propelled the price above the lower boundary of the multi-month triangle that had previously been breached. However, this price action might be misleading as it appears to be a false breakout. Consequently, we could be looking at a possible bullish correction period in the near future.

Technical Analysis

By Shayan

The Daily Chart

An in-depth examination of Polkadot’s day-to-day price chart indicates a robust rebound around the $5.5 support level. Buying pressure has intensified at this point, leading to a renewed interest in the asset and a consequent jump in its value.

Following its break above the earlier violated lower boundary of the prolonged triangular pattern, Polkadot’s price movement indicates a misleading bearish breakdown. This development implies heightened purchasing enthusiasm among investors.

At present, Polkadot encounters a significant hurdle around the $6.3 mark. Should buyers manage to breach this barrier and maintain their upward momentum, the price trend could progress toward the 100-day moving average at $7.2. Alternatively, if the price is unsuccessful in overcoming this resistance, Polkadot may enter a period of sideways movement within the range of $5.5 to $6.3.

The 4-Hour Chart

As a researcher studying Polkadot’s price behavior, I find that examining the 4-hour chart offers valuable insights. After breaking above the downward trendline of the price channel, there was a significant upward move, signaling a resurgence in demand and strong buying pressure. This surge could potentially be attributed to heightened activity within the perpetual markets.

DOT is currently facing a significant barrier, consisting of the $6.3 resistance mark and the prior notable peak at $6.428.

If Polkadot surpasses the resistance threshold, there’s a chance for a minor short squeeze and a shift in market perception, potentially propelling the coin towards the $7 resistance zone. However, if Polkadot fails to break through this level, a brief period of sideways movement is likely within the $6.3-$5.4 range. Therefore, the coming days will be crucial as they may influence Polkadot’s future trend.

Sentiment Analysis

By Shayan

As an analyst, I’ve noticed a surge in interest for Polkadot recently, resulting in a notable upward trend approaching its previous significant peak at $6.3. Grasping the intricacies of supply conditions at this pivotal point is crucial to making astute trading moves.

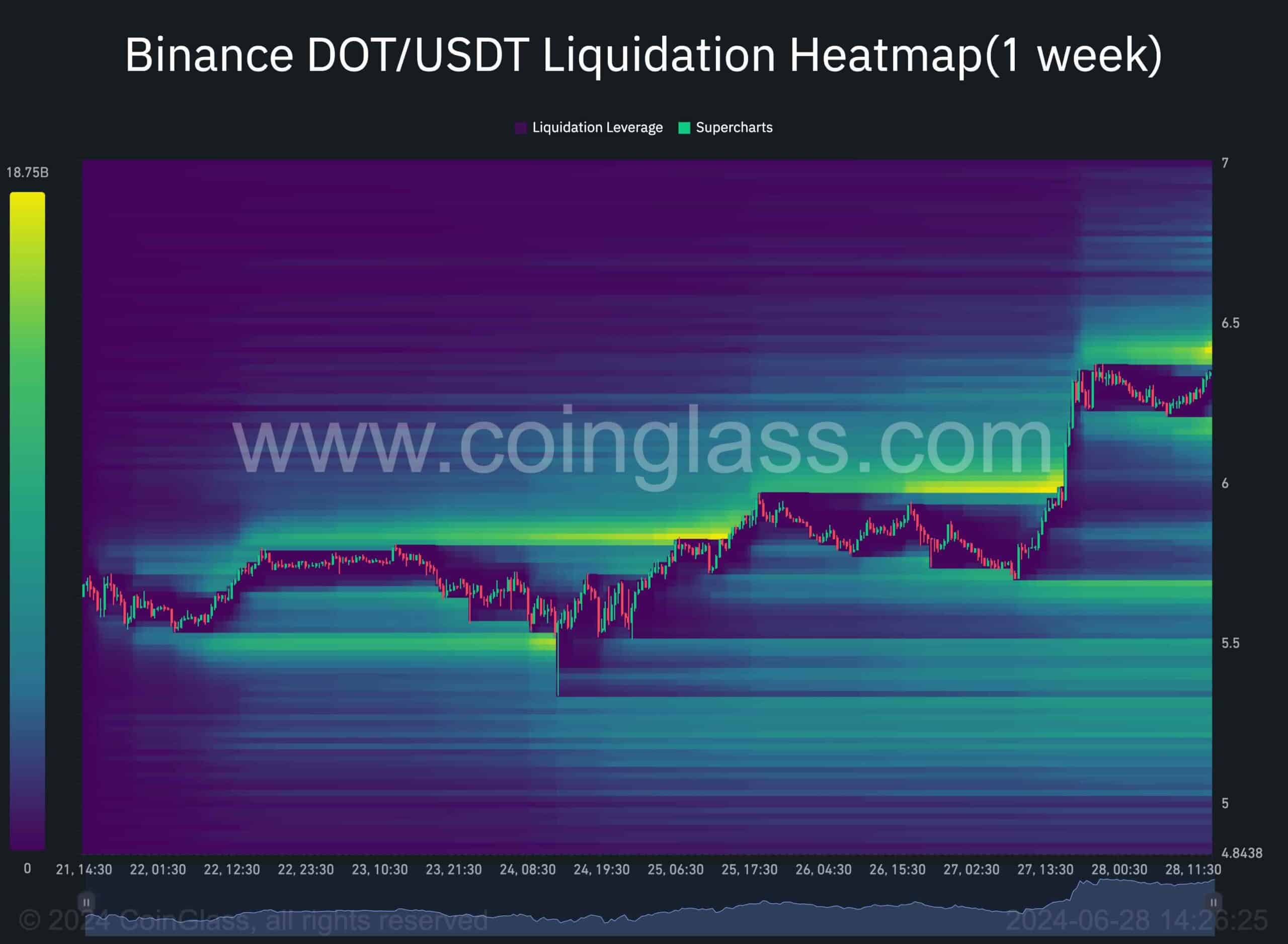

The included chart highlights possible areas where Polkadot could be sold off based on its price trends, offering valuable information for investors looking to adopt strategic mid-term moves.

During the current upward trend, the price chart indicates that it has been aiming for pockets of significant liquidity above its previous highs. This pattern suggests strong bullish momentum and heightened buying activity. Of particular note is the considerable amount of liquidity amassed above the crucial $6.3 resistance level. Buyers may look to capitalize on this opportunity by targeting this level as a short-term objective, enabling them to regain control at this pivot point and potentially offset any existing short positions.

As a crypto investor, I believe that seizing this idle liquidity would be crucial for buyers to maintain their buying pressure and boost Polkadot’s price upward in the intermediate term. Nevertheless, this level might also act as a formidable resistance point, and the upcoming price movements around this region could provide us with essential clues regarding Polkadot’s future price trend.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

2024-06-29 09:54