Polkadot‘s price has recently bounced back after hitting its 200-day moving average, leading to a bullish recovery. But, this positive trend may encounter significant hurdles at various resistance points, making it uncertain if the upturn will persist.

Technical Analysis

By Shayan

The Daily Chart

An in-depth examination of the daily price chart shows that Polkadot experienced a modest turnaround close to its significant moving average of $7, after undergoing a sharp drop. Yet, the absence of strong buying pressure casts doubt on the sustainability of this trend change.

In simple terms, Polkadot faces some strong opposition ahead. The price of $8.1, which is where the 100-day moving average and the 0.382 Fibonacci retracement level converge, could act as a significant barrier for any upward trend. These levels, along with the support provided by the 200-day moving average, are important indicators for Polkadot’s price action in the near future. A successful breakout from this range is expected to influence the market’s direction next.

The 4-Hour Chart

Taking a closer look at the last four hours of trading reveals a pause in decision-making around the $6 pivot point, which eventually led to a strong price increase. This uptick in buying activity brought the price close to important resistance areas, marked by the 0.5 Fib level at $7.4 and the 0.618 Fib level at $7.8.

In this crucial zone, a sizable amount is stored, making it essential to keep an eye on it. Consequently, the price movements within this span significantly influence Polkadot’s potential future trend. A breach above this vital region might prolong the existing upward trend, pushing it toward the critical resistance point at $9.

Sentiment Analysis

By Shayan

Recently, the price trend of Polkadot has indicated a bullish reversal, possibly indicating a resurgence of optimistic feelings among investors. To gain insights into potential future market developments, it’s useful to examine futures markets and assess their sentiment and liquidity.

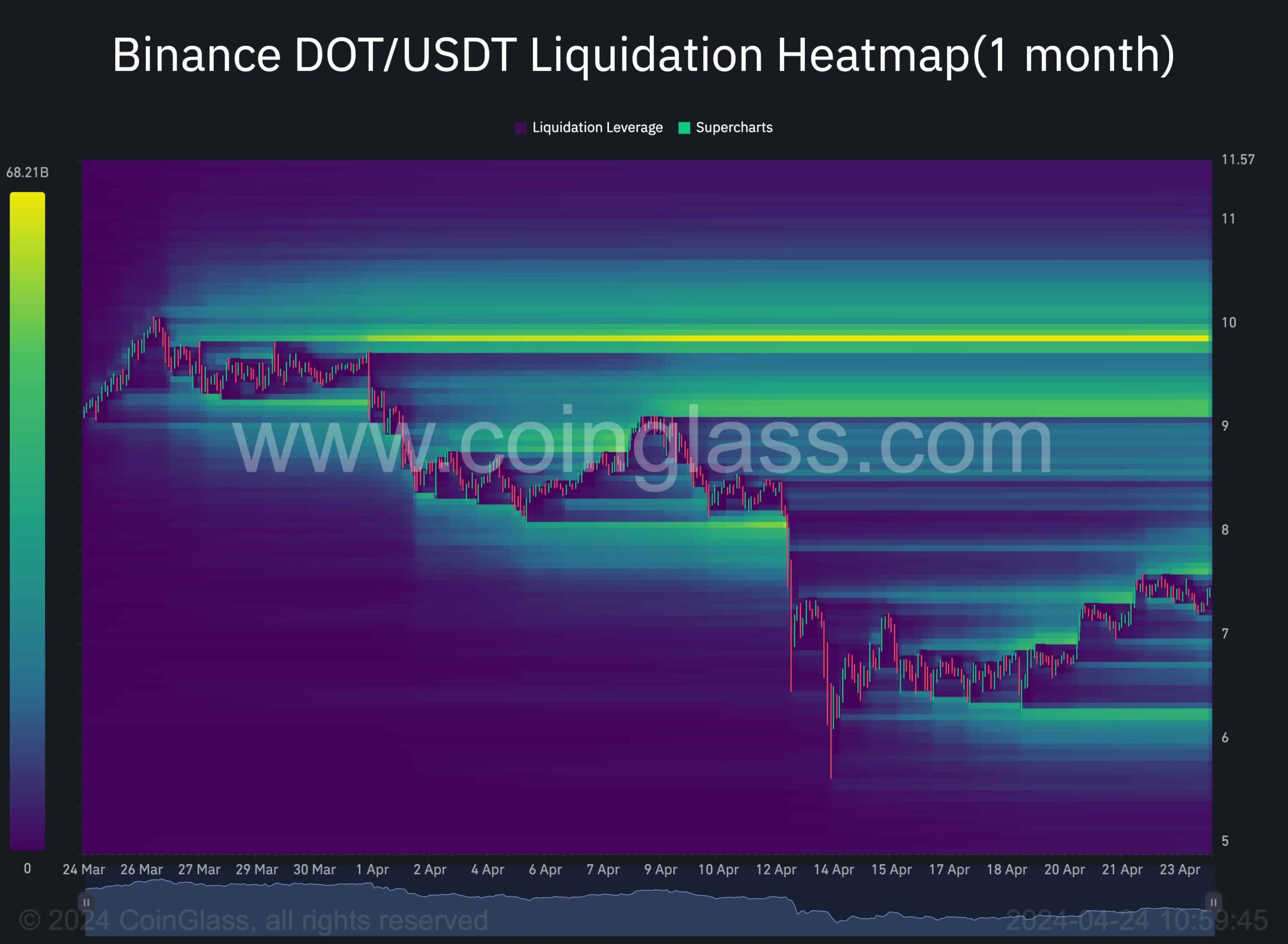

The chart next to this text shows the Binance DOT/USDT heatmap, which indicates potential price points where large sell-offs could take place. When the price reaches levels that might trigger a chain reaction of sell-offs, as marked in yellow, these areas become crucial support and resistance points to watch.

Based on the graph’s indication, there are numerous sell orders and buy-stop orders clustered above the $9 mark. This implies that the price may trend towards the $9-$10 range in the near future, resulting in significant selling off of short positions.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-04-24 18:00