As a researcher with extensive experience in the cryptocurrency market, I have witnessed Bitcoin’s price volatility firsthand. Monday’s price surge to $71,767 was an impressive feat, bringing it just under 3% away from its all-time high. However, despite the significant inflows into US spot Bitcoin ETFs, Bitcoin has since retraced and now hovers around $70,500.

The surge in Bitcoin‘s price approached $72,000 yesterday, but was halted. Following the substantial ETF investments, the value of the asset has since retreated roughly $1,000.

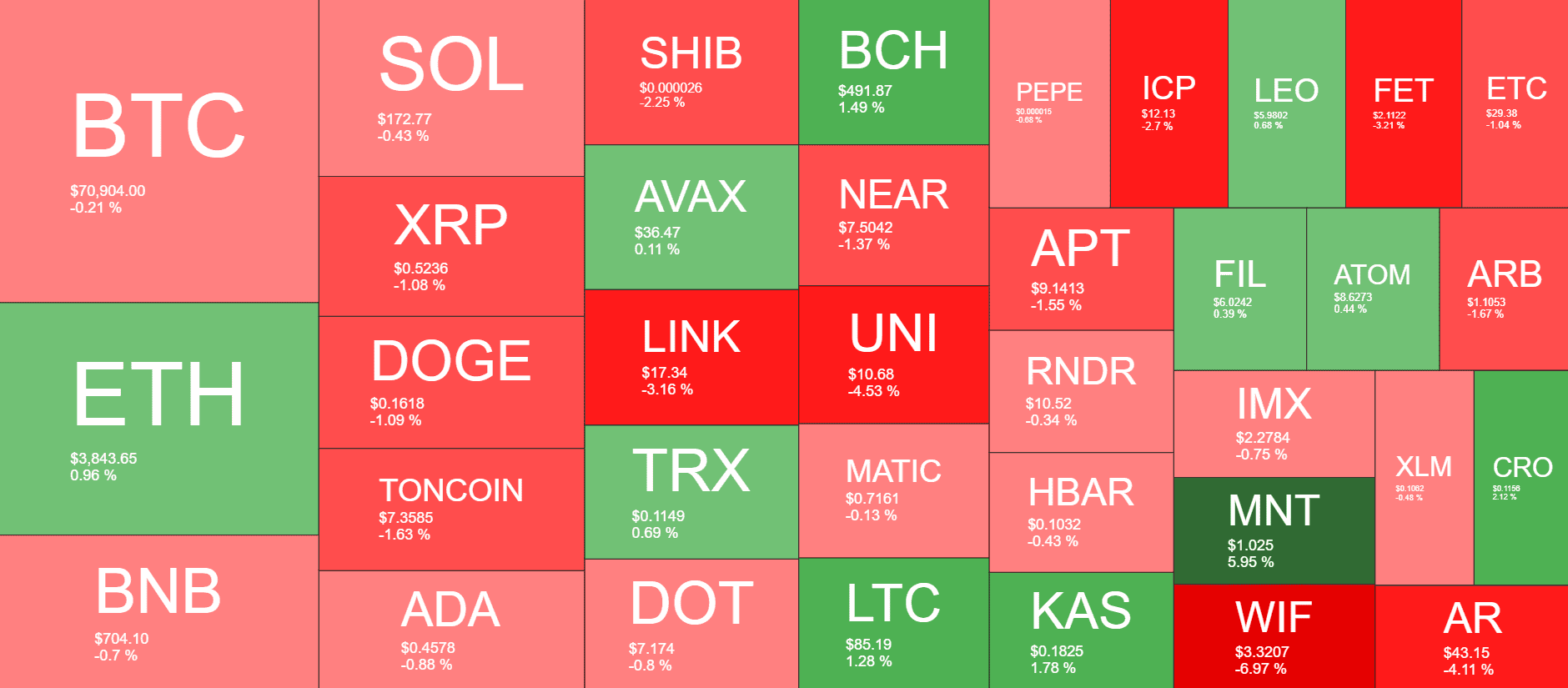

Many alternative cryptocurrencies experienced minor losses today after experiencing significant growth the previous day. However, Binance Coin (BNB) remains above the $700 mark, whereas Chainlink (LINK) saw a decline of approximately 3%.

BTC Struggles at $71K

As an analyst, I would describe the recent price action of Bitcoin in this way: Last weekend, Bitcoin maintained its position around $67,500 after experiencing a minor dip on Friday, down to $66,600. However, the calm market conditions gave way to a more active and optimistic atmosphere on Monday. The cryptocurrency surged by approximately $3,000, reaching as high as $70,000 before pulling back slightly.

A slight pullback occurred, causing the cryptocurrency to dip down to $68,700. However, bulls regained control on Wednesday.

The price of the leading digital asset reached a 15-day peak of $71,767, which represented a significant increase and was just a scant 3% below its all-time high achieved in mid-March. This surge occurred during a day marked by substantial inflows into US Bitcoin spot exchange-traded funds (ETFs).

Despite their efforts, the conditions weren’t sufficient to sustain Bitcoin’s upward trend. As a result, Bitcoin has retreated approximately $1,000 and is now hovering around $71,000. Its market capitalization has dipped below $1.4 trillion, while its control over the altcoins on CoinMarketCap remains at 50.3%.

Meme Coins in Retreat

As a crypto investor, I’ve seen some impressive gains from larger-alt coins like BNB, SOL, XRP, DOGE, TON, Ada, Shib, and DOT, in the past day. However, today these coins have taken a turn for the worse and are now showing red figures on my screen. Yet, their daily losses pale in comparison to the significant strides they made yesterday.

The prices of LINK and UNI have dipped by approximately 3% for LINK and 4.5% for UNI. However, LINK remains over $17, whereas UNI now hovers above the $10 mark.

As a researcher studying the meme coin market, I’ve observed some notable price declines in recent days. For example, WIF has dipped by 6%, Floki’s value has decreased by 5%, and Bonk has seen a drop of approximately 4.5%.

The cryptocurrency market capitalization has dropped by approximately $30 billion from its previous high, yet it remains near the $2.8 trillion mark.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- How to Handle Smurfs in Valorant: A Guide from the Community

- PENDLE PREDICTION. PENDLE cryptocurrency

- Dead by Daylight: All Taurie Cain Perks

2024-06-06 11:56