As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility, especially when it comes to meme coins. And today has been no exception. The entire category took a hit, with an average decline of about 7%. Some coins lost more than others, and the losses were particularly significant for small-cap meme coins.

As an analyst, I’ve observed that the past 24 hours have brought significant turbulence to the cryptocurrency market as a whole, and meme coins have been no exception to this trend. These digital assets have collectively experienced a dip of approximately 7%. This downward spiral appears to be in line with the broader crypto market decline that has persisted for some time now.

Meme Coins Bloodbath

Meme coins as a whole experienced a decline of approximately 7% over the last 24 hours. Individual coins within this category saw varying degrees of loss.

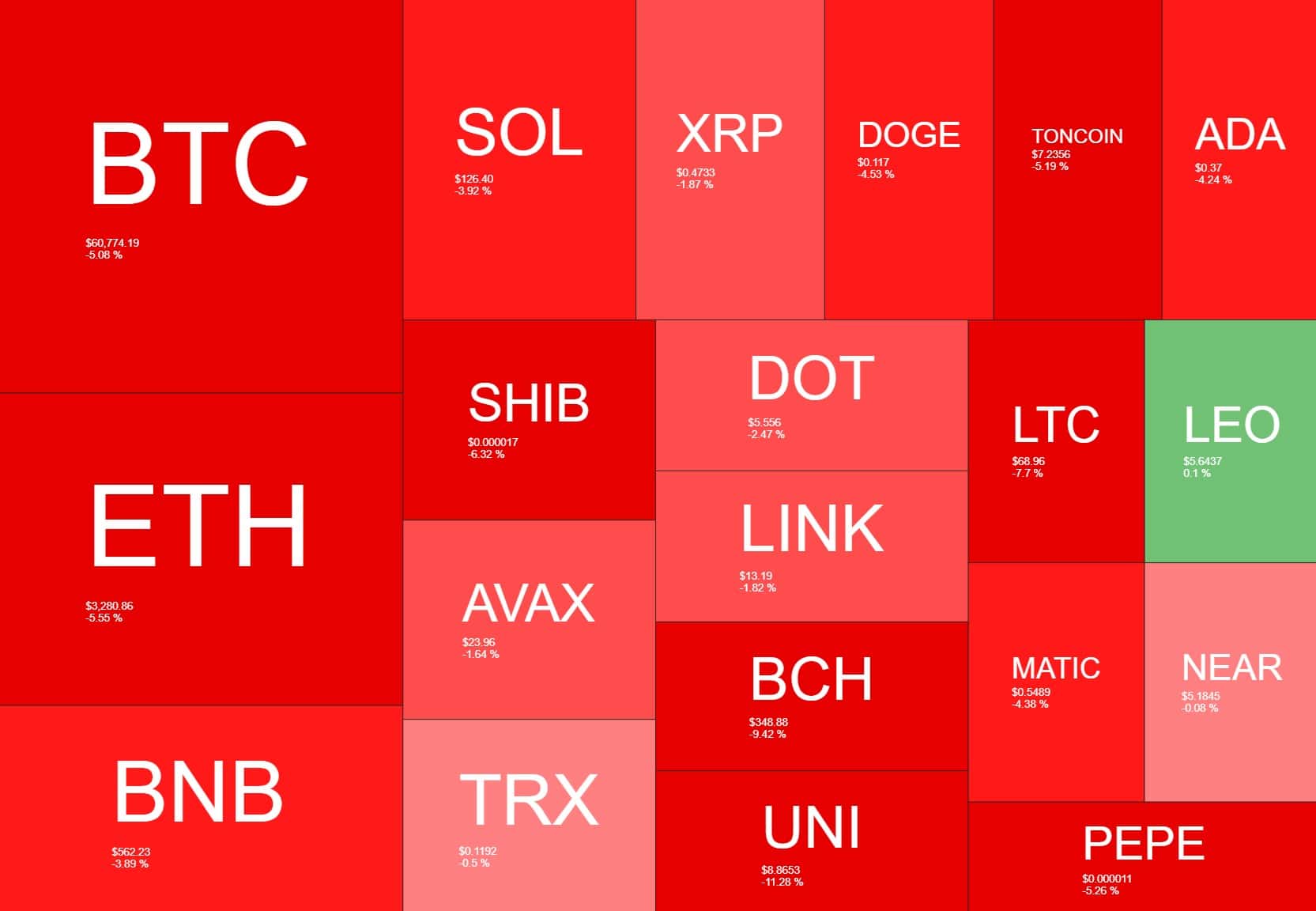

The larger-cap altcoins are performing as follows:

As a crypto investor, I’ve noticed that small-cap meme coins have experienced significant setbacks in recent hours. For example, RYU plunged by 79%, while MUMU and ANDY saw losses of around 25% each.

In contrast to the current market situation, BODEN, the popular meme coin, experienced a rise of approximately 10.6% over the past 24 hours. This growth stands out as an exception.

Broader Market Decline

As a crypto investor, I’ve noticed that the price of Bitcoin has dipped below $61K for the first time since May 13th. The reason behind this decline might be due to the recent announcement from the Mt. Gox trustee. They’ve stated their readiness to initiate creditor payments as per the rehabilitation plan, which could potentially lead to a mass sell-off of Bitcoin held by these creditors.

The entire market tumbled in response, with red being the only color seen on the heatmaps today.

As a researcher studying recent market trends, I’ve discovered that over $315 million in leveraged positions were liquidated in the last 24 hours due to the market downturn. Approximately $130 million of this amount was tied to Bitcoin, while Ethereum accounted for roughly $72 million.

Currently, Ethereum (ETH) is being traded for less than $3,300. It seems that bears are now setting their sights on $3,000 as a potential next support level.

In contrast to that, Bitcoin holds significant support at the $60,000 mark, an essential psychological threshold. A potential bearish breakthrough below this level could lead investors to focus on the resistance around $58,000.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- REF PREDICTION. REF cryptocurrency

- COW PREDICTION. COW cryptocurrency

- STARL PREDICTION. STARL cryptocurrency

- MOOV PREDICTION. MOOV cryptocurrency

- USD PLN PREDICTION

- BRG PREDICTION. BRG cryptocurrency

2024-06-24 19:18