As a seasoned crypto investor with a few battle scars from past market fluctuations, I’ve learned to read both the technical and sentiment analysis when evaluating potential investments in digital assets. Ethereum’s current price action has been intriguing me lately, as it seems poised for another bull run following its recent dip below $3,000.

The price of Ethereum has not yet resumed its upward momentum after being rejected at the $4,000 mark. However, bulls are starting to regain power, potentially setting the stage for a stronger rebound.

Technical Analysis

By TradingRage

The Daily Chart

I’ve noticed on the daily chart that Ethereum’s price has been forming lower peaks and troughs within a downward trending channel ever since it failed to surmount the $4,000 resistance point.

Despite currently trading below the $3,000 mark and the middle line of the channel, there are signs that the cryptocurrency is regaining strength. If this upward trend continues and the market successfully recovers to these levels, a breakout above the channel may occur, potentially leading to prices reaching $4,000 and beyond.

The 4-Hour Chart

As a researcher studying the financial markets, I find that analyzing the price action using a 4-hour chart provides greater clarity compared to shorter or longer timeframes. The market has recently attempted to surmount the $3,000 resistance zone with minimal success, and is now probing the middle boundary of the descending channel.

As an analyst, I’d interpret the RSI reading above 50% for Ethereum as a strong indication of upward momentum. This suggests that ETH is likely to surmount the current resistance level and potentially advance towards the $3,600 area. Market participants can therefore be hopeful that a new bullish trend is about to commence.

Sentiment Analysis

By TradingRage

Ethereum Funding Rates

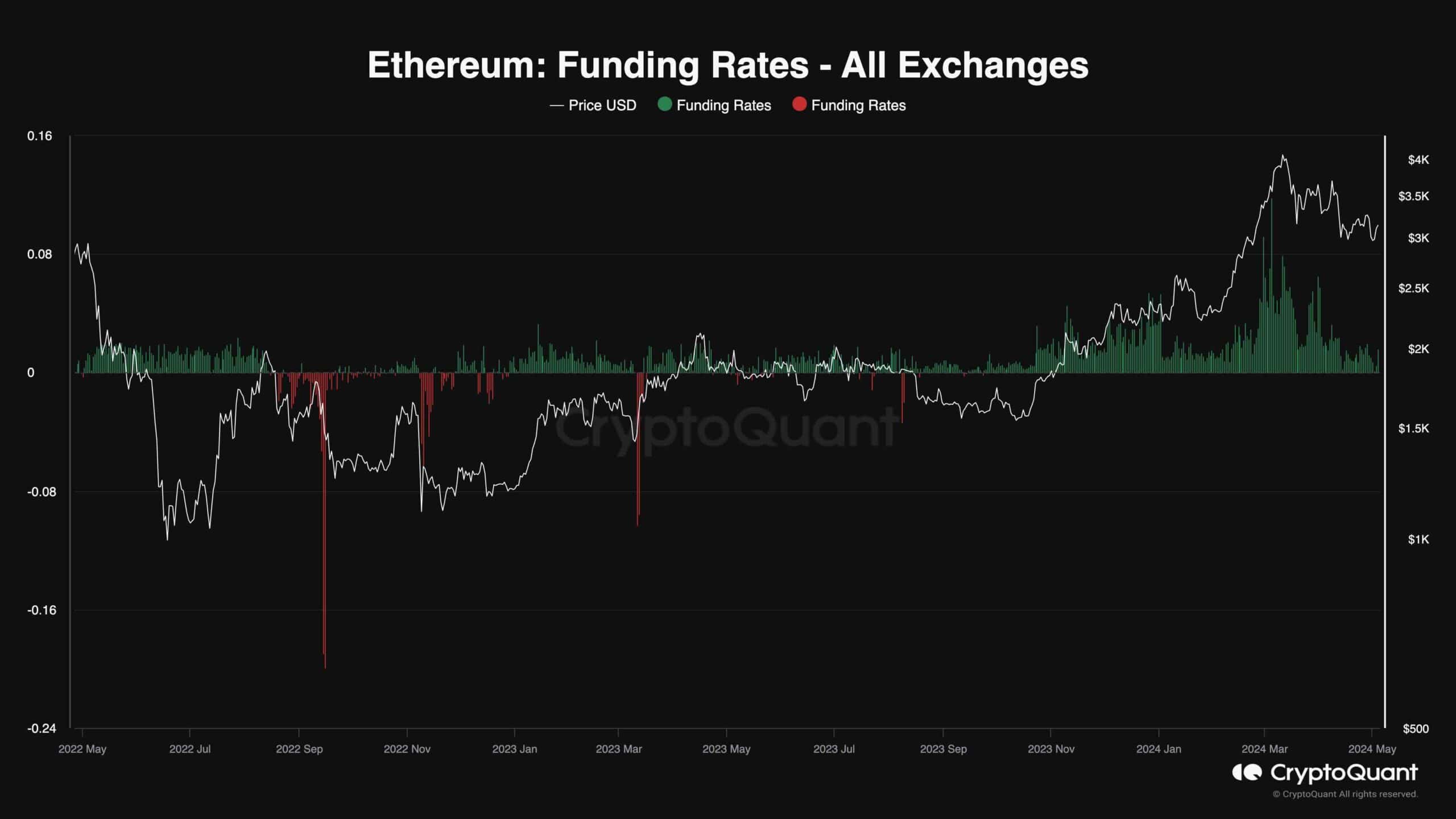

After Ethereum’s price drop, several futures traders have faced liquidation or changed their long positions. This development could indicate that the futures market is becoming less heated.

The graph illustrates the Ethereum funding rates indicator, which signifies the intensity of buyers or sellers in executing their futures contracts using market orders. A positive value indicates a bullish outlook, while a negative value suggests bearish anticipation.

As a seasoned crypto investor, I’ve noticed that funding rates have taken a noticeable dip compared to a few months back. However, it’s important to keep in mind that low but positive funding rates are actually a bullish sign. This means that the futures market is no longer as frenzied as before, yet the underlying demand remains strong. Consequently, we can anticipate another price surge in the near future.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-05-04 17:36