As a seasoned crypto investor with over two decades of experience under my belt, I must admit that the events unfolding in November 2024 have left me quite exhilarated. The election of Donald Trump, a known Bitcoin supporter and a pro-crypto president, has sent ripples throughout the cryptosphere.

The opening week of November 2024 is likely to be a significant milestone in crypto lore. So far, we’ve witnessed numerous large-scale institutions, asset managers, and even some nations express approval for Bitcoin. Notable entities like BlackRock, Fidelity, VanEck, as well as many billionaires, celebrities, and countless others have voiced their support for the cryptocurrency sector.

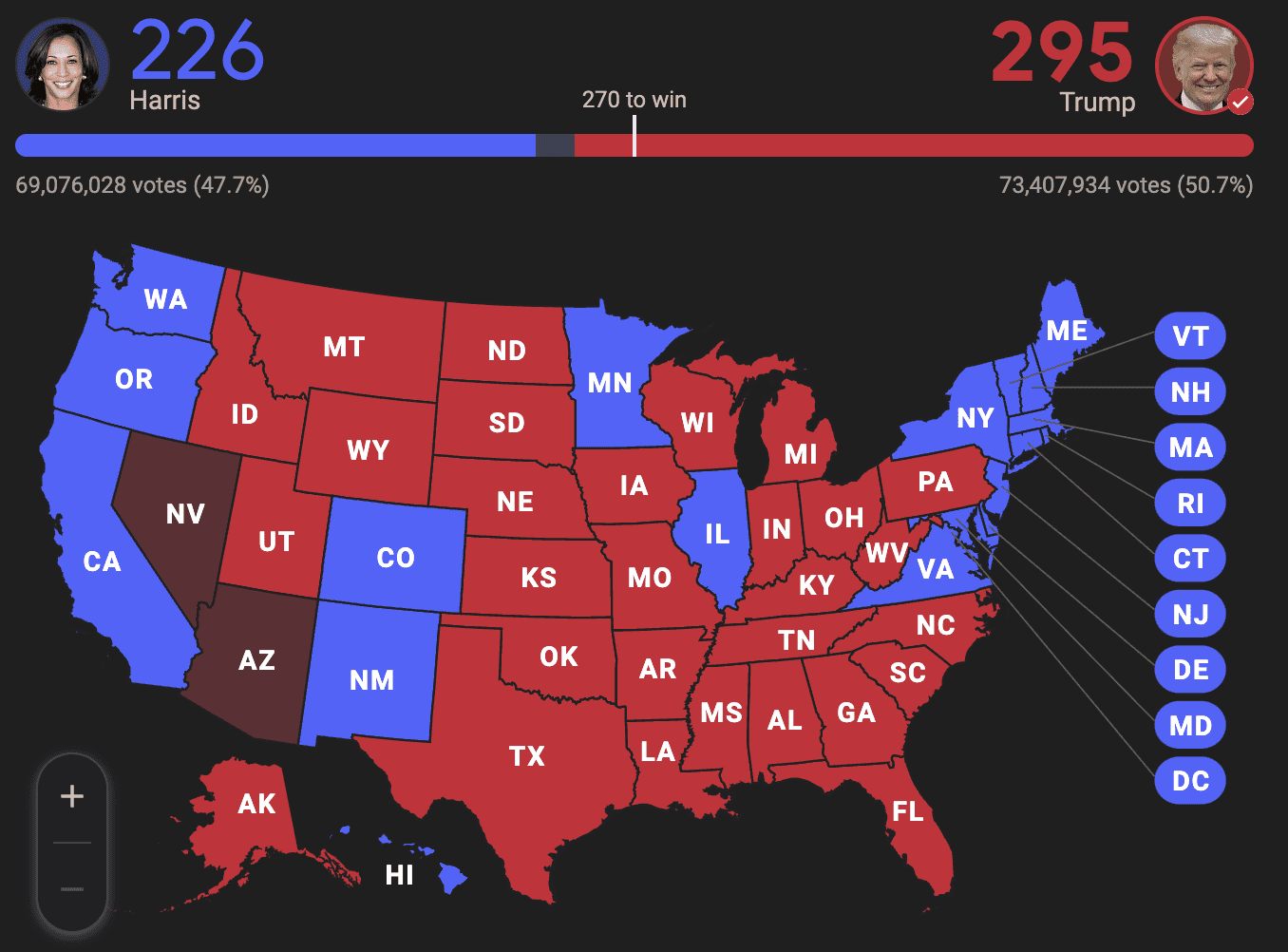

On November 5th, American citizens exercised their right to decide who would lead the country for the subsequent four years, and that individual was Donald Trump. This election held several historical milestones, but a significant aspect for the crypto industry is that Trump will be the first U.S. president to be both supportive of cryptocurrencies and Bitcoin. This is noteworthy.

