Recently, Polkadot‘s price dropped by approximately 33% following news of the escalating Iran-Israel conflict on April 14th. Yet, this decline found a halt at the vital 200-day moving average line, implying that the crypto could be in for a brief correction and stabilization period.

Polkadot Price Technical Analysis

By Shayan

The Daily Chart

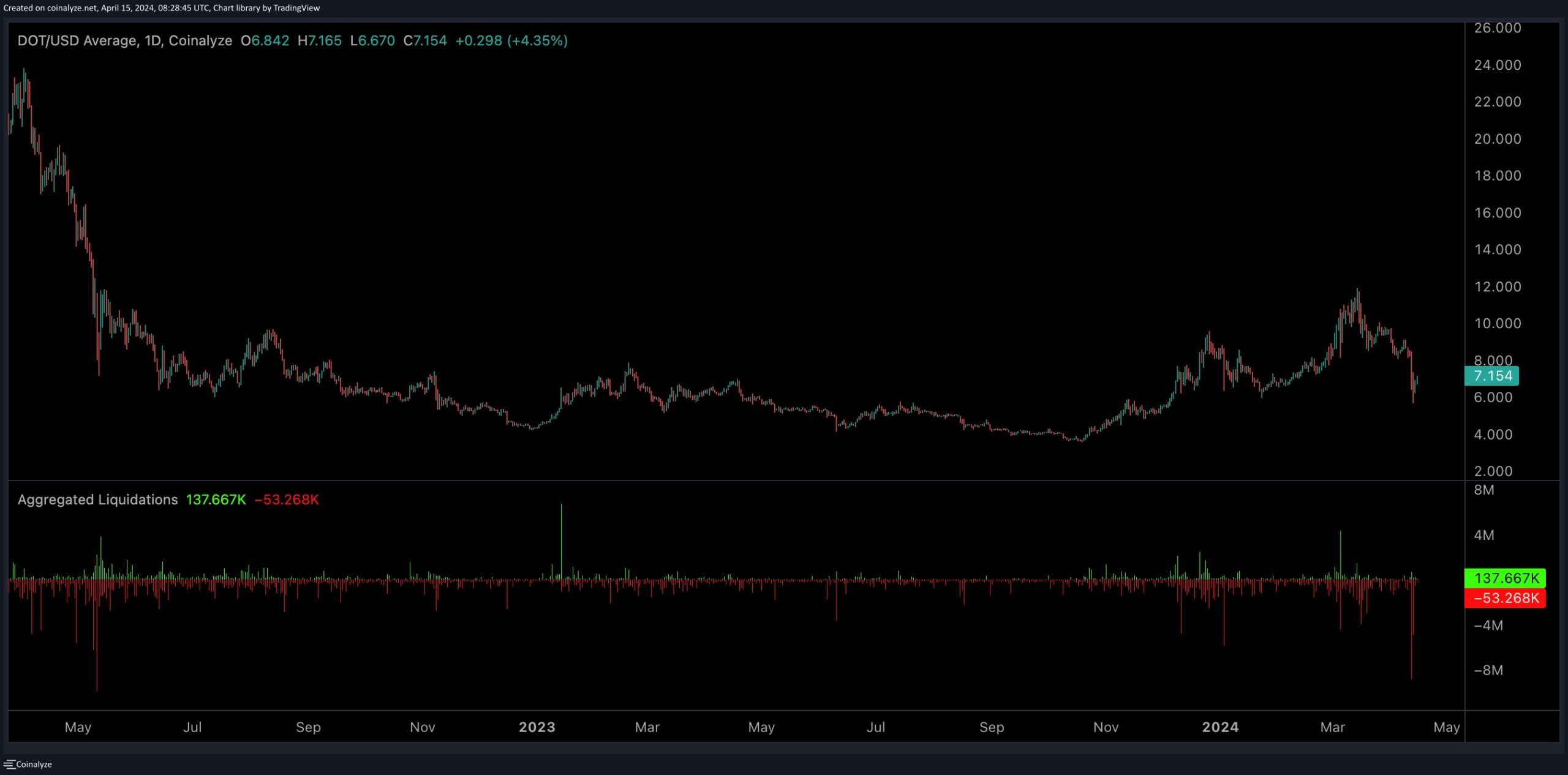

An in-depth examination of Polkadot’s daily price chart shows a significant drop, as the cryptocurrency fell by nearly 32% after the troubling news broke on April 14th about Iran allegedly invading Israel.

When this drop occurred, it broke through multiple important lines of defense and caused a major long squeeze in the continuous markets. Consequently, many long positions were forced to be closed.

Put simply, when the price of DOT took a sharp drop, it set off a chain reaction of sell orders, which in turn increased the pace of selling in the market. However, despite this intense selling pressure, the DOT price managed to hold steady at its significant moving average of $6.9 and showed a slight recovery.

In simpler terms, the cryptocurrency’s value may stabilize between its current support at the 200-day moving average and its resistance level at $9 over the next few weeks or months. This is known as a consolidation phase.

The 4-Hour Chart

Based on a detailed examination of Polkadot’s price action over the past 4 hours, it appears that after failing to break through the $9 resistance mark, the coin experienced significant selling pressure and subsequently dropped in value.

When the price failed to hold above the crucial $8 mark, it triggered a chain reaction that caused the price to plummet towards the substantial $6 support.

Instead of this: “However, the cryptocurrency displayed a small change to bullish behavior when it hit the essential $6 mark of support, suggesting there was demand present at that point.”

Despite this, Polkadot is projected to carry on with its downward correction. The upcoming resistance levels are predicted to be around $7.4 (0.5 Fibonacci level) and $7.8 (0.618 Fibonacci level).

Sentiment Analysis

By Shayan

On April 14th, a major drop in Polkadot’s value occurred due to the intensifying clash between Iran and Israel causing market turbulence.

Traders were significantly impacted by the geopolitical tension as it caused concern for increased market instability and potential price drops. This led to a sudden surge in volatility, which directly affected those trading perpetual futures contracts. As a result, around US$14 million worth of long positions were forcedly liquidated.

Significantly, this latest development represents the largest withdrawal of long positions in the futures market since last May. As a result, the market seems to be calming down, creating an opportunity for a possible bullish comeback and pushing prices upward.

In other words, these recent happenings serve as a clear demonstration of how vulnerable the market is to significant trade volumes, particularly during times of major news announcements.

This post has been powered by Polkadot.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- How to Handle Smurfs in Valorant: A Guide from the Community

- ESO Werewolf Build: The Ultimate Guide

- Mastering Destiny 2: Tips for Speedy Grandmaster Challenges

- Overwatch Director wants to “fundamentally change” OW2 beyond new heroes and maps

- Exploring Izanami’s Lore vs. Game Design in Smite: Reddit Reactions

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

2024-04-15 15:07