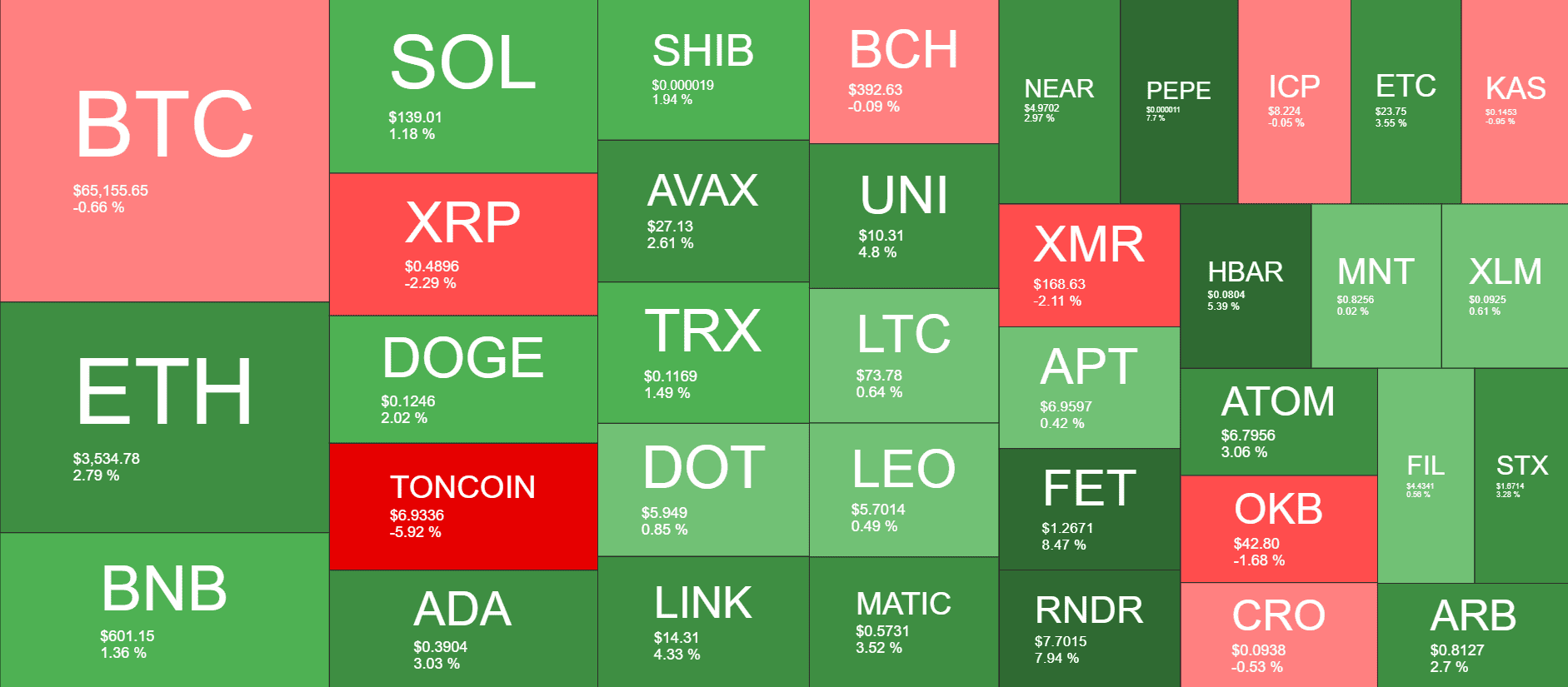

As a seasoned analyst with extensive experience in the crypto market, I’ve witnessed firsthand how Bitcoin’s price actions can be unpredictable and sometimes painful. Yesterday was no exception as we saw Bitcoin dump twice to a monthly low of $64,000 before recovering some ground. However, it’s important to note that several altcoins have bounced back stronger than Bitcoin, with those connected to the Ethereum ecosystem leading the charge.

Yesterday, Bitcoin endured two sharp price drops, reaching a monthly minimum of $64,000. However, it eventually regained some footing.

Some alternative cryptocurrencies have rebounded after the widespread market downturn the previous day, particularly those linked to Ethereum‘s network.

ETH, ENS, LDO on the Rebound

The cryptocurrency sector was abuzz with major news on X, as ConsenSys revealed that the US Securities and Exchange Commission had ended its investigation into Ethereum 2.0. This announcement, celebrated by ConsenSys as a significant triumph for Ethereum developers, led to noticeable price increases for various Ethereum-linked tokens.

As a researcher, I’ve observed an impressive surge in the value of Lido DAO’s native coin, with a daily gain exceeding 15% and reaching just over $2.3. Simultaneously, Ethereum Name Service (ENS) has experienced a significant price increase of approximately 13.5%, trading now above $26.

Ether (ETH) has made a modest gain of around 3% day over day, bringing its current price to approximately $3,550 – the second largest cryptocurrency’s new position.