During his election run, he consistently expressed strong backing for the industry and made some notable pledges. Notably, among these promises is his intention to dismiss the current Chair of the U.S. Securities and Exchange Commission (SEC). This action could significantly impact the wider cryptocurrency sector due to the following reasons: Under Gensler’s leadership, the SEC has brought over 100 legal actions against businesses primarily dealing with crypto, including well-known names like Coinbase, Kraken, Binance, and many more. To grasp the importance of this, it’s essential to be aware that the SEC, under Gensler, has been active in taking legal action against numerous crypto-centric companies.

From my perspective as a researcher, it appears that the regulatory environment established by the Biden administration has, in many ways, been seen as an adversary to the cryptocurrency sector. This situation has placed numerous domestic and international businesses under a continuous cloud of potential legal action, thereby limiting their growth and opportunities. However, it remains uncertain how this landscape will evolve under a Trump presidency. A leader who is well-versed in crafting sensible regulations, actively engaging with industry experts, and prioritizing the interests of individual investors would undeniably bring a much-needed change of wind – a change that is long overdue.

Trump proposed a plan to establish a national Bitcoin reserve, guaranteeing that all Bitcoin acquired by the U.S. will be kept in this stockpile. Additionally, efforts would be made to encourage domestic Bitcoin mining. This significant step marks a substantial shift for the world’s leading economy to officially endorse Bitcoin, setting it apart from smaller economies like El Salvador who have previously embraced the digital currency.

The markets responded enthusiastically to his election, and it’s intriguing to observe if this optimism continues up until his inauguration on January 20th. Given that both Biden and Harris have emphasized a peaceful transition of power within the administration, as long as there are no unexpected events, the positive winds for the industry seem evident.

Without a doubt, the question has shifted to whether or not Trump will fulfill his promises. Notably, during his campaign, he accepted millions in cryptocurrency donations from industry players and leaders. One thing that’s clear is that everyone is eagerly anticipating him to uphold his commitment now.

