The price of Ethereum dropped noticeably during the weekend due to escalating conflicts in the Middle East. However, there are potential buying points that could prevent further decline.

Ethereum Price Technical Analysis

By TradingRage

The Daily Chart

In the course of a regular trading day, Ethereum’s price has constructed a significant bullish flag formation on the chart. The recent decline caused the price to dip beneath the $3,000 mark momentarily, but the market bounced back from the lower edge of the channel. Given the prompt bounce-back, the dip below $3,000 might be classified as a deceptive bearish breakout.

In simple terms, the cost of Ethereum (ETH) might increase towards the $3,600 resistance point and the upper limit of the flag pattern in the near future. Reaching these thresholds could influence the market’s direction significantly.

The 4-Hour Chart

At a closer look on the 4-hour chart, the price is nearing the $3,300 barrier as potential short-term resistance. Overcoming this level might lead to an upward trend reaching towards the next resistance at $3,600 for further testing.

The Relative Strength Index (RSI) is currently climbing above the 50% mark, signaling that buying power is increasing and the trend may soon revert to the upward trajectory within the major trendline. Consequently, optimistic investors can look forward to the continuation of the long-term bull market.

Sentiment Analysis

By TradingRage

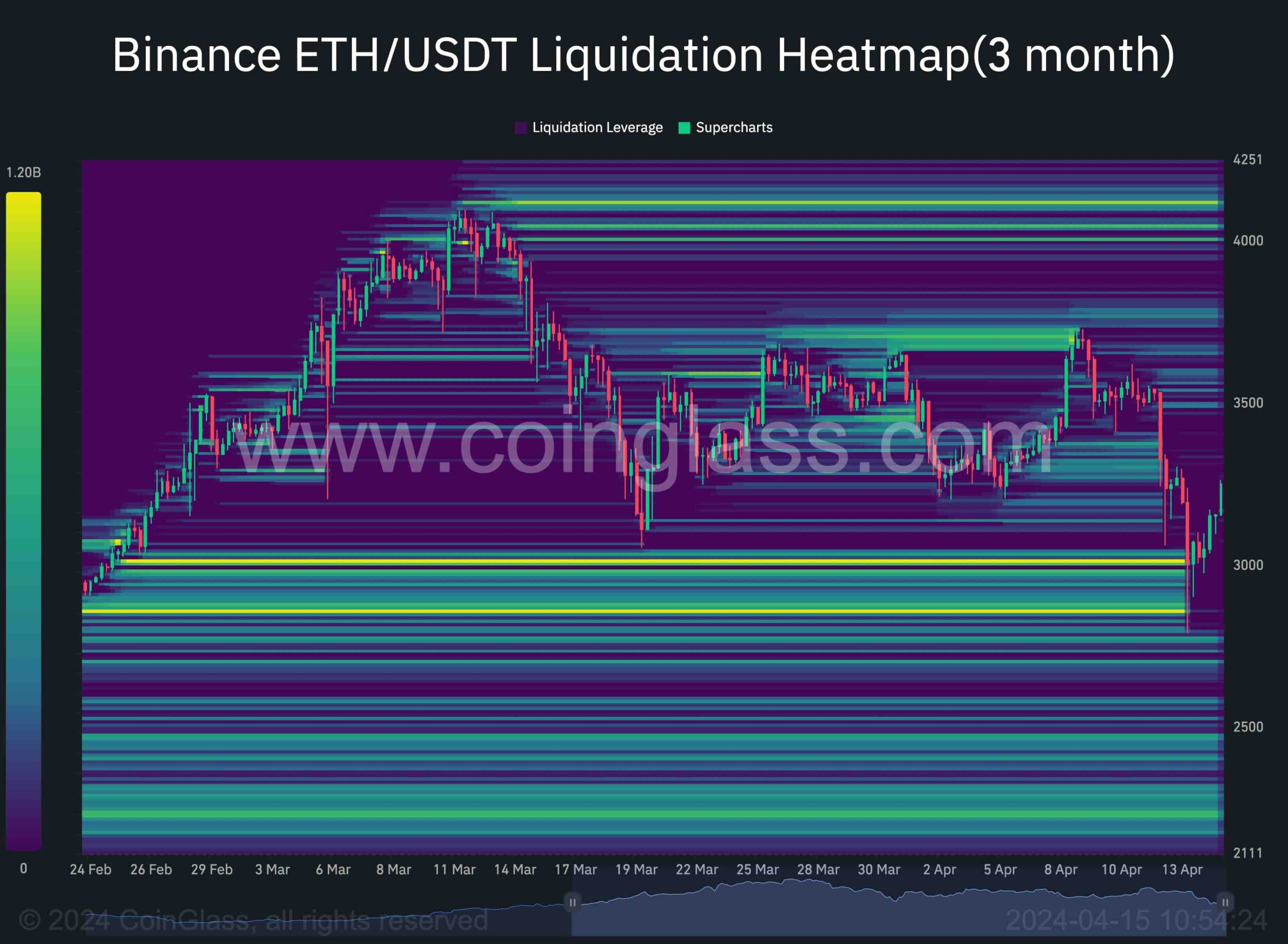

Ethereum Liquidation Heatmap

Over the weekend, the cost dipped under the $3,000 mark momentarily, which is a significant region based on technical assessment. Consequently, several investors may have set their stop losses in this vicinity.

this chart illustrates the number of open long positions in the Binance ETH/USDT market that have been liquidated as the price dropped below $3,000.

Currently, the cryptocurrency market is bouncing back. This rebound suggests that the selling pressure caused by previous liquidations has encountered enough buying interest. The recent price decrease might have been a false signal or a “bear trap.” Consequently, the market could aim for higher prices above $4,000 if no major surprises occur in the immediate future.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- How to Handle Smurfs in Valorant: A Guide from the Community

- ESO Werewolf Build: The Ultimate Guide

- Mastering Destiny 2: Tips for Speedy Grandmaster Challenges

- Overwatch Director wants to “fundamentally change” OW2 beyond new heroes and maps

- Exploring Izanami’s Lore vs. Game Design in Smite: Reddit Reactions

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

2024-04-15 15:34