What to know:

- Memecoins like dogecoin and Shiba Inu are gaining market share within the broader crypto economy, according to a research report by CEX.IO.

- Memecoin trading volume grew 979% from Jan.1 to Dec. 1, and accounts for 5.27% of the entire crypto market’s volume.

- Political memecoins have lost popularity since the U.S. election.

As a seasoned researcher with over two decades of experience in the ever-evolving world of finance and technology, I have witnessed numerous market phenomena that defy conventional wisdom. However, the rise of memecoins like dogecoin and Shiba Inu within the broader crypto economy is undoubtedly one of the most intriguing developments I’ve come across in recent years.

Memecoins undoubtedly capture a big slice of crypto observers’ attention — even if not everyone is a fan. But data shows they’re gobbling up a growing amount of the crypto economy too.

On December 1st, the market segment dominated by Dogecoin (DOGE) and Shiba Inu (SHIB) represented approximately 3.16% of the total market capitalization of all cryptocurrencies, marking an increase from 1.3% at the start of the year as per a recent report by CEX.IO exchange. When excluding the leading cryptos like Bitcoin (BTC) and Ether (ETH), the memecoin market share expanded to 11.21%, up from its initial 4.2%.

Approximately $140 billion in market value, according to CoinGecko data, is locked away in cryptocurrencies that claim no practical use. Known for their extreme volatility, these cryptocurrencies often bear names associated with animals, internet memes, political figures or events.

With bitcoin reaching an all-time high of over $100,000 for the first time, meme-based cryptocurrencies are also experiencing significant growth. Notably, Dogecoin has surged by 168% since the election of Donald Trump ignited a wave of enthusiasm across the crypto market. Currently, Dogecoin holds the seventh position among all cryptocurrencies in terms of market capitalization, standing at approximately $64 billion, as reported by CoinDesk.

Is it characteristic of the early phase of a modern bull market for such conditions to occur, or could it be a sign that the market has become excessively heated?

In past market phases, memecoins usually see a significant shift in capital accumulation towards the final stages of the growth period following a coin’s halving event, as explained by Alexandr Kerya, the vice president of product management at CEX.IO, via email to CoinDesk.

The term “halving” signifies an occurrence that takes place approximately every four years, such as the latest one in early 2014. During this event, the compensation for bitcoin mining is reduced by half, and this reduction frequently coincides with a rise in cryptocurrency values.

Kerya pointed out that this particular cycle is remarkable because the impact of meme coins increased substantially prior to the halving, and it continued to have an effect even as Bitcoin underwent a period of consolidation in the middle of the year.

Originating from a humorous context back in 2013, Dogecoin – the earliest meme-based cryptocurrency – garnered considerable popularity during the market’s peak in 2021, which concluded last year. This surge was partly fueled by Elon Musk, CEO of Tesla, frequently mentioning it on social platforms. Similar dog-themed digital currencies such as SHIB capitalized on DOGE’s success and amassed billions of dollars in valuation. Eventually, meme coins like Dogecoin have been recognized as a distinct investment category within the crypto market, comparable to Decentralized Finance (DeFi) tokens, Artificial Intelligence tokens, or privacy coins.

According to Kerya, just like with DeFi, it’s likely that the memecoin market will eventually level off, but right now, we’re figuring out where that balance point will be set.

Eating up market share

This year, the field of meme-based cryptocurrencies experienced rapid expansion, as reported. Specifically, the number of projects launched daily on Pump.fun – a Solana-centric crypto initiative that simplifies token creation for users – soared from around 30 in February to over 3,000 in March. Currently, approximately 60,000 memecoins are being generated each day, with half of them originating from Pump.fun, according to the report.

During the span from January 1st to December 1st, the combined market value of memecoins surged by an impressive 330%. To put this into perspective, Bitcoin has risen by 140% since the start of the year, and Ether by 71%. Notably, trading activity for memecoins skyrocketed by a staggering 979%, making up approximately 5.27% of the entire crypto market’s trade volume. Interestingly, memecoins maintained substantial trading volumes in June when other sectors within the crypto economy experienced downturns.

As an investigator delving into the crypto realm, I’ve noticed the surge in popularity of memecoins serves as a beacon for novice investors. This trend underscores the escalating impact of retail-led narratives within our market. On a positive note, it mirrors market enthusiasm and the expectation of an extended post-halving rally.

The memecoin sector has changed over the years. Dogecoin and Shiba Inu dominated trading volume and market capitalization in 2021. In contrast, 2024 has seen a wide variety of newer memecoins — such as dogwifhat (WIF), Brett (BRETT), Peanut the Squirrel (PNUT) and Popcat (POPCAT) — crack (or come close to) the top 100 coins by market cap.