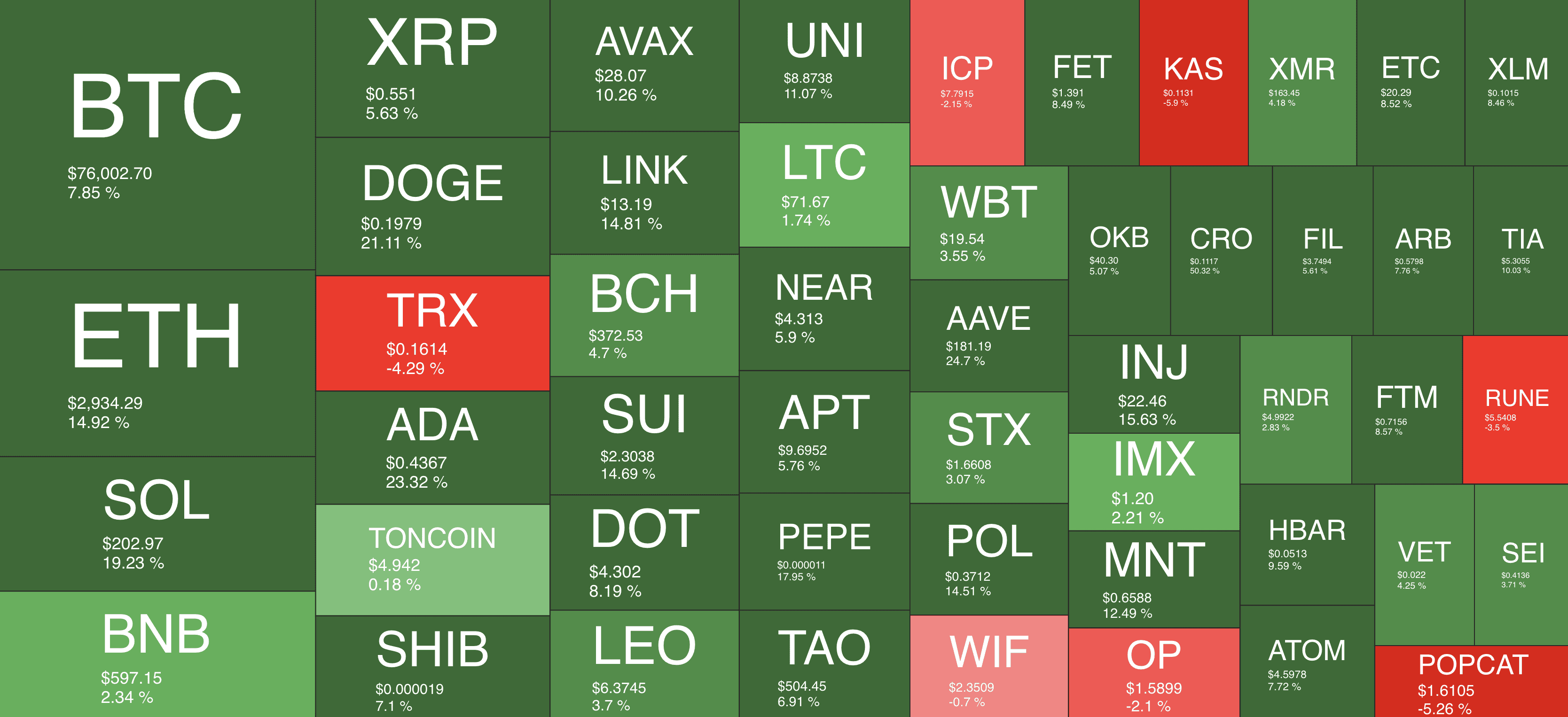

The overall cryptocurrency sector is experiencing a significant rise, causing various alternative coins (altcoins) to skyrocket. While some experts are predicting an extended bull market, it remains to be seen what the future holds.

As an analyst, I find ourselves in an advantageous industrial landscape, theoretically speaking. Rest assured, we’ll continue to provide updates as they unfold, just as we’ve always done.

Market Data

Market Cap: $2.69T | 24H Vol: $172B | BTC Dominance: 55.8%

BTC: $76,176 (+8.5%) | ETH: $2,943 ( +16.2% ) | BNB: $598 (+3.2)

This Week’s Crypto Headlines You Can’t Miss

2024 U.S. Presidential Election Outcome: Donald Trump Claims Victory

With Donald Trump taking a significant lead in the election results, Bitcoin’s value started to surge. It soared beyond its previous all-time high from March ($73,737) and reached new heights exceeding $75,000 on the charts.

Bitcoin’s surge in value persisted during that remarkable week, with its peak reaching $76,800 on Bitstamp on Thursday night, following the U.S. Federal Reserve’s decision to lower interest rates by 25 basis points to a range of 4.5% – 4.75%. This move fueled Bitcoin’s ongoing rally.

Investors have resumed their investments in Bitcoin ETFs with an unprecedented inflow of approximately $1.4 billion on November 7th, following a more cautious stance prior to the elections. Notably, BlackRock’s IBIT led the way with over $1.1 billion in inflows alone. In simpler terms, after taking a pause before the elections, investors have aggressively poured funds back into Bitcoin ETFs, with BlackRock’s IBIT receiving the majority of these new investments on November 7th.

Solana’s native token, SOL, has soared to become the 4th largest cryptocurrency by market value, surpassing BNB in the process. Over the past week, SOL has been one of the top performers, with a rise of over 21%. Currently trading at approximately $200, this is a new multi-month high for SOL.

The challenge in Bitcoin mining reached a record level of 101.6 trillion as the network demonstrated its resilience prior to Bitcoin’s price jump to unprecedented levels. In the run-up to this significant price increase, the network’s robustness was evident as the mining difficulty skyrocketed to an unprecedented peak. Over the past month, this measure has grown by approximately 15%, reinforcing the blockchain’s security.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- LDO PREDICTION. LDO cryptocurrency

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- ICP PREDICTION. ICP cryptocurrency

- EUR IDR PREDICTION

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- Original Two Warcraft Games Are Getting Delisted From This Store Following Remasters’ Release

- Starseed Asnia Trigger Tier List & Reroll Guide

2024-11-08 17:07