As a researcher with extensive experience in analyzing cryptocurrency markets, I believe that Ethereum’s price trend might be on the verge of a significant change. While it has been following Bitcoin and experiencing a downward spiral since March, there are several technical and sentiment indicators suggesting that a bullish reversal could be imminent.

The price of Ethereum has mirrored Bitcoin‘s trend, decreasing since early March. However, signs indicate a potential shift in the near future.

Technical Analysis

By TradingRage

The Daily Chart

From my perspective as a researcher, on the day-to-day chart, the price has been forming a series of lower highs and lower lows, indicating a descending channel pattern. However, with the 200-day moving average and a significant support level at $2,750 close by, I believe the market is primed for a rebound. Right now, the price is approaching the resistance level of $3,000.

As a crypto investor, I believe that surpassing the current level could signal a bullish trend, potentially pushing the price up towards the upper limit of the channel and challenging the $3,600 resistance.

The 4-Hour Chart

On the 4-hour timeframe, the price has been fluctuating around the $3,000 mark for several weeks. Nevertheless, the market has shattered the downward trendline, signaling a potential shift in momentum. Should the price sustain above this line and surpass the $3,000 barrier, the likelihood of an uptrend toward the upper boundary of the channel increases.

The RSI reaching 50% indicates a balanced market momentum, yet the near-term outcome remains uncertain and could possibly be determined within the next day.

Sentiment Analysis

By TradingRage

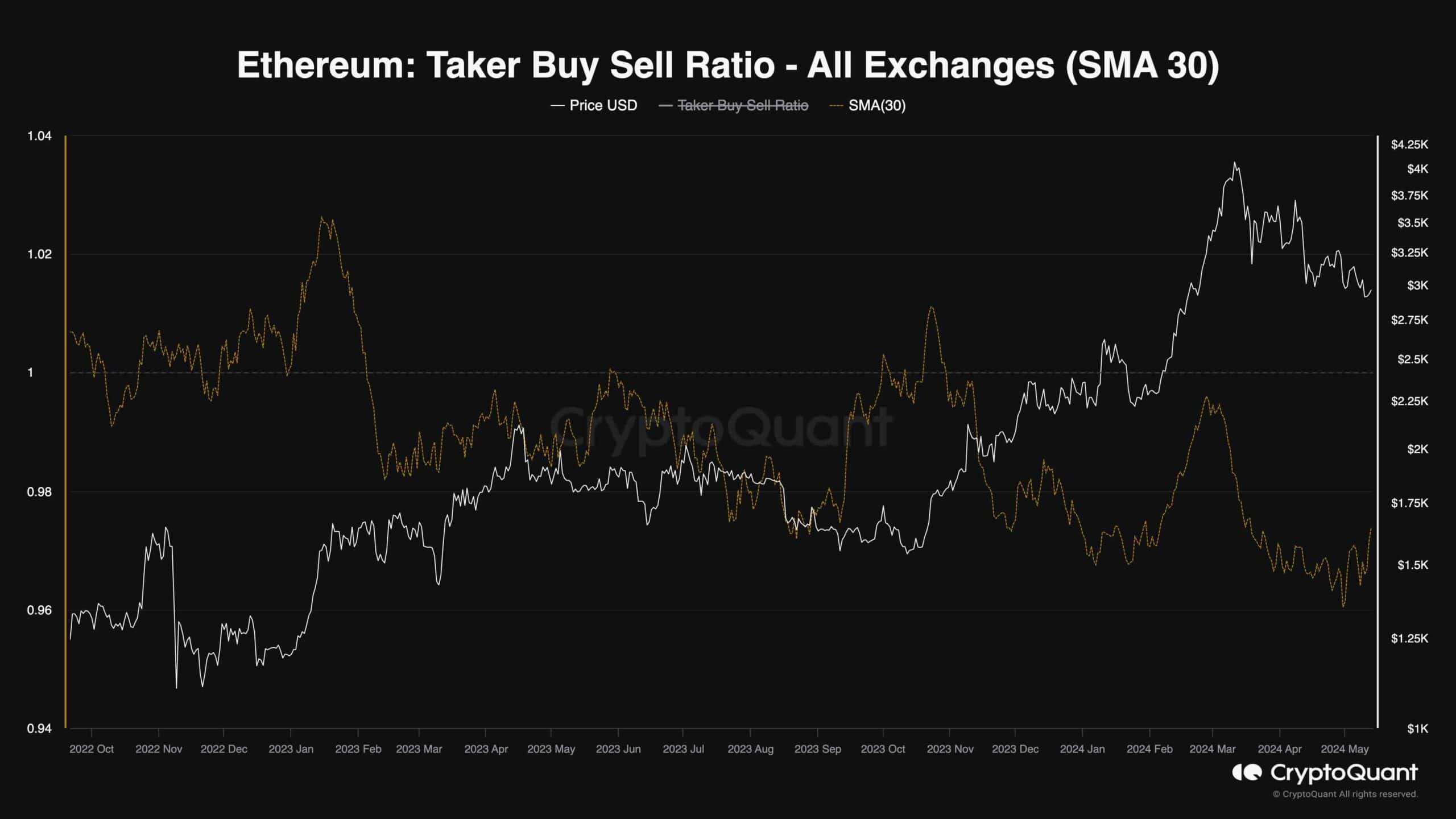

Taker Buy Sell Ratio (30-Day SMA)

As a market analyst, I’ve found that the perpetual futures market plays a pivotal role in shaping crypto prices in the current market scenario. By closely examining its key performance indicators, we can uncover valuable insights into potential future price trends.

This chart illustrates the average number of buy and sell orders executed by takers over the past 30 days, which helps determine whether buyers or sellers have been more active in the market. Since market orders influence price changes, this indicator offers valuable information.

Over the past several months, the Taker Buy Sell Ratio for Bitcoin futures trading has been hovering below the 1 mark. This suggests that the majority of traders have been actively selling Bitcoins in the futures market. This selling pressure could be due to either speculative strategies or hedging of spot portfolio holdings. However, recent developments indicate a potential turnaround for this metric. Its upward trend implies that the aggressive supply of Bitcoin from the futures market might soon diminish. With sufficient demand from the spot market, a new bullish trend for Bitcoin could emerge.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Honkai: Star Rail’s Comeback: The Cactus Returns and Fans Rejoice

2024-05-13 16:30