Among larger-capacity alternatives, PEPE experienced a rise of 8%, HBAR climbed up by 5%, FET went up by 8.5%, RNDR advanced by 8%, ADA inched up by 3%, LINK gained 4%, UNI lifted by 5%, and MATIC grew by 3.5% today.

In contrast, TON has slumped by 6% in the past 24 hours and now sits under $6.9.

BTC Bounces Above $65K

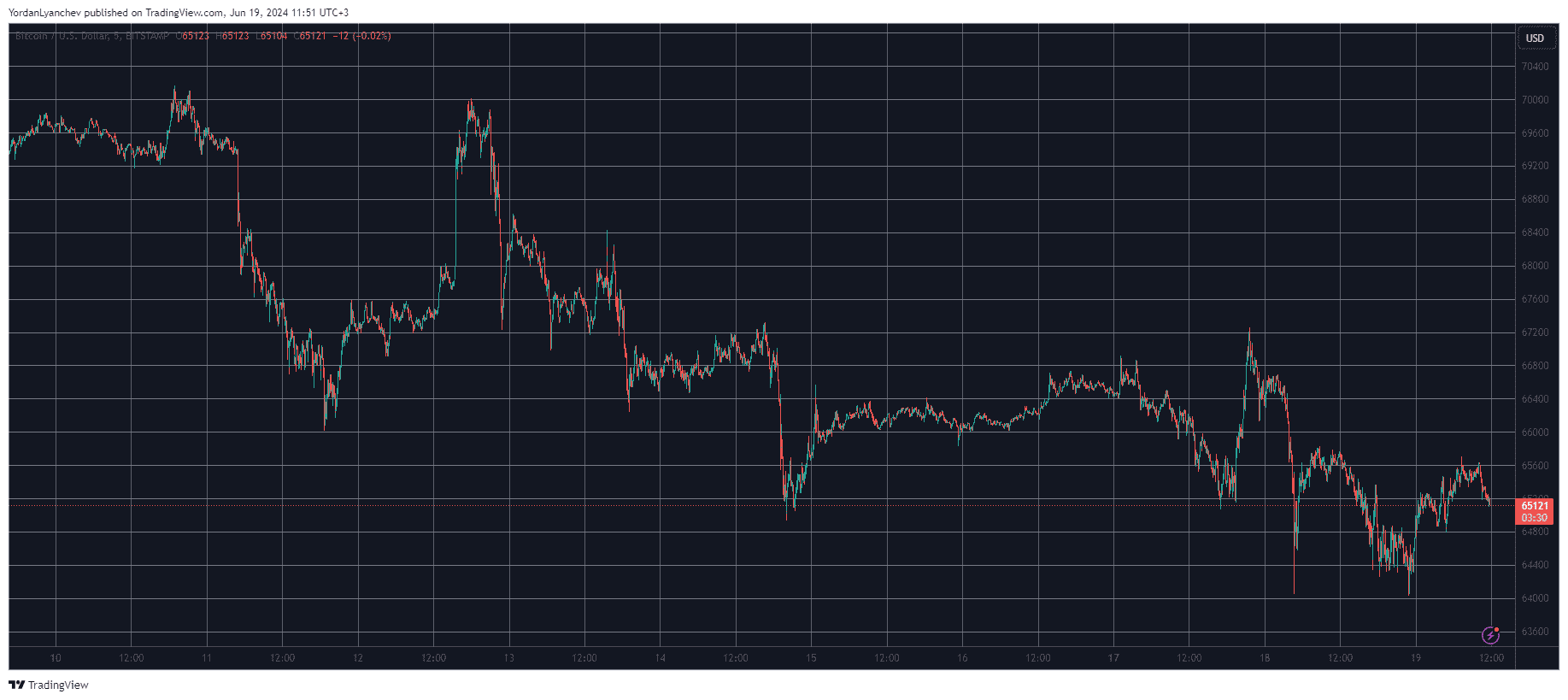

As an analyst, I’ve noticed that the price of Bitcoin has weakened significantly in recent days, possibly due to increased withdrawals from US-listed Bitcoin spot ETFs. Just a week ago, we saw Bitcoin reach impressive heights of around $70,000 on occasion.

I observed firsthand how the psychological barrier prevented Bitcoin from advancing beyond the $66,000 mark during the weekend. The volatility decreased significantly as BTC hovered around that price point until it encountered resistance at $67,000 on Monday, resulting in a quick correction and causing discomfort for bullish investors.

Despite the setbacks causing additional distress, bitcoin plunged to a monthly nadir of $64,000 on two separate occasions yesterday. However, it has bounced back by over $1,000 since then and is currently hovering just above the $65,000 mark.

I’ve analyzed the data and found that the market capitalization of this cryptocurrency has decreased to a value of $1.285 trillion. Additionally, its market supremacy over the alternative coins has dwindled down to approximately 51.5%.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- LAZIO PREDICTION. LAZIO cryptocurrency

- PROM PREDICTION. PROM cryptocurrency

- ETC PREDICTION. ETC cryptocurrency

- CEL PREDICTION. CEL cryptocurrency

- VR PREDICTION. VR cryptocurrency

2024-06-19 11:54