As a seasoned crypto investor with battle-tested nerves and a knack for recognizing promising opportunities, I find myself intrigued by Mantra DAO (OM)’s recent surge. Having navigated through countless market cycles since the early days of Bitcoin, I can tell you that nothing beats the thrill of witnessing a digital asset skyrocket like this.

TL;DR

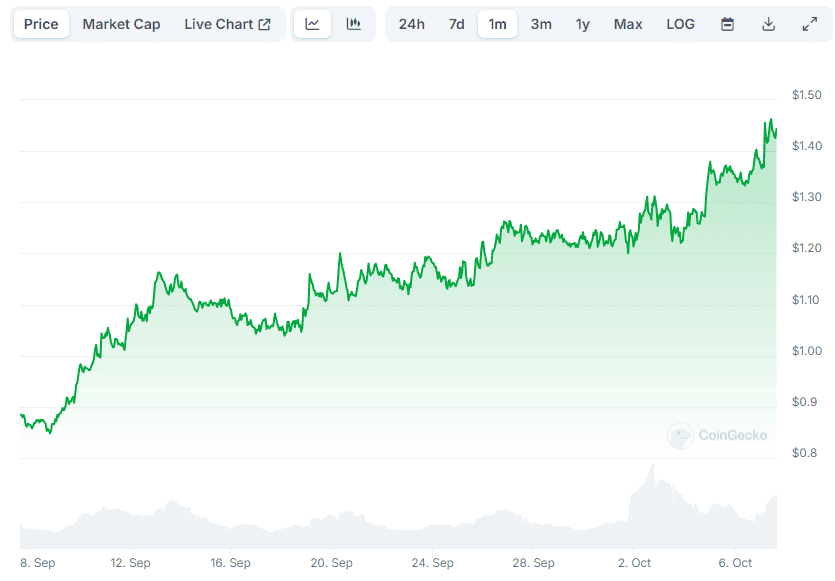

- Mantra (OM) surged over 60% in the past 30 days, hitting an all-time high of $1.50 with analysts predicting a further jump.

On-chain metrics suggest continued gains, but the RSI indicates it may be overbought, signaling a possible correction.

New Peak for OM

As a crypto investor, I’ve noticed that the major digital currencies have seen quite a rollercoaster ride over the last few weeks. For example, Bitcoin (BTC) dipped to around $60,000 at the start of October before bouncing back to its current price of approximately $63,000, according to CoinGecko’s data.

Recently, I’ve noticed that certain digital assets have been experiencing significant price increases. For instance, Mantra DAO (OM) has skyrocketed by more than 60% in just the past month. In fact, earlier today (October 7), it reached a brand-new all-time high of nearly $1.50, with its market capitalization breaking the $1.2 billion mark.

The impressive performance of the token has attracted notice from various players within the industry. In fact, a widely recognized X user named IBCIG declared that OneMemory’s (OM) progression is “incredibly relentless,” predicting a potential surge up to $2.

I can confidently say that, among the projects in my crypto portfolio, this one stands out with its purpose-built token economics and solid Layer 1 infrastructure. It truly excels within the Real World Assets (RWA) sector.

Daan Crypto Trades and Token Sherpa also provided their insights. The former stated that OM showed “exceptionally strong performance amidst the turmoil over the past few weeks/months,” while the latter believes the current peak signifies the start of a significant bullish trend.

On-Chain Metrics Flash the Buy Signal

A variety of key indicators hint that Old Money’s (OM) bullish trend is far from over. One such indicator is the Momentum Indicator (MOM), which gauges an asset’s rate of change and contrasts its current value with prices from earlier periods. At present, it stands at approximately 0.2, indicating a potential chance for purchasing.

Over a 10-day period, the Simple Moving Average, the Exponential Moving Average for a monthly scale, and the Hull Moving Average suggest potential increases may be coming up.

One indicator suggesting a possible market correction is the Relative Strength Index (RSI). When this momentum oscillator exceeds 75, it moves into an ‘overbought’ region, which may imply that the asset (OM) in question might be overpriced and could experience a dip.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- ORB PREDICTION. ORB cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- MAGIC PREDICTION. MAGIC cryptocurrency

- LSK PREDICTION. LSK cryptocurrency

2024-10-07 17:14