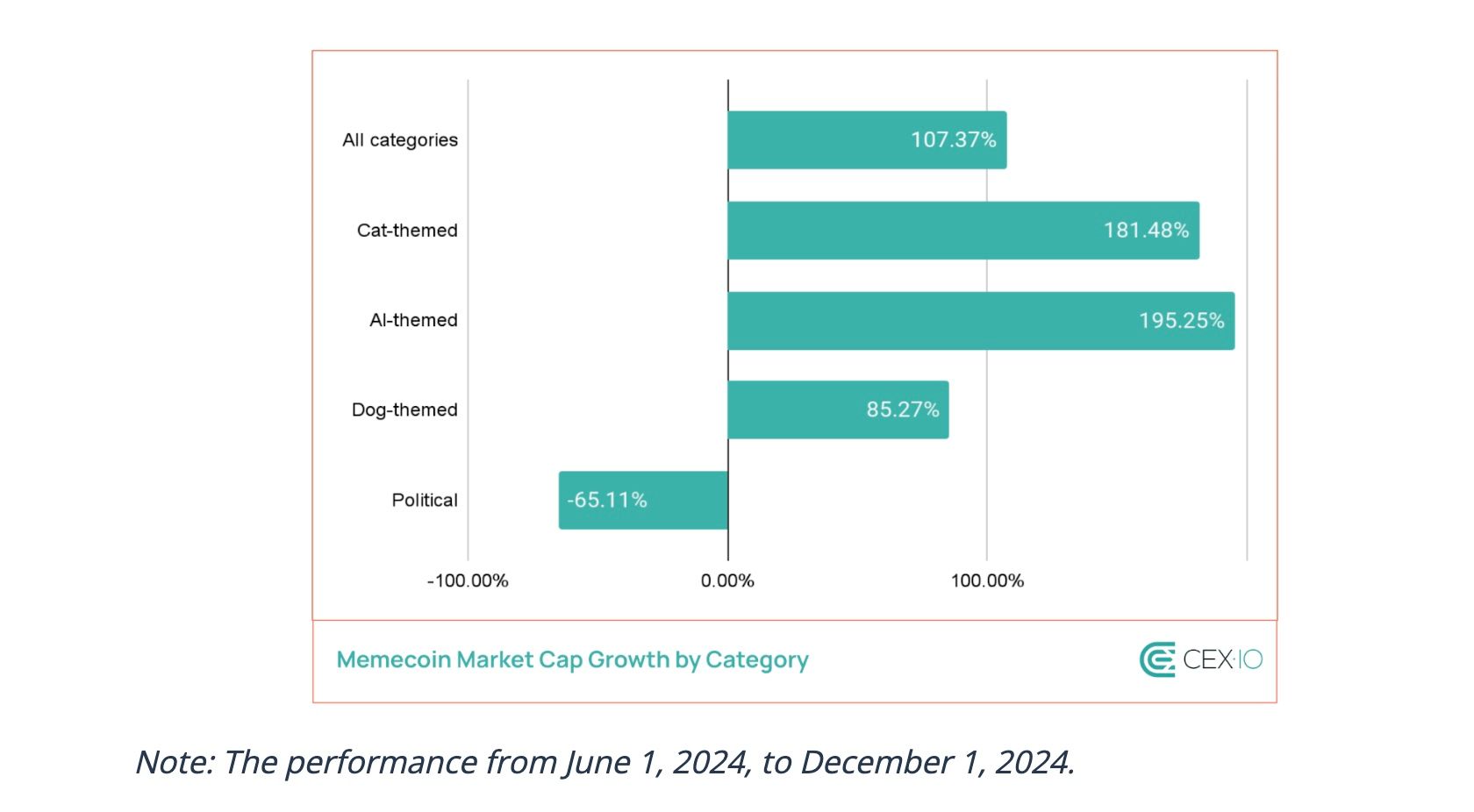

Previously, most prominent meme coins were themed around dogs. However, since March, cat-themed and artificial intelligence-themed tokens have been making significant gains at the expense of dog-themed ones. Additionally, political meme coins performed well leading up to the U.S. election in November; following this event, they experienced a substantial 80% drop in trading volume.

The locations where trading happens have changed as well. Dogecoin operates its own proof-of-work blockchain, much like Bitcoin‘s. Meme-based coins like pepe (PEPE) and MAGA (TRUMP) on the Ethereum network have gained some traction. However, Solana, boosted by Pump.fun, has emerged as the leading memecoin of 2024; it contributes to around 30% of the sector’s trading volume, and approximately 15% of the total market cap of meme coins is built on it.

In contrast, the trading volume for memecoins on the Telegram’s TON network has expanded an astounding 750 times over the past six months, despite the fact that the chain represents just a mere 1% of the overall memecoin market capitalization.

In the future, it’s likely that we’ll see a tighter integration of launchpads and decentralized exchanges to leverage the potential of memecoins in increasing retail participation and revenue for DeFi platforms. This was pointed out by Kerya. However, an excessive focus on memecoins in ecosystems like Solana has sparked some worries and could potentially lead to complications, possibly impacting its overall growth and development.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-06 00